- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Exploring Three Undiscovered Gems In The Indian Stock Market

Reviewed by Simply Wall St

Over the last 7 days, the Indian stock market has risen by 1.0%, contributing to a remarkable 39% increase over the past year, with earnings projected to grow by 17% annually in the coming years. In this buoyant environment, identifying stocks that are not only resilient but also poised for growth can uncover potential opportunities for investors seeking to capitalize on India's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Suraj | 27.47% | 17.95% | 67.29% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

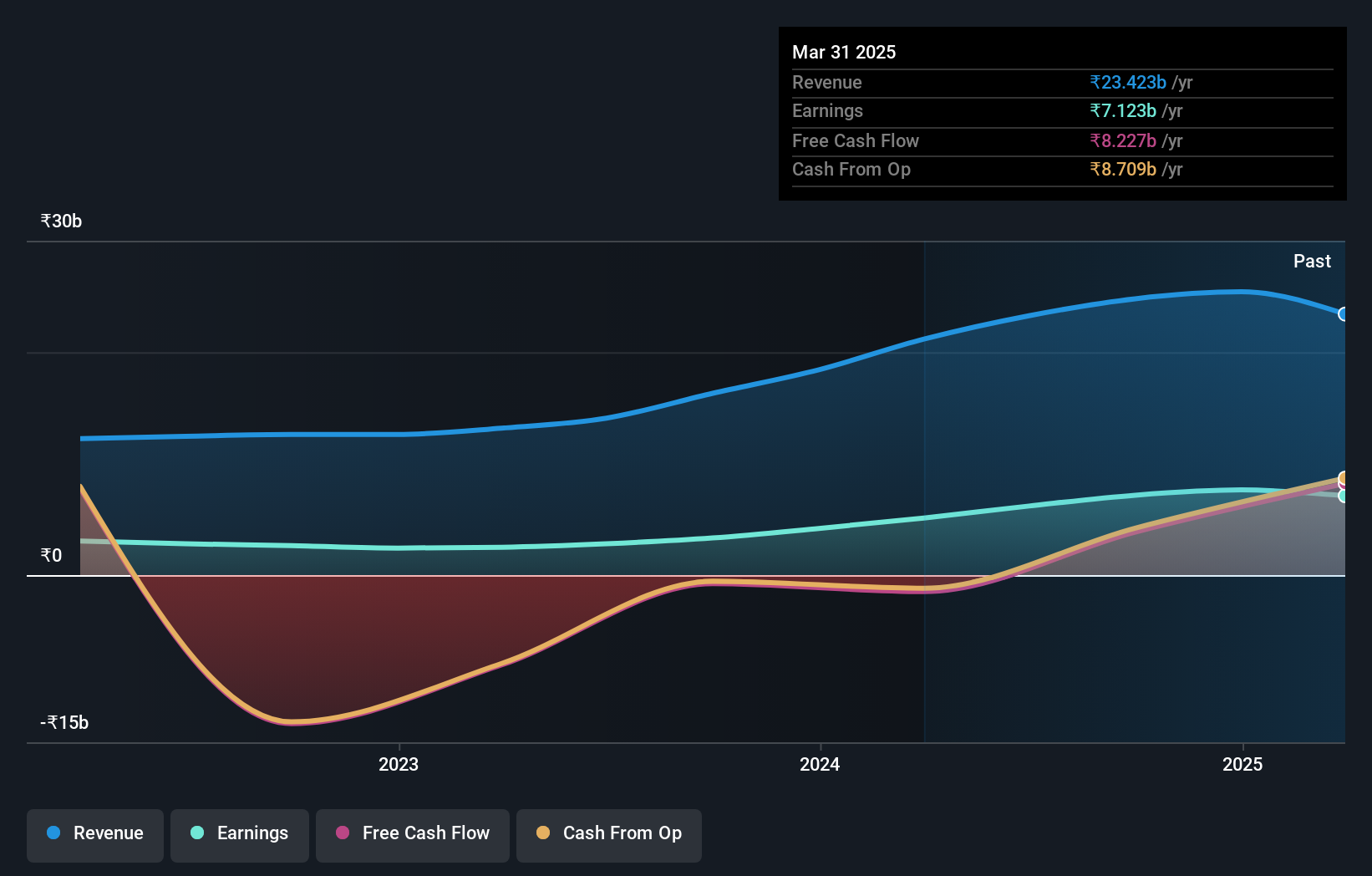

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited operates in the Indian financial sector, offering capital market services in both primary and secondary markets, with a market capitalization of ₹130.92 billion.

Operations: The company's primary revenue stream is from capital market activities, generating ₹20.25 billion, supplemented by facilities and ancillary services at ₹375.25 million and insurance broking and ancillary services contributing ₹2.77 billion.

IIFL Securities, a notable player in India's financial sector, showcases impressive earnings growth of 120% over the past year, outpacing the industry's 64%. The company's net debt to equity ratio stands at a satisfactory 35.5%, having reduced from 117.6% five years ago. Despite its volatile share price recently, IIFL offers high-quality earnings and trades at a competitive price-to-earnings ratio of 21x compared to the broader market's 34x.

- Unlock comprehensive insights into our analysis of IIFL Securities stock in this health report.

Evaluate IIFL Securities' historical performance by accessing our past performance report.

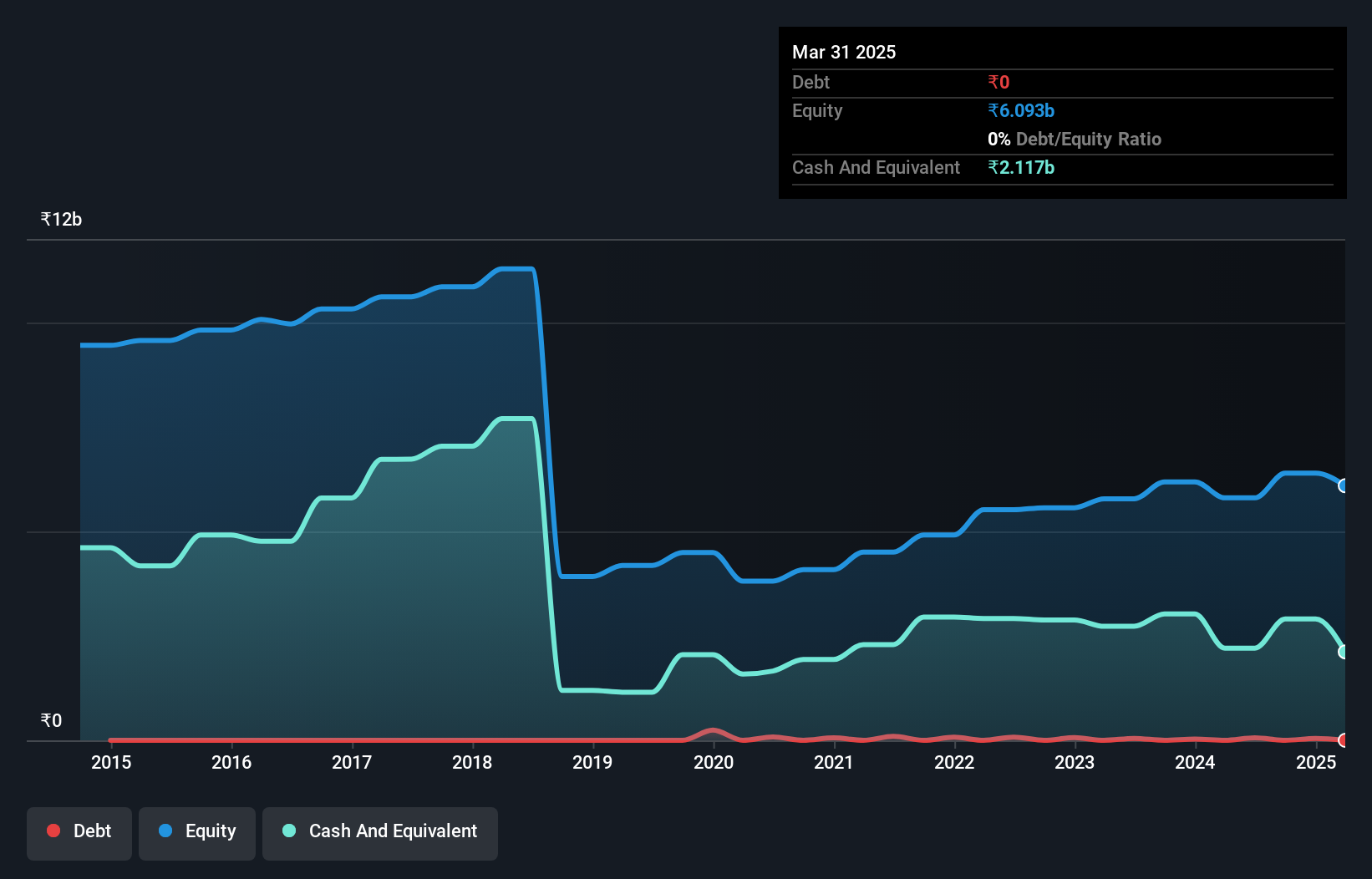

Ingersoll-Rand (India) (NSEI:INGERRAND)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ingersoll-Rand (India) Limited specializes in the manufacturing and sale of industrial air compressors within India, with a market capitalization of ₹144.29 billion.

Operations: The company's primary revenue stream comes from its Air Solutions segment, generating ₹12.27 billion.

Ingersoll-Rand (India), a smaller player in the machinery sector, has shown steady financial performance with earnings growing at 27.5% annually over five years, though recent growth of 12.9% lagged behind industry rates. The company boasts high-quality earnings and more cash than total debt, indicating sound financial health. Recently, it declared a dividend of ₹20 per share for FY2024 and reported Q1 revenue of ₹3.23 billion with net income rising to ₹618.6 million from the previous year’s ₹537.3 million.

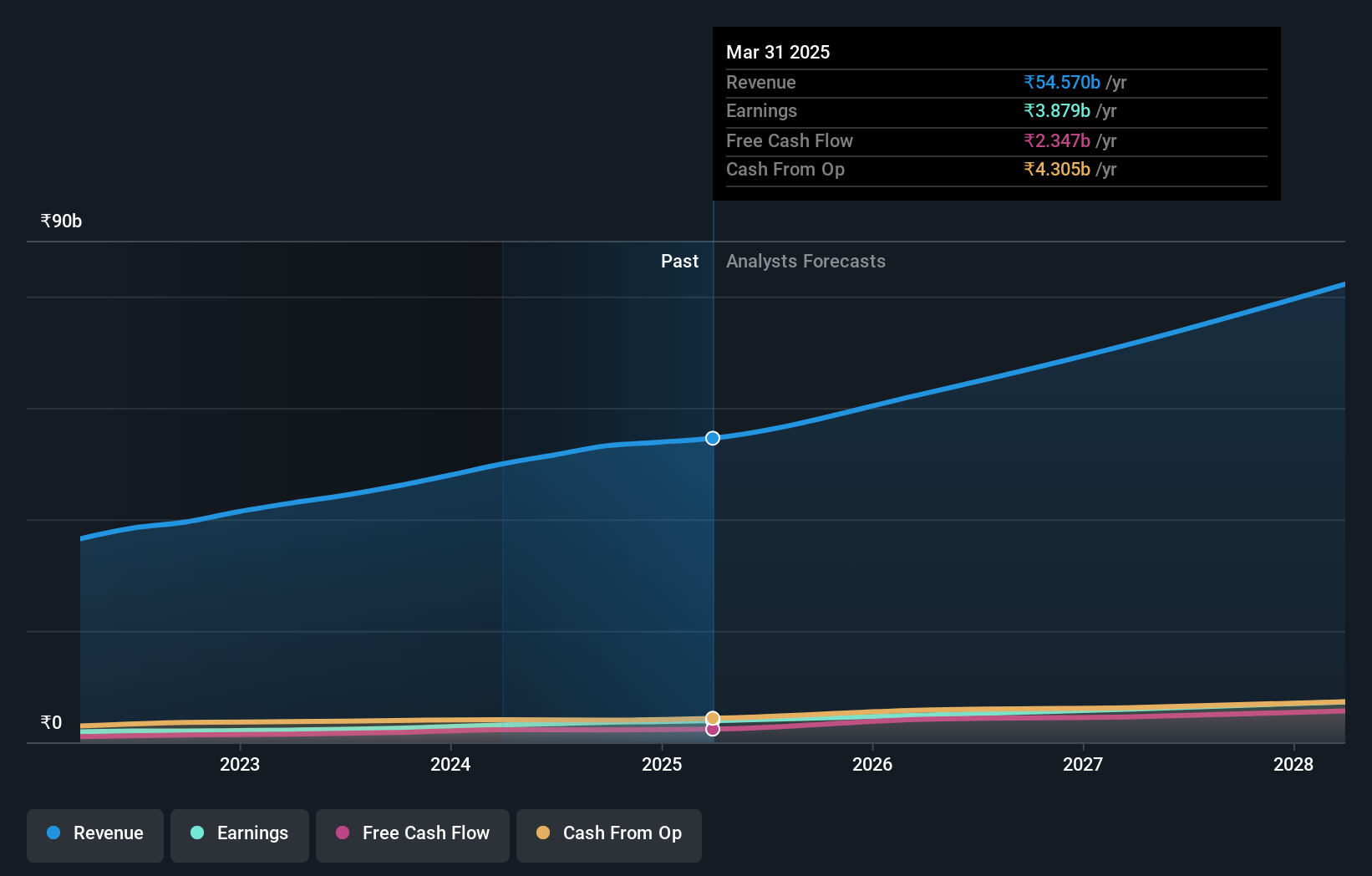

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited is involved in the manufacture and sale of polymer and composite products across India and international markets, with a market capitalization of ₹99.47 billion.

Operations: Time Technoplast generates revenue primarily from polymer products, contributing ₹33.43 billion, and composite products, which add ₹18 billion to its financials.

Time Technoplast, a notable player in the packaging industry, has shown impressive earnings growth of 44.6% over the past year, outpacing the industry's 8.7%. Its price-to-earnings ratio of 29.8x is attractive compared to the broader Indian market's 33.7x, suggesting potential value for investors. The company also reported net income of INR 793 million for Q1 2024, up from INR 561 million a year prior, reflecting its robust financial health and high-quality earnings profile.

- Take a closer look at Time Technoplast's potential here in our health report.

Gain insights into Time Technoplast's past trends and performance with our Past report.

Key Takeaways

- Reveal the 473 hidden gems among our Indian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)