- India

- /

- Electrical

- /

- NSEI:HBLENGINE

If You Like EPS Growth Then Check Out HBL Power Systems (NSE:HBLPOWER) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like HBL Power Systems (NSE:HBLPOWER). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for HBL Power Systems

HBL Power Systems's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, HBL Power Systems has grown EPS by 22% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). HBL Power Systems shareholders can take confidence from the fact that EBIT margins are up from 2.6% to 4.6%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

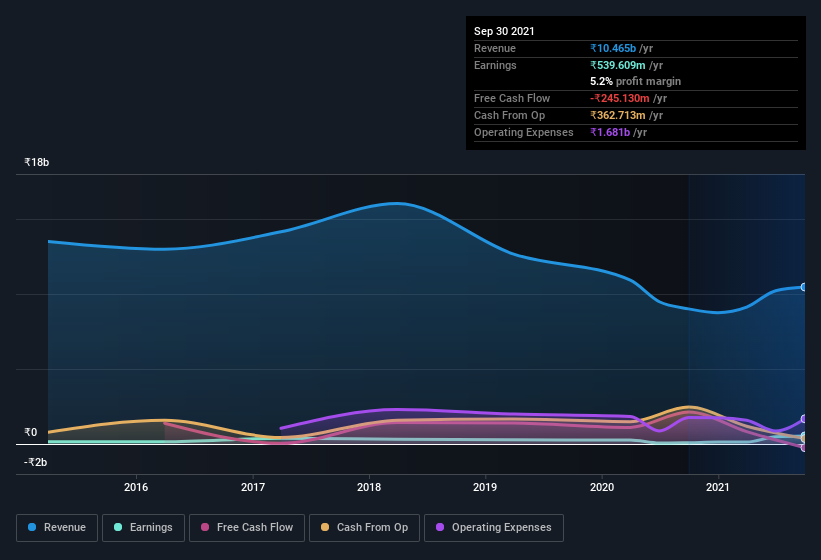

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since HBL Power Systems is no giant, with a market capitalization of ₹19b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are HBL Power Systems Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

HBL Power Systems top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Founder, Aluru Prasad, paid ₹14m to buy shares at an average price of ₹51.00.

The good news, alongside the insider buying, for HBL Power Systems bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold ₹2.0b worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 10% of the company; visible skin in the game.

Should You Add HBL Power Systems To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about HBL Power Systems's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Still, you should learn about the 3 warning signs we've spotted with HBL Power Systems (including 1 which makes us a bit uncomfortable) .

As a growth investor I do like to see insider buying. But HBL Power Systems isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade HBL Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HBL Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HBLENGINE

HBL Engineering

Manufactures and sells batteries, power electronics, and spun concrete products in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives