- India

- /

- Electrical

- /

- NSEI:FINCABLES

Pinning Down Finolex Cables Limited's (NSE:FINCABLES) P/E Is Difficult Right Now

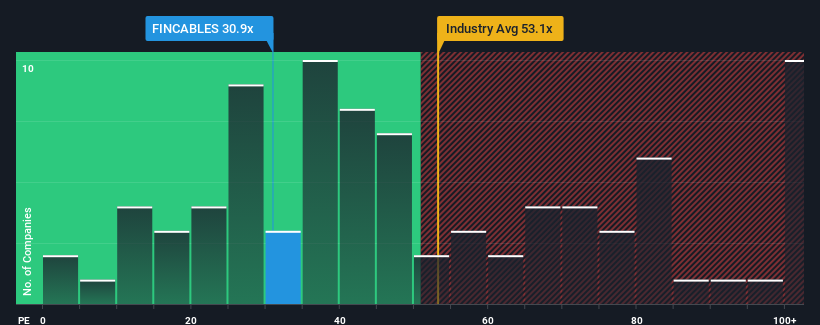

With a median price-to-earnings (or "P/E") ratio of close to 34x in India, you could be forgiven for feeling indifferent about Finolex Cables Limited's (NSE:FINCABLES) P/E ratio of 30.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Finolex Cables as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Finolex Cables

How Is Finolex Cables' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Finolex Cables' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 46% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 5.9% per year during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 20% each year growth forecast for the broader market.

With this information, we find it interesting that Finolex Cables is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Finolex Cables' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Finolex Cables with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Finolex Cables. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FINCABLES

Finolex Cables

Engages in the manufacture and sale of electrical and communication cables, and other electrical appliances in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)