- India

- /

- Hospitality

- /

- NSEI:ITDC

Can You Imagine How India Tourism Development's (NSE:ITDC) Shareholders Feel About The 41% Share Price Increase?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the India Tourism Development Corporation Limited (NSE:ITDC) share price is 41% higher than it was a year ago, much better than the market return of around 33% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Unfortunately the longer term returns are not so good, with the stock falling 24% in the last three years.

View our latest analysis for India Tourism Development

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year India Tourism Development saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

India Tourism Development's revenue actually dropped 27% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

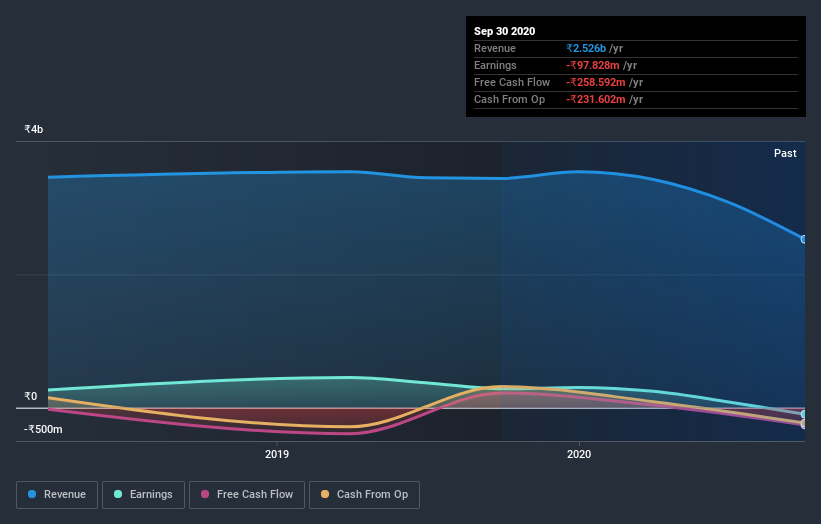

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on India Tourism Development's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that India Tourism Development shareholders have gained 41% (in total) over the last year. That certainly beats the loss of about 7% per year over three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand India Tourism Development better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with India Tourism Development , and understanding them should be part of your investment process.

We will like India Tourism Development better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading India Tourism Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ITDC

India Tourism Development

Operates in the travel, tourism, and hospitality industry in India.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives