- Israel

- /

- Renewable Energy

- /

- TASE:ENLT

Recent 4.2% pullback isn't enough to hurt long-term Enlight Renewable Energy (TLV:ENLT) shareholders, they're still up 437% over 5 years

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Enlight Renewable Energy Ltd (TLV:ENLT) share price. It's 437% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 22% in about a quarter.

In light of the stock dropping 4.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

However if you'd rather see where the opportunities and risks are within ENLT's industry, you can check out our analysis on the IL Renewable Energy industry.

We don't think that Enlight Renewable Energy's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Enlight Renewable Energy saw its revenue grow at 43% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 40% per year in that time. Despite the strong run, top performers like Enlight Renewable Energy have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

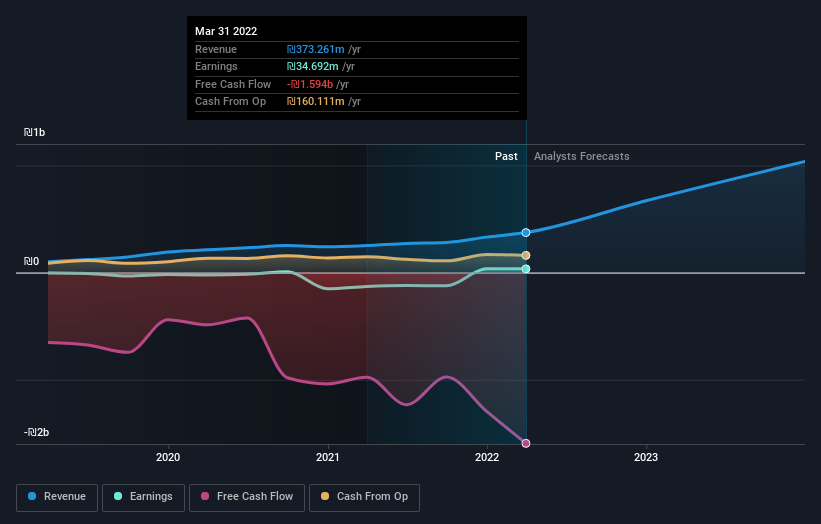

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Enlight Renewable Energy has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Enlight Renewable Energy stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Enlight Renewable Energy shareholders have received returns of 14% over twelve months, which isn't far from the general market return. We should note here that the five-year TSR is more impressive, at 40% per year. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Enlight Renewable Energy a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Enlight Renewable Energy is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

But note: Enlight Renewable Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enlight Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ENLT

Enlight Renewable Energy

Operates a renewable energy platform in Israel, the Middle East, North Africa, Europe, and the United States.

High growth potential with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)