- India

- /

- Construction

- /

- NSEI:CEMPRO

Party Time: Brokers Just Made Major Increases To Their ITD Cementation India Limited (NSE:ITDCEM) Earnings Forecasts

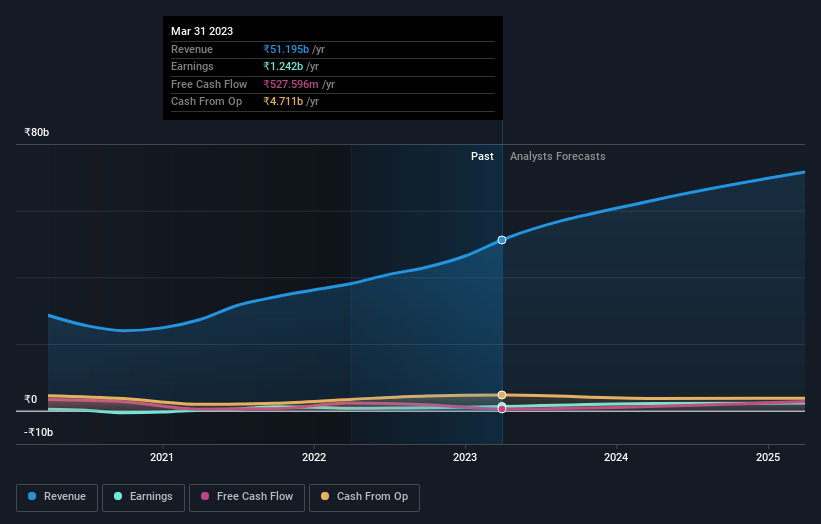

Shareholders in ITD Cementation India Limited (NSE:ITDCEM) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investor sentiment seems to be improving too, with the share price up 5.4% to ₹155 over the past 7 days. Could this big upgrade push the stock even higher?

After this upgrade, ITD Cementation India's dual analysts are now forecasting revenues of ₹63b in 2024. This would be a major 23% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to soar 73% to ₹12.50. Before this latest update, the analysts had been forecasting revenues of ₹57b and earnings per share (EPS) of ₹10.40 in 2024. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for ITD Cementation India

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting ITD Cementation India's growth to accelerate, with the forecast 23% annualised growth to the end of 2024 ranking favourably alongside historical growth of 15% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect ITD Cementation India to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. More bullish expectations could be a signal for investors to take a closer look at ITD Cementation India.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CEMPRO

Cemindia Projects

Provides construction and civil engineering contracting services in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives