- India

- /

- Consumer Finance

- /

- NSEI:CHOLAFIN

Here's Why We Think Cholamandalam Investment and Finance (NSE:CHOLAFIN) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Cholamandalam Investment and Finance (NSE:CHOLAFIN), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Cholamandalam Investment and Finance

How Quickly Is Cholamandalam Investment and Finance Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Cholamandalam Investment and Finance has grown EPS by 13% per year. That growth rate is fairly good, assuming the company can keep it up.

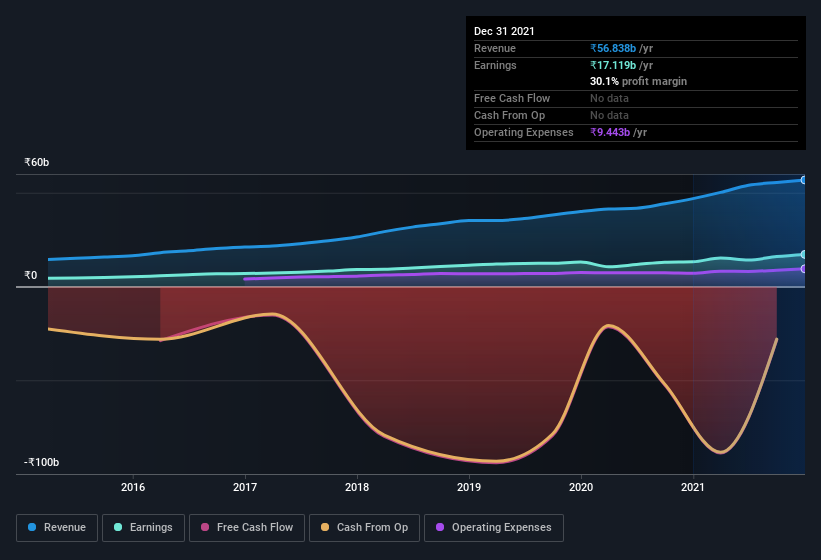

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Cholamandalam Investment and Finance's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Cholamandalam Investment and Finance maintained stable EBIT margins over the last year, all while growing revenue 21% to ₹57b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Cholamandalam Investment and Finance.

Are Cholamandalam Investment and Finance Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹568b company like Cholamandalam Investment and Finance. But we do take comfort from the fact that they are investors in the company. Notably, they have an enormous stake in the company, worth ₹8.1b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Does Cholamandalam Investment and Finance Deserve A Spot On Your Watchlist?

One important encouraging feature of Cholamandalam Investment and Finance is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Before you take the next step you should know about the 2 warning signs for Cholamandalam Investment and Finance (1 is significant!) that we have uncovered.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Cholamandalam Investment and Finance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CHOLAFIN

Cholamandalam Investment and Finance

Operates as a non-banking finance company in India.

Reasonable growth potential with proven track record.