We Think Shareholders Are Less Likely To Approve A Large Pay Rise For AU Small Finance Bank Limited's (NSE:AUBANK) CEO For Now

Key Insights

- AU Small Finance Bank's Annual General Meeting to take place on 26th of July

- Total pay for CEO Sanjay Agarwal includes ₹25.6m salary

- The total compensation is 630% higher than the average for the industry

- AU Small Finance Bank's EPS grew by 2.6% over the past three years while total shareholder return over the past three years was 9.1%

Under the guidance of CEO Sanjay Agarwal, AU Small Finance Bank Limited (NSE:AUBANK) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 26th of July. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for AU Small Finance Bank

How Does Total Compensation For Sanjay Agarwal Compare With Other Companies In The Industry?

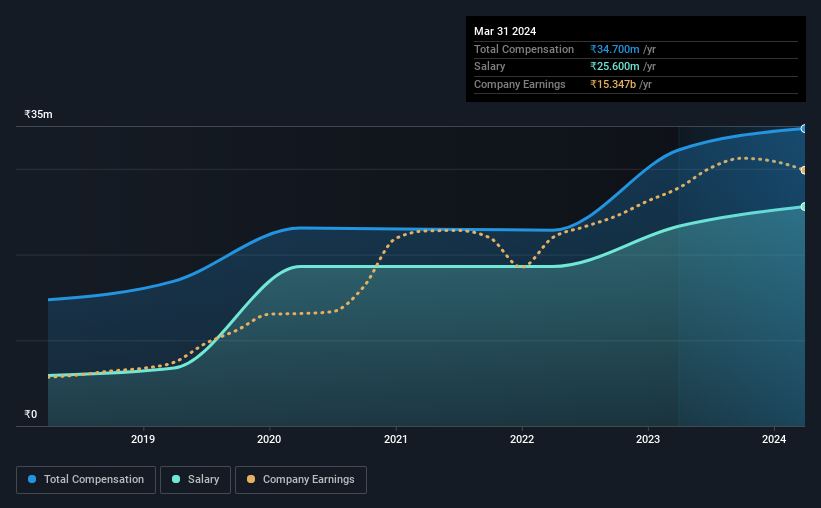

According to our data, AU Small Finance Bank Limited has a market capitalization of ₹466b, and paid its CEO total annual compensation worth ₹35m over the year to March 2024. That's a modest increase of 7.8% on the prior year. Notably, the salary which is ₹25.6m, represents most of the total compensation being paid.

In comparison with other companies in the Indian Banks industry with market capitalizations ranging from ₹335b to ₹1.0t, the reported median CEO total compensation was ₹4.8m. Accordingly, our analysis reveals that AU Small Finance Bank Limited pays Sanjay Agarwal north of the industry median. Moreover, Sanjay Agarwal also holds ₹89b worth of AU Small Finance Bank stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹26m | ₹23m | 74% |

| Other | ₹9.1m | ₹8.9m | 26% |

| Total Compensation | ₹35m | ₹32m | 100% |

On an industry level, around 72% of total compensation represents salary and 28% is other remuneration. There isn't a significant difference between AU Small Finance Bank and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

AU Small Finance Bank Limited's Growth

AU Small Finance Bank Limited's earnings per share (EPS) grew 2.6% per year over the last three years. In the last year, its revenue is up 22%.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has AU Small Finance Bank Limited Been A Good Investment?

With a total shareholder return of 9.1% over three years, AU Small Finance Bank Limited has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for AU Small Finance Bank that investors should be aware of in a dynamic business environment.

Switching gears from AU Small Finance Bank, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AUBANK

AU Small Finance Bank

Offers various banking and financial services in India.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026