Here's Why We Think Lakshmi Machine Works (NSE:LAXMIMACH) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Lakshmi Machine Works (NSE:LAXMIMACH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Lakshmi Machine Works

How Fast Is Lakshmi Machine Works Growing Its Earnings Per Share?

In the last three years Lakshmi Machine Works' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Lakshmi Machine Works has grown its trailing twelve month EPS from ₹349 to ₹376, in the last year. That amounts to a small improvement of 7.8%.

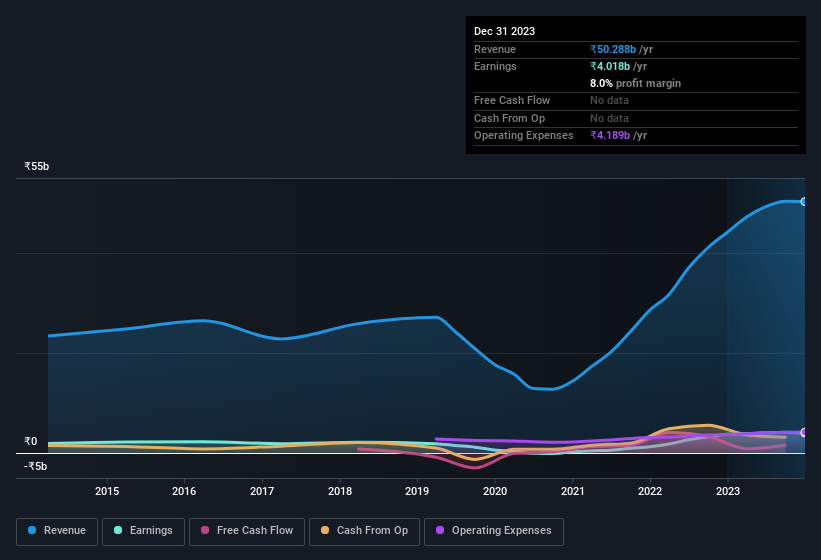

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Lakshmi Machine Works maintained stable EBIT margins over the last year, all while growing revenue 14% to ₹50b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Lakshmi Machine Works' future profits.

Are Lakshmi Machine Works Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Lakshmi Machine Works shares worth a considerable sum. We note that their impressive stake in the company is worth ₹23b. This totals to 14% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Does Lakshmi Machine Works Deserve A Spot On Your Watchlist?

One positive for Lakshmi Machine Works is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Even so, be aware that Lakshmi Machine Works is showing 1 warning sign in our investment analysis , you should know about...

Although Lakshmi Machine Works certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LMW

LMW

Manufactures and sells textile spinning machinery in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in