L.G. Balakrishnan & Bros Limited's (NSE:LGBBROSLTD) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

L.G. Balakrishnan & Bros (NSE:LGBBROSLTD) has had a great run on the share market with its stock up by a significant 23% over the last three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study L.G. Balakrishnan & Bros' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for L.G. Balakrishnan & Bros

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for L.G. Balakrishnan & Bros is:

8.4% = ₹618m ÷ ₹7.3b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.08 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

L.G. Balakrishnan & Bros' Earnings Growth And 8.4% ROE

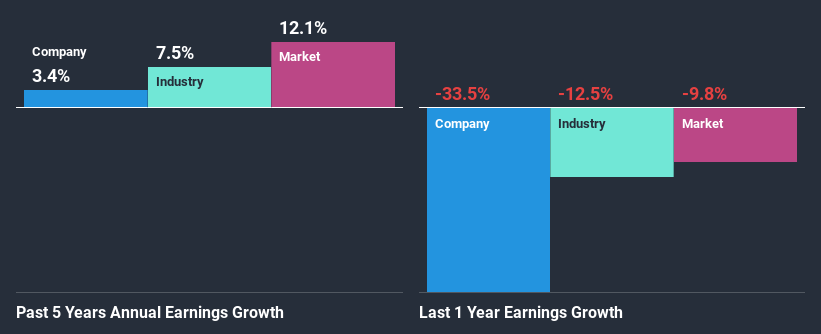

As you can see, L.G. Balakrishnan & Bros' ROE looks pretty weak. An industry comparison shows that the company's ROE is not much different from the industry average of 8.1% either. Thus, the low ROE certainly provides some context to L.G. Balakrishnan & Bros' very little net income growth of 3.4% seen over the past five years.

As a next step, we compared L.G. Balakrishnan & Bros' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 7.5% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is L.G. Balakrishnan & Bros fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is L.G. Balakrishnan & Bros Using Its Retained Earnings Effectively?

L.G. Balakrishnan & Bros' low three-year median payout ratio of 16% (or a retention ratio of 84%) should mean that the company is retaining most of its earnings to fuel its growth. However, the low earnings growth number doesn't reflect this fact. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Moreover, L.G. Balakrishnan & Bros has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

On the whole, we feel that the performance shown by L.G. Balakrishnan & Bros can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade L.G. Balakrishnan & Bros, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LGBBROSLTD

L.G. Balakrishnan & Bros

Manufactures and sells chains, sprockets, and metal formed parts for automotive and industrial applications in India and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)