Investors in IndusInd Bank (NSE:INDUSINDBK) have unfortunately lost 48% over the last year

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the IndusInd Bank Limited (NSE:INDUSINDBK) share price is down 48% in the last year. That's well below the market decline of 4.6%. To make matters worse, the returns over three years have also been really disappointing (the share price is 35% lower than three years ago).

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

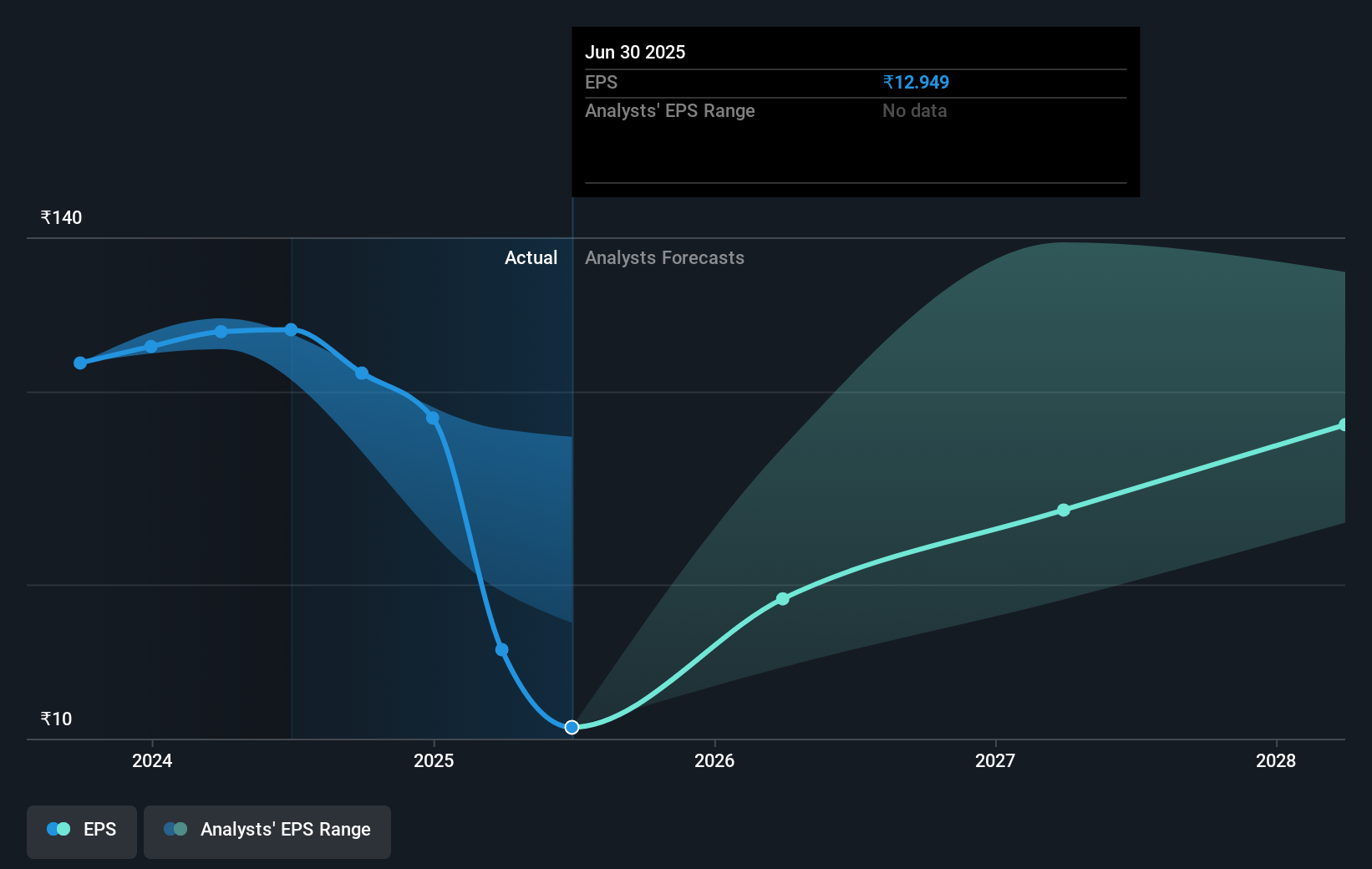

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, IndusInd Bank had to report a 89% decline in EPS over the last year. This fall in the EPS is significantly worse than the 48% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 58.33 there is obviously some real optimism that earnings will bounce back.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into IndusInd Bank's key metrics by checking this interactive graph of IndusInd Bank's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 4.6% in the twelve months, IndusInd Bank shareholders did even worse, losing 48%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with IndusInd Bank , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDUSINDBK

IndusInd Bank

Provides various banking products and financial services to individuals, corporations, government entities, and public sector undertakings in India.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives