- India

- /

- Consumer Finance

- /

- NSEI:CREDITACC

Is Now The Time To Put CreditAccess Grameen (NSE:CREDITACC) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like CreditAccess Grameen (NSE:CREDITACC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for CreditAccess Grameen

CreditAccess Grameen's Improving Profits

In the last three years CreditAccess Grameen's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, CreditAccess Grameen's EPS catapulted from ₹43.54 to ₹84.46, over the last year. It's a rarity to see 94% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

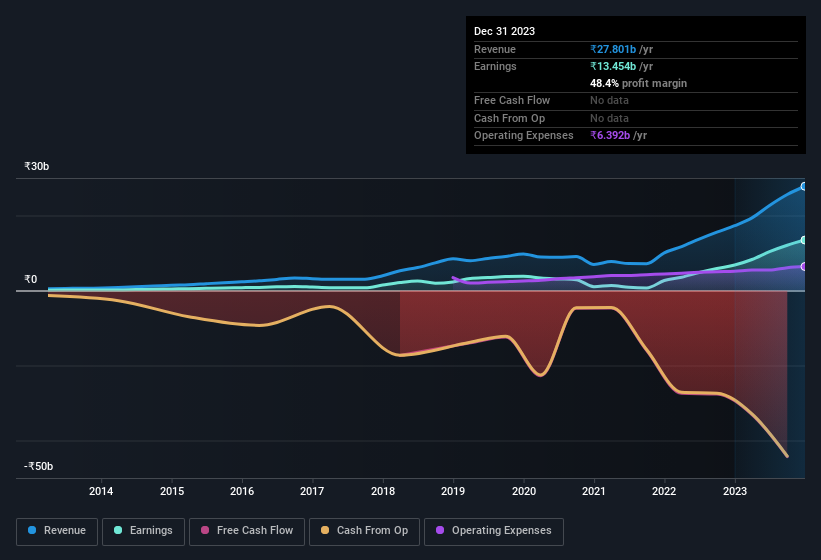

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that CreditAccess Grameen's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note CreditAccess Grameen achieved similar EBIT margins to last year, revenue grew by a solid 61% to ₹28b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for CreditAccess Grameen?

Are CreditAccess Grameen Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that CreditAccess Grameen insiders have a significant amount of capital invested in the stock. Indeed, they hold ₹2.8b worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like CreditAccess Grameen with market caps between ₹166b and ₹530b is about ₹44m.

CreditAccess Grameen's CEO took home a total compensation package of ₹20m in the year prior to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add CreditAccess Grameen To Your Watchlist?

CreditAccess Grameen's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. CreditAccess Grameen certainly ticks a few boxes, so we think it's probably well worth further consideration. We should say that we've discovered 1 warning sign for CreditAccess Grameen that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CREDITACC

CreditAccess Grameen

A non-banking financial company, provides micro finance services for women from poor and low income households in India.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives