- India

- /

- Professional Services

- /

- NSEI:RPSGVENT

Shareholders have faith in loss-making RPSG Ventures (NSE:RPSGVENT) as stock climbs 12% in past week, taking five-year gain to 262%

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. Long term RPSG Ventures Limited (NSE:RPSGVENT) shareholders would be well aware of this, since the stock is up 262% in five years. And in the last week the share price has popped 12%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for RPSG Ventures

RPSG Ventures isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years RPSG Ventures saw its revenue grow at 13% per year. That's a fairly respectable growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 29% per year over in that time. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

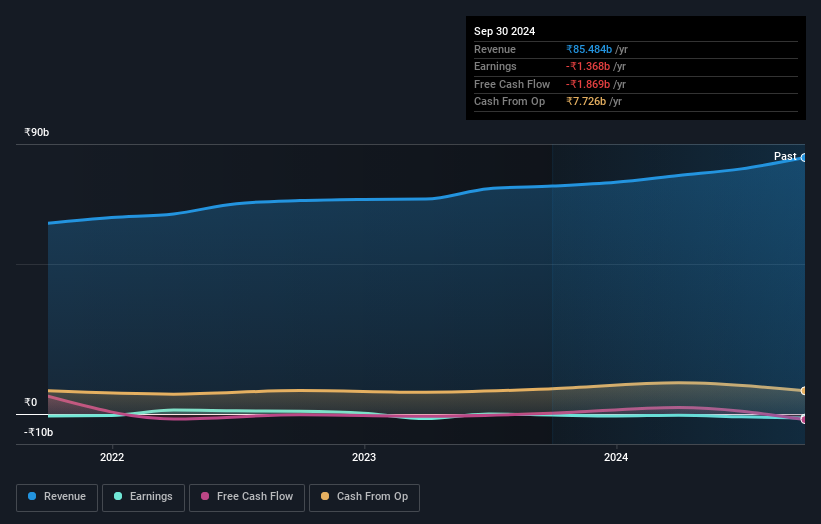

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at RPSG Ventures' financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that RPSG Ventures has rewarded shareholders with a total shareholder return of 58% in the last twelve months. That gain is better than the annual TSR over five years, which is 29%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand RPSG Ventures better, we need to consider many other factors. Even so, be aware that RPSG Ventures is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RPSGVENT

RPSG Ventures

Owns, operates, invests, and promotes business in the fields of information technology, business process outsourcing, property, entertainment, fast moving consumer goods, and sports activities in India.

Good value with imperfect balance sheet.

Market Insights

Community Narratives