- India

- /

- Auto Components

- /

- NSEI:LUMAXTECH

₹457 - That's What Analysts Think Lumax Auto Technologies Limited (NSE:LUMAXTECH) Is Worth After These Results

It's been a good week for Lumax Auto Technologies Limited (NSE:LUMAXTECH) shareholders, because the company has just released its latest third-quarter results, and the shares gained 6.6% to ₹430. It was a workmanlike result, with revenues of ₹7.3b coming in 2.4% ahead of expectations, and statutory earnings per share of ₹13.63, in line with analyst appraisals. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Lumax Auto Technologies after the latest results.

View our latest analysis for Lumax Auto Technologies

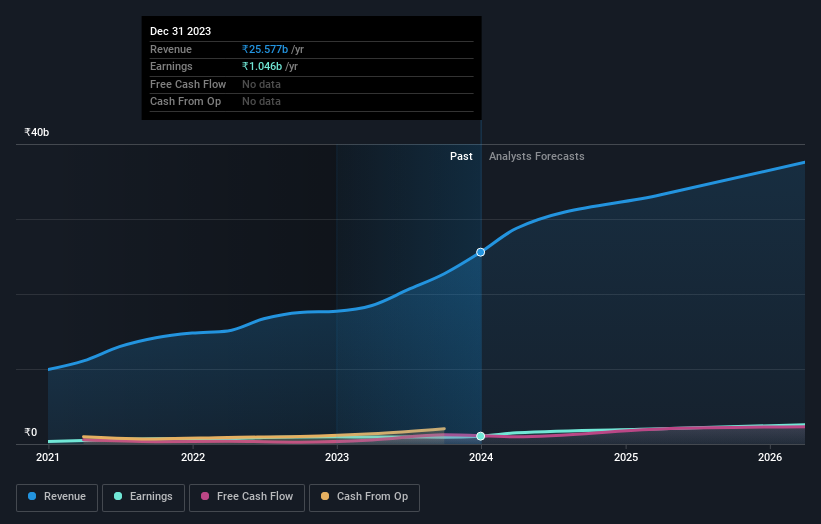

Taking into account the latest results, the most recent consensus for Lumax Auto Technologies from five analysts is for revenues of ₹33.2b in 2025. If met, it would imply a huge 30% increase on its revenue over the past 12 months. Per-share earnings are expected to leap 83% to ₹28.05. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹32.1b and earnings per share (EPS) of ₹25.45 in 2025. So it seems there's been a definite increase in optimism about Lumax Auto Technologies' future following the latest results, with a solid gain to the earnings per share forecasts in particular.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 9.3% to ₹457per share. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Lumax Auto Technologies analyst has a price target of ₹560 per share, while the most pessimistic values it at ₹245. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Lumax Auto Technologies' past performance and to peers in the same industry. It's clear from the latest estimates that Lumax Auto Technologies' rate of growth is expected to accelerate meaningfully, with the forecast 23% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 16% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 11% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Lumax Auto Technologies is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Lumax Auto Technologies following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Lumax Auto Technologies going out to 2026, and you can see them free on our platform here..

You still need to take note of risks, for example - Lumax Auto Technologies has 2 warning signs we think you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LUMAXTECH

Lumax Auto Technologies

Manufactures and sells automotive components in India.

High growth potential with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)