- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Orient Electric (NSE:ORIENTELEC) stock falls 9.6% in past week as three-year earnings and shareholder returns continue downward trend

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Orient Electric Limited (NSE:ORIENTELEC) shareholders have had that experience, with the share price dropping 37% in three years, versus a market return of about 58%. The last week also saw the share price slip down another 9.6%.

With the stock having lost 9.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Orient Electric

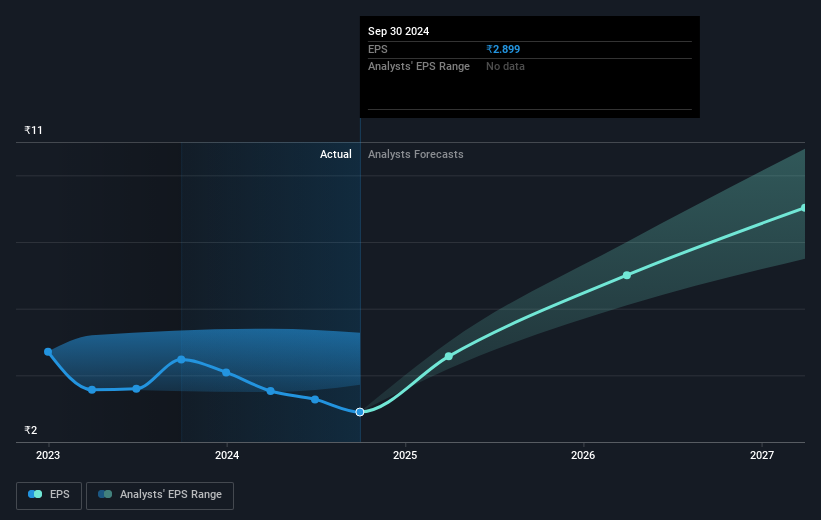

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, Orient Electric's earnings per share (EPS) dropped by 26% each year. This fall in the EPS is worse than the 14% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 80.28.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Orient Electric's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Orient Electric shareholders gained a total return of 2.5% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 5% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Orient Electric better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Orient Electric , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)