- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Three Undiscovered Gems In India To Enhance Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.6% drop, yet it has shown resilience with a remarkable 40% rise over the past year and an anticipated annual earnings growth of 17%. In this dynamic environment, identifying stocks that are not only positioned for growth but also underappreciated by the broader market can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Avantel | 5.92% | 33.97% | 37.33% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets and has a market capitalization of ₹122.23 billion.

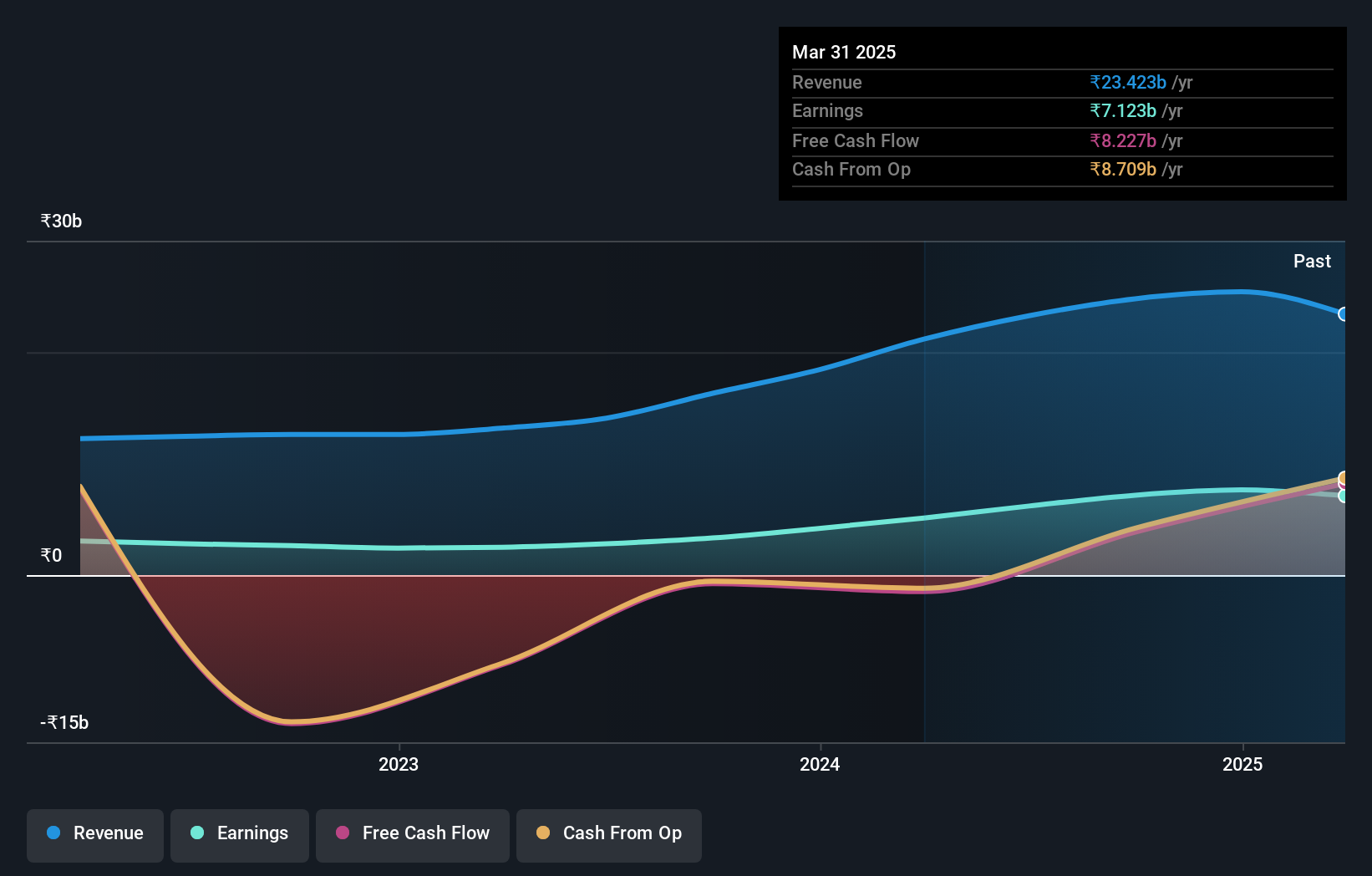

Operations: IIFL Securities Limited generates revenue primarily from capital market activities, amounting to ₹20.25 billion, and also earns from facilities and ancillary services as well as insurance broking and ancillary services.

IIFL Securities, a nimble player in the Indian market, has shown impressive earnings growth of 120% over the past year, outpacing its industry peers. The company seems to have managed its debt well, reducing its debt-to-equity ratio from 117.6% to 67.2% in five years. With a price-to-earnings ratio of 19.7x below the market average and high-quality earnings reported, IIFL appears attractively valued despite recent regulatory challenges and a volatile share price.

- Click to explore a detailed breakdown of our findings in IIFL Securities' health report.

Review our historical performance report to gain insights into IIFL Securities''s past performance.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in manufacturing and selling aluminium and copper fin and tube-type heat exchangers for the HVACR industry, with a market cap of ₹28.11 billion.

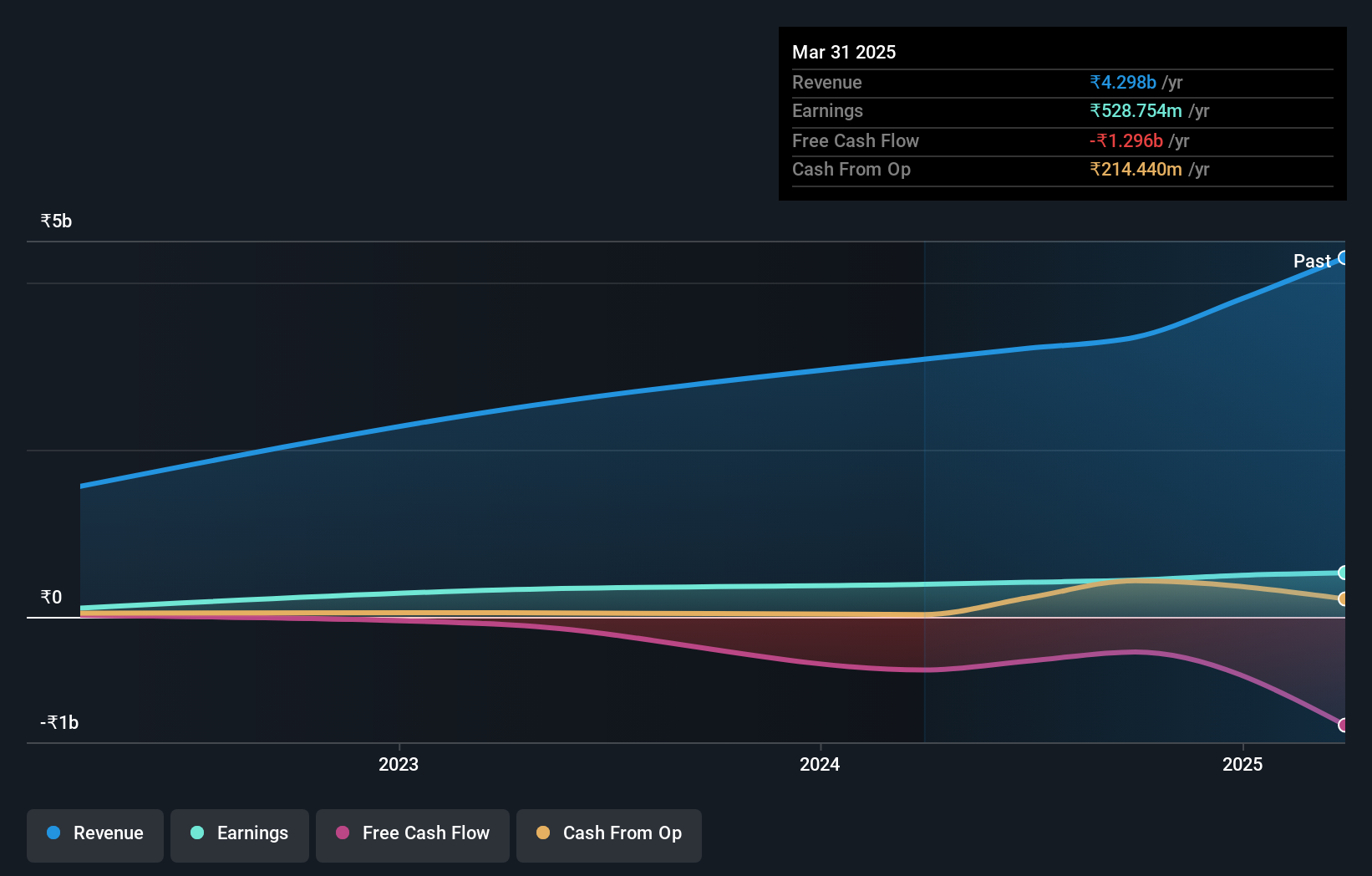

Operations: KRN derives its revenue primarily from the manufacture and sale of HVAC parts and accessories, amounting to ₹3.08 billion.

KRN Heat Exchanger and Refrigeration, a dynamic player in India's industrial landscape, has shown robust financial health with an impressive 28.1x EBIT coverage on its debt interest payments. Over the past year, earnings surged by 20.9%, outpacing industry averages. Despite a satisfactory net debt to equity ratio of 37.5%, KRN's free cash flow remains negative at INR -635.64 million as of March 2024 due to significant capital expenditures for expansion initiatives like their new manufacturing facility, funded partly through a recent INR 3.42 billion IPO aimed at enhancing production capabilities and client reach in the air conditioning and refrigeration sector.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on the generation of solar power in India, with a market capitalization of ₹76.57 billion.

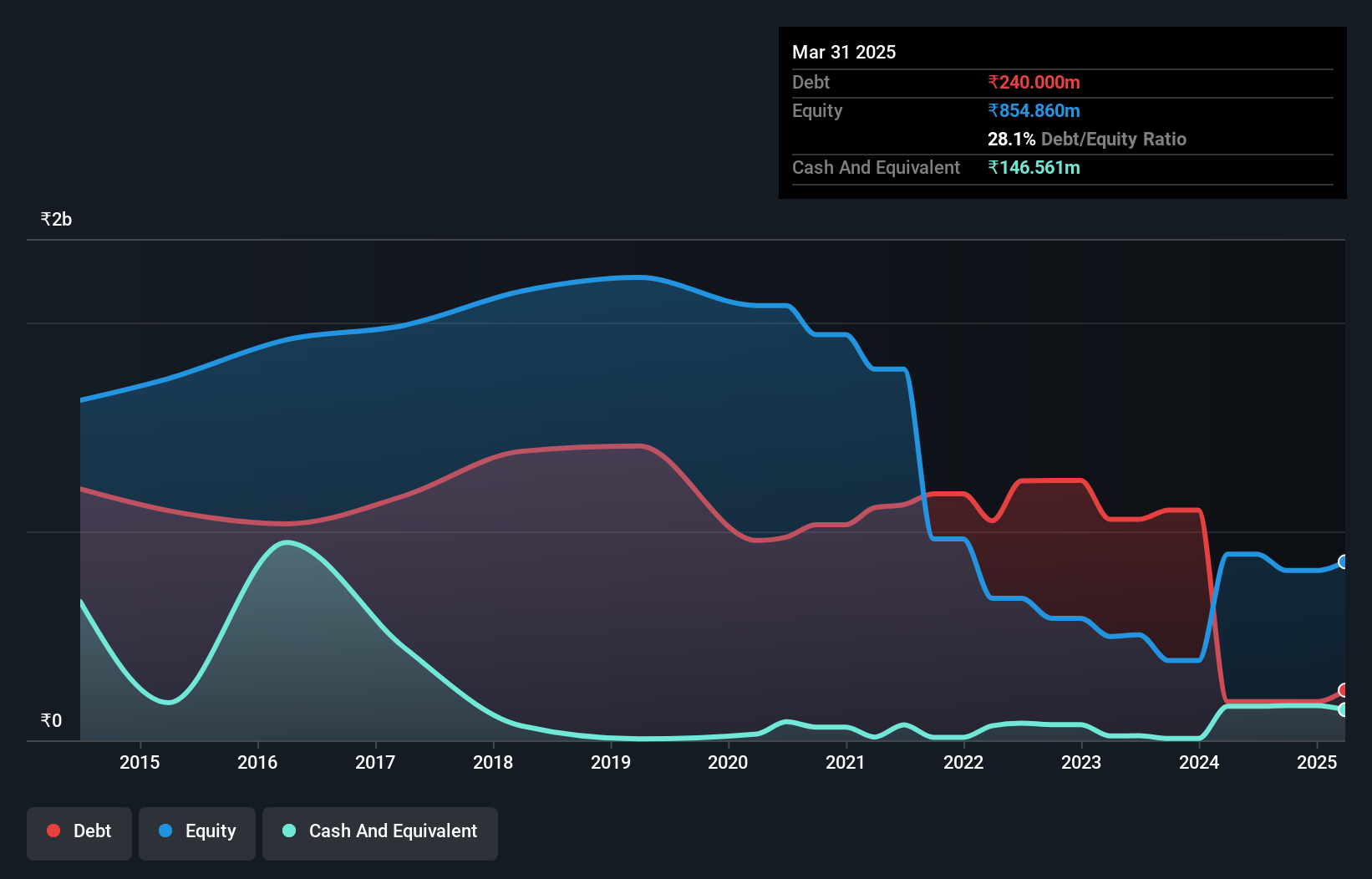

Operations: Ujaas Energy derives its revenue primarily from solar power plant operations, contributing ₹307.70 million. The company also generates income from electric vehicle (EV) segments, adding ₹41 million to its revenue stream.

Ujaas Energy, a relatively small player in the renewable sector, has shown noteworthy financial shifts. Over the past five years, its debt to equity ratio improved significantly from 59.4% to 20.8%, indicating better financial management. Recently turning profitable with a net income of ₹38.15M for Q1 2024 compared to a loss last year, Ujaas also reported revenue growth from ₹74.83M to ₹107.16M during the same period. Despite these improvements, shareholders faced substantial dilution over the past year due to strategic decisions like bonus share allotments and stock splits aimed at enhancing market presence and liquidity.

- Get an in-depth perspective on Ujaas Energy's performance by reading our health report here.

Gain insights into Ujaas Energy's historical performance by reviewing our past performance report.

Taking Advantage

- Unlock our comprehensive list of 468 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives