- India

- /

- Consumer Finance

- /

- NSEI:MANAPPURAM

Here's Why Manappuram Finance (NSE:MANAPPURAM) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Manappuram Finance (NSE:MANAPPURAM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Manappuram Finance

How Quickly Is Manappuram Finance Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Manappuram Finance managed to grow EPS by 8.7% per year, over three years. That's a good rate of growth, if it can be sustained.

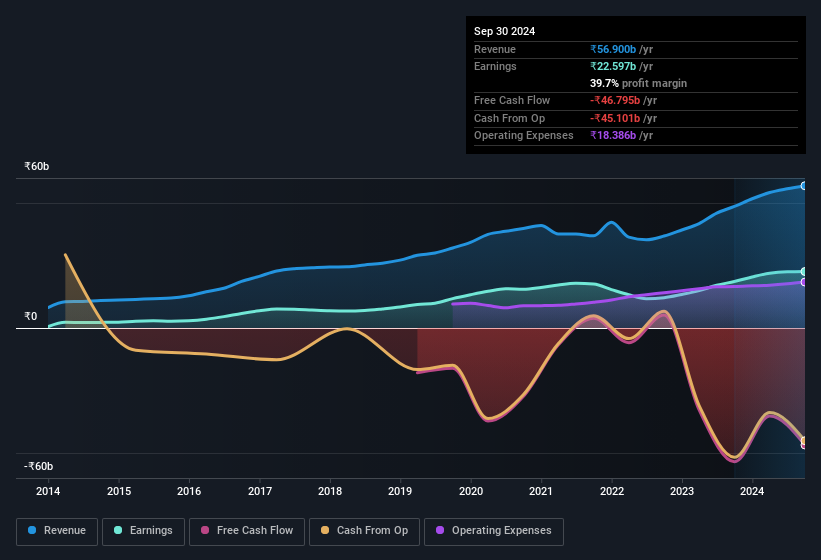

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Manappuram Finance's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Manappuram Finance remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 17% to ₹57b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Manappuram Finance's future profits.

Are Manappuram Finance Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While some insiders did sell some of their holdings in Manappuram Finance, one lone insider trumped that with significant stock purchases. Specifically the MD, CEO & Non-Independent Executive Director, Vazhappully Nandakumar, spent ₹80m, paying about ₹177 per share. It's hard to ignore news like that.

On top of the insider buying, we can also see that Manappuram Finance insiders own a large chunk of the company. Actually, with 36% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. That level of investment from insiders is nothing to sneeze at.

Does Manappuram Finance Deserve A Spot On Your Watchlist?

One important encouraging feature of Manappuram Finance is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. You still need to take note of risks, for example - Manappuram Finance has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

The good news is that Manappuram Finance is not the only stock with insider buying. Here's a list of small cap, undervalued companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MANAPPURAM

Manappuram Finance

A gold loan non-banking financial company, provides retail credit products and financial services in India.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives