- India

- /

- Auto Components

- /

- NSEI:LUMAXTECH

Lumax Auto Technologies' (NSE:LUMAXTECH) Dividend Will Be Increased To ₹3.00

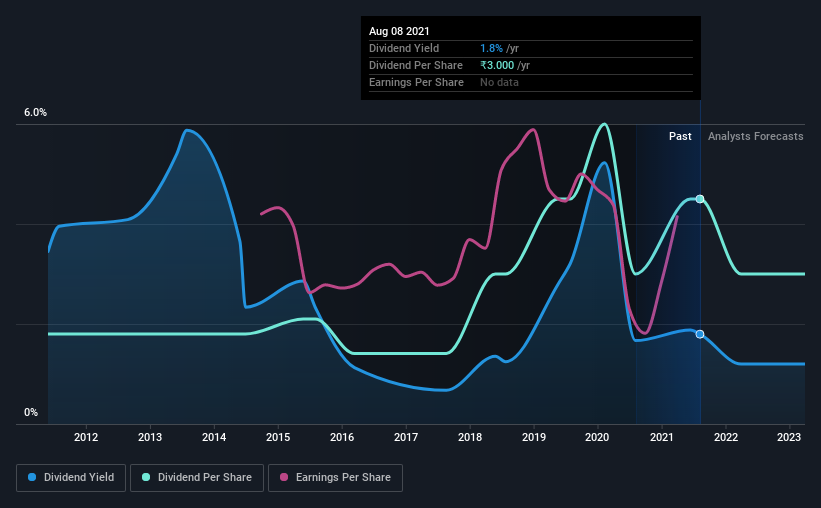

Lumax Auto Technologies Limited's (NSE:LUMAXTECH) dividend will be increasing to ₹3.00 on 30th of September. This makes the dividend yield 1.8%, which is above the industry average.

View our latest analysis for Lumax Auto Technologies

Lumax Auto Technologies' Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Lumax Auto Technologies was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 52.7%. If the dividend continues along recent trends, we estimate the payout ratio will be 31%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was ₹1.20 in 2011, and the most recent fiscal year payment was ₹3.00. This implies that the company grew its distributions at a yearly rate of about 9.6% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Lumax Auto Technologies might have put its house in order since then, but we remain cautious.

We Could See Lumax Auto Technologies' Dividend Growing

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Lumax Auto Technologies has seen EPS rising for the last five years, at 8.2% per annum. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Lumax Auto Technologies Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Lumax Auto Technologies is a strong income stock thanks to its track record and growing earnings. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Lumax Auto Technologies that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Lumax Auto Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LUMAXTECH

Lumax Auto Technologies

Manufactures and sells automotive components in India.

High growth potential with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)