- India

- /

- Commercial Services

- /

- NSEI:UDS

Unveiling Rajesh Exports And Two Additional Stocks Believed To Be Trading Below Fair Value On The Indian Exchange

Reviewed by Simply Wall St

Despite a flat performance over the past week, the Indian market has shown remarkable growth with a 45% increase over the last year and earnings expected to grow by 16% annually. In such a thriving environment, identifying stocks that are trading below their fair value could present opportunities for informed investment decisions.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2123.00 | ₹3296.21 | 35.6% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹420.35 | ₹636.71 | 34% |

| Updater Services (NSEI:UDS) | ₹314.35 | ₹538.92 | 41.7% |

| Vedanta (NSEI:VEDL) | ₹447.70 | ₹742.42 | 39.7% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹314.75 | ₹507.64 | 38% |

| Strides Pharma Science (NSEI:STAR) | ₹934.45 | ₹1664.05 | 43.8% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹538.90 | ₹912.33 | 40.9% |

| Delhivery (NSEI:DELHIVERY) | ₹377.00 | ₹746.22 | 49.5% |

| PVR INOX (NSEI:PVRINOX) | ₹1460.20 | ₹2550.18 | 42.7% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3294.10 | ₹5716.33 | 42.4% |

Underneath we present a selection of stocks filtered out by our screen.

Rajesh Exports (NSEI:RAJESHEXPO)

Overview: Rajesh Exports Limited, primarily engaged in refining, manufacturing, wholesaling, and retailing gold and diamond jewelry and various gold products in India, has a market capitalization of approximately ₹92.93 billion.

Operations: The company's revenue from gold products totals approximately ₹280.92 billion.

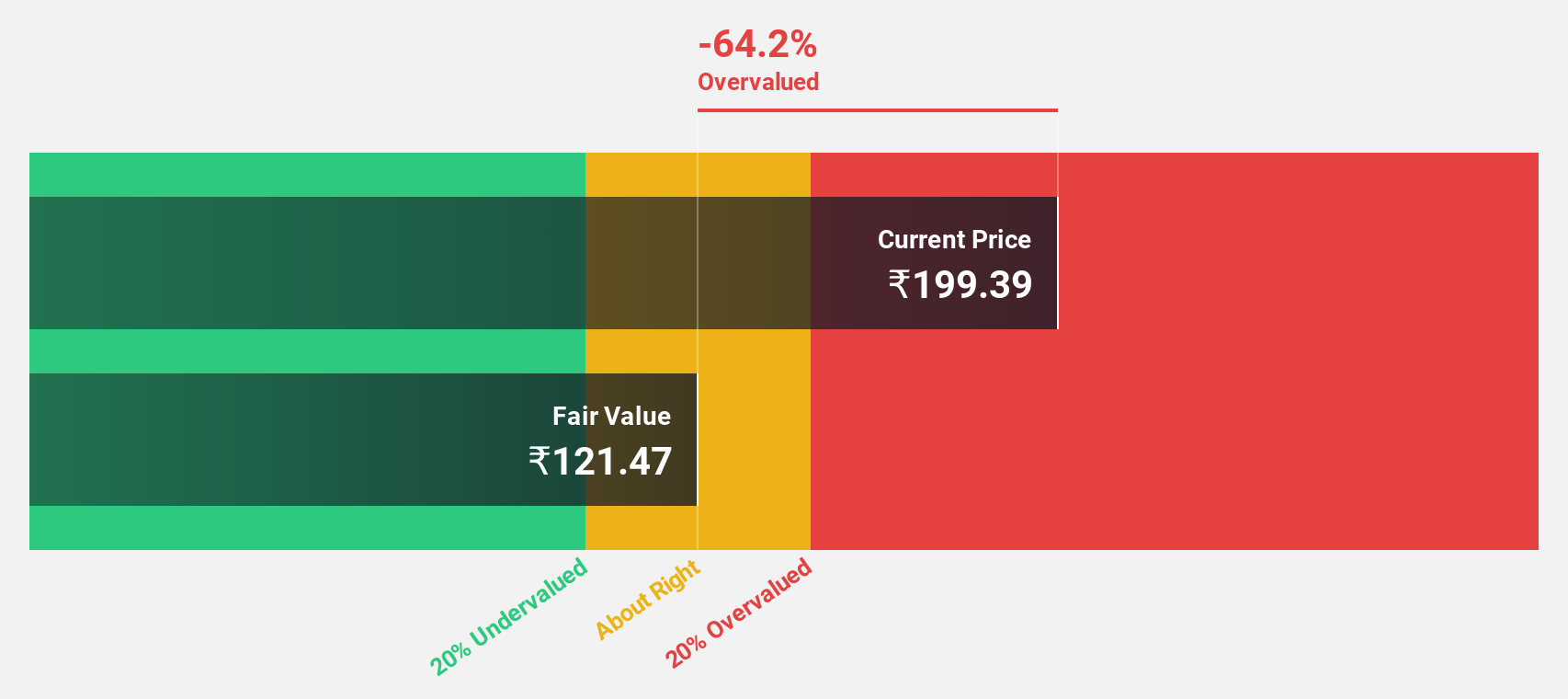

Estimated Discount To Fair Value: 38%

Rajesh Exports, priced at ₹314.75, is trading 38% below its estimated fair value of ₹507.64, indicating significant undervaluation based on cash flows. Despite a modest profit margin decline from 0.4% to 0.1%, the company's earnings are expected to grow substantially by 31.7% annually over the next three years, outpacing the Indian market's growth rate of 15.8%. However, its forecasted revenue growth at 14.1% annually is robust but does not exceed the high threshold of 20%.

- According our earnings growth report, there's an indication that Rajesh Exports might be ready to expand.

- Unlock comprehensive insights into our analysis of Rajesh Exports stock in this financial health report.

Texmaco Rail & Engineering (NSEI:TEXRAIL)

Overview: Texmaco Rail & Engineering Limited is an engineering and infrastructure company based in India, operating both domestically and internationally, with a market capitalization of approximately ₹113.50 billion.

Operations: The company generates revenue through three primary segments: the Freight Car Division at ₹27.50 billion, Infra - Electrical at ₹2.26 billion, and Infra - Rail & Green Energy at ₹5.27 billion.

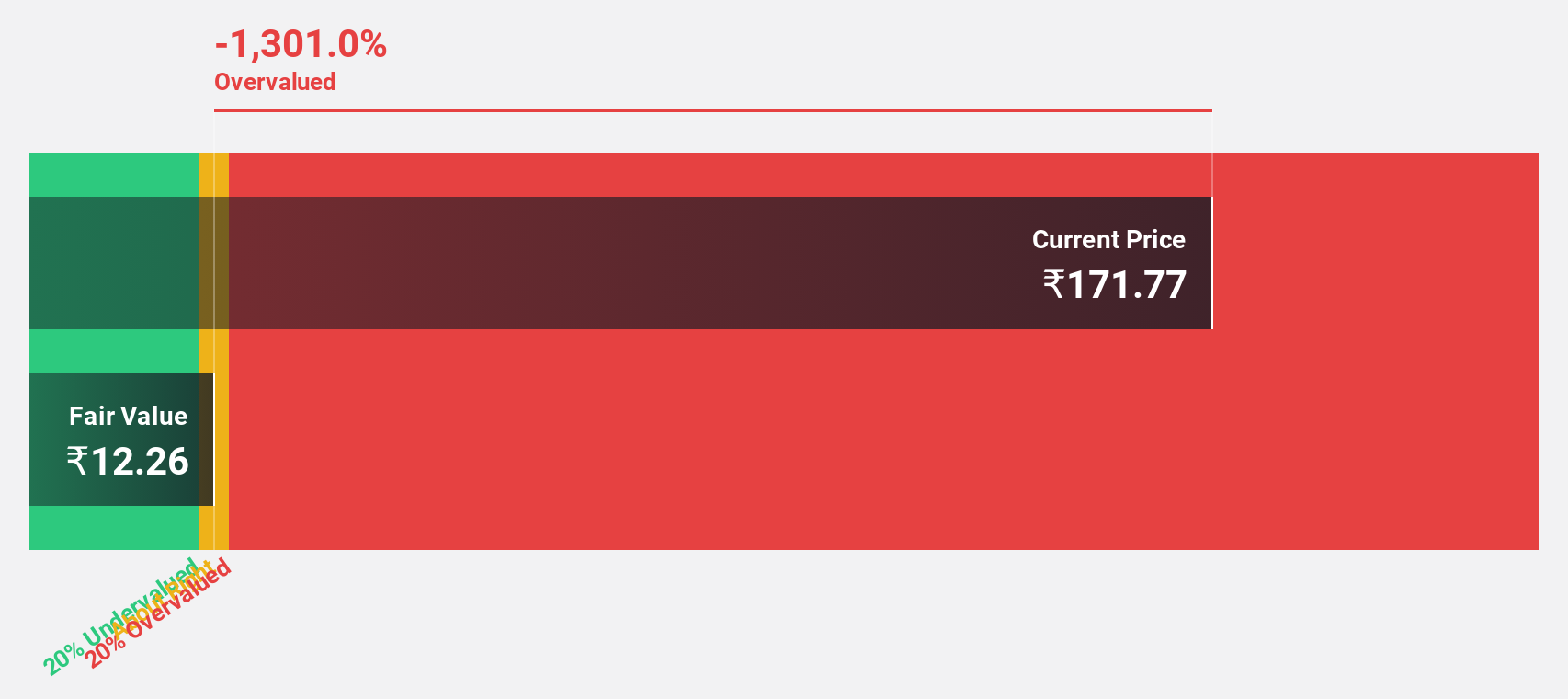

Estimated Discount To Fair Value: 14.2%

Texmaco Rail & Engineering, with a current price of ₹284.12, trades 14.2% below its fair value of ₹331.24, reflecting potential undervaluation in cash flow terms. Despite a forecasted low return on equity at 9.4%, the company's earnings are expected to increase by 28.9% annually over the next three years, surpassing the Indian market's growth rate of 15.8%. However, revenue growth projections stand at 14.2% annually, underperforming against a higher industry benchmark of 20%. Additionally, recent dividend approval suggests positive financial health and shareholder value enhancement.

- Our earnings growth report unveils the potential for significant increases in Texmaco Rail & Engineering's future results.

- Navigate through the intricacies of Texmaco Rail & Engineering with our comprehensive financial health report here.

Updater Services (NSEI:UDS)

Overview: Updater Services Limited operates an integrated business services platform in India, with a market capitalization of approximately ₹21.05 billion.

Operations: The company generates revenue primarily from two segments: Business Support Services at ₹8.09 billion and Integrated Facility Management Services at ₹16.74 billion.

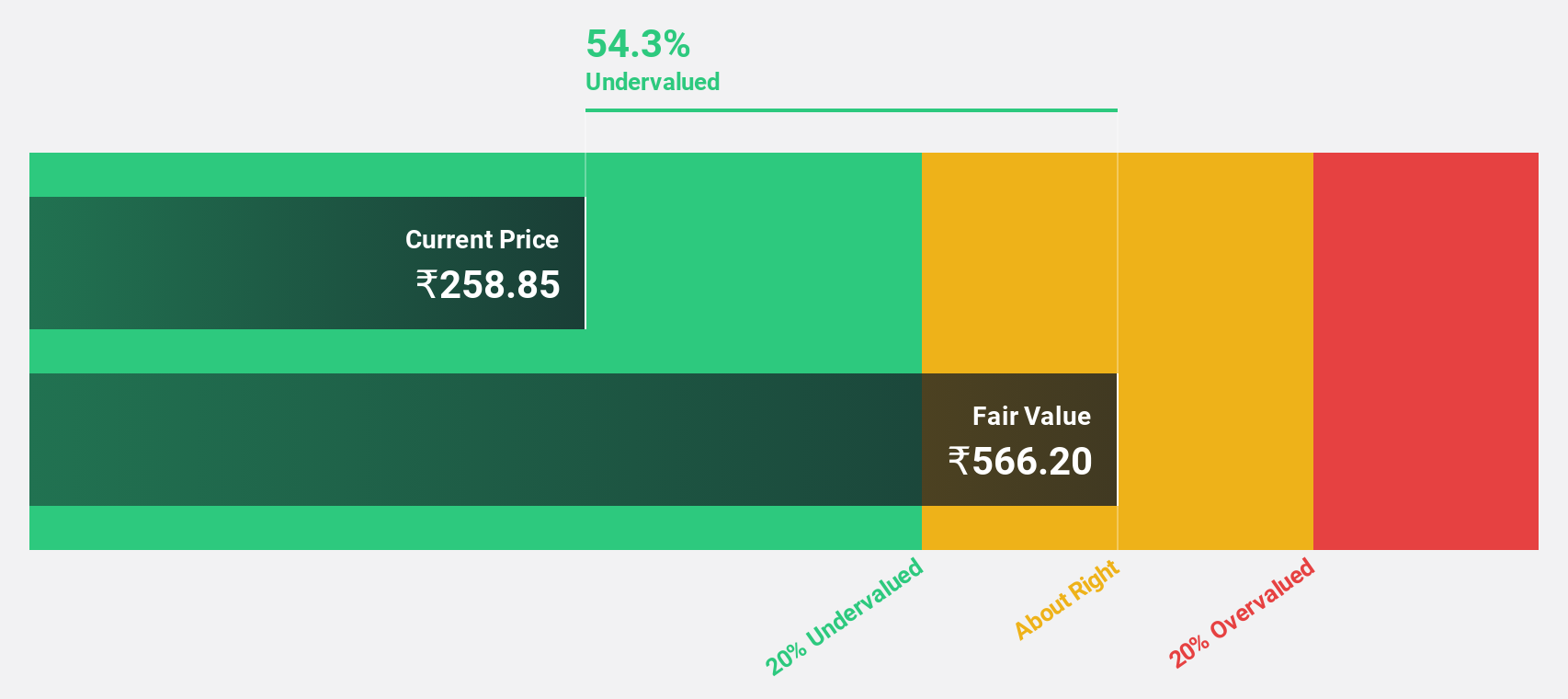

Estimated Discount To Fair Value: 41.7%

Updater Services Limited, priced at ₹314.35, is significantly undervalued based on cash flow analysis with a fair value estimate of ₹538.92. The company's earnings are expected to grow by 34.45% annually, outpacing the Indian market's 15.8%. Despite recent regulatory challenges and penalties totaling INR 4,469,14,393 after adjustments, these are not expected to impact financials significantly as legal resolutions are pursued. This positions Updater Services favorably for potential growth amidst its industry peers.

- Our growth report here indicates Updater Services may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Updater Services.

Make It Happen

- Gain an insight into the universe of 20 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UDS

Updater Services

Operates an integrated business services platform in India and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)