We Think Indo Count Industries Limited's (NSE:ICIL) CEO Compensation Looks Fair

The performance at Indo Count Industries Limited (NSE:ICIL) has been quite strong recently and CEO Kailash Lalpuria has played a role in it. Coming up to the next AGM on 29 September 2022, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for Indo Count Industries

How Does Total Compensation For Kailash Lalpuria Compare With Other Companies In The Industry?

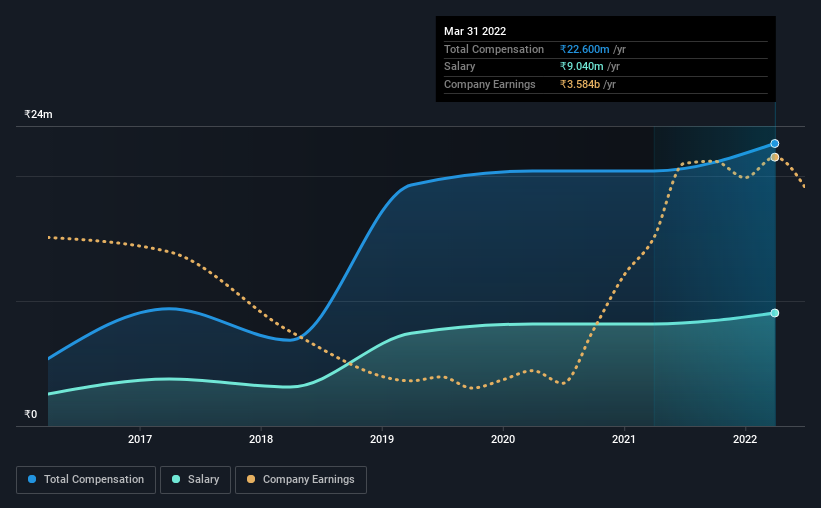

According to our data, Indo Count Industries Limited has a market capitalization of ₹30b, and paid its CEO total annual compensation worth ₹23m over the year to March 2022. That's a notable increase of 11% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at ₹9.0m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹16b and ₹64b had a median total CEO compensation of ₹24m. So it looks like Indo Count Industries compensates Kailash Lalpuria in line with the median for the industry.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹9.0m | ₹8.2m | 40% |

| Other | ₹14m | ₹12m | 60% |

| Total Compensation | ₹23m | ₹20m | 100% |

Speaking on an industry level, nearly 100% of total compensation represents salary, while the remainder of 0.2268% is other remuneration. Indo Count Industries sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Indo Count Industries Limited's Growth Numbers

Over the past three years, Indo Count Industries Limited has seen its earnings per share (EPS) grow by 69% per year. In the last year, its revenue is down 2.4%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Indo Count Industries Limited Been A Good Investment?

Boasting a total shareholder return of 237% over three years, Indo Count Industries Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Indo Count Industries (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Indo Count Industries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ICIL

Indo Count Industries

Manufactures and sells home textile products in India and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives