- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

The Bull Case For Nayax (TASE:NYAX) Could Change Following ChargeSmart EV Partnership Announcement – Learn Why

Reviewed by Sasha Jovanovic

- On October 8, 2025, ChargeSmart EV announced a long-term partnership with Nayax Ltd., naming Nayax as its preferred cashless payments provider to support the rollout of thousands of new DC fast chargers in the United States using Nayax’s VPOS Touch card readers and Commerce SDK payment solution.

- This collaboration aims to unify both in-app and on-site payments within a single Nayax platform, eliminating the need for multiple providers and enhancing reliability and convenience across ChargeSmart’s expanding EV charging network.

- We'll examine how becoming ChargeSmart’s preferred payment provider could expand Nayax’s reach in the US EV charging sector.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Nayax Investment Narrative Recap

To be a Nayax shareholder, one needs to believe in the company's ability to seize new verticals where digital payments are accelerating, like EV charging. The recent ChargeSmart partnership highlights this opportunity by potentially expanding Nayax’s presence in the US. While this could bolster short-term momentum around recurring SaaS and processing revenue growth, the most important current catalyst, it does not materially change the primary risk of intensifying competition pressuring margins and hardware pricing in new markets.

The August partnership with Autel Energy, focusing on embedded payment solutions for another leading EV charger provider, is highly relevant to ChargeSmart’s announcement. These consecutive contracts reinforce Nayax’s push for first-mover advantage in the EV space, an area expected to support revenue growth as more infrastructure rolls out, but also test Nayax’s ability to defend margins if digital payment commoditization accelerates.

In contrast, investors should be aware of how strong competitors entering the EV payment market could...

Read the full narrative on Nayax (it's free!)

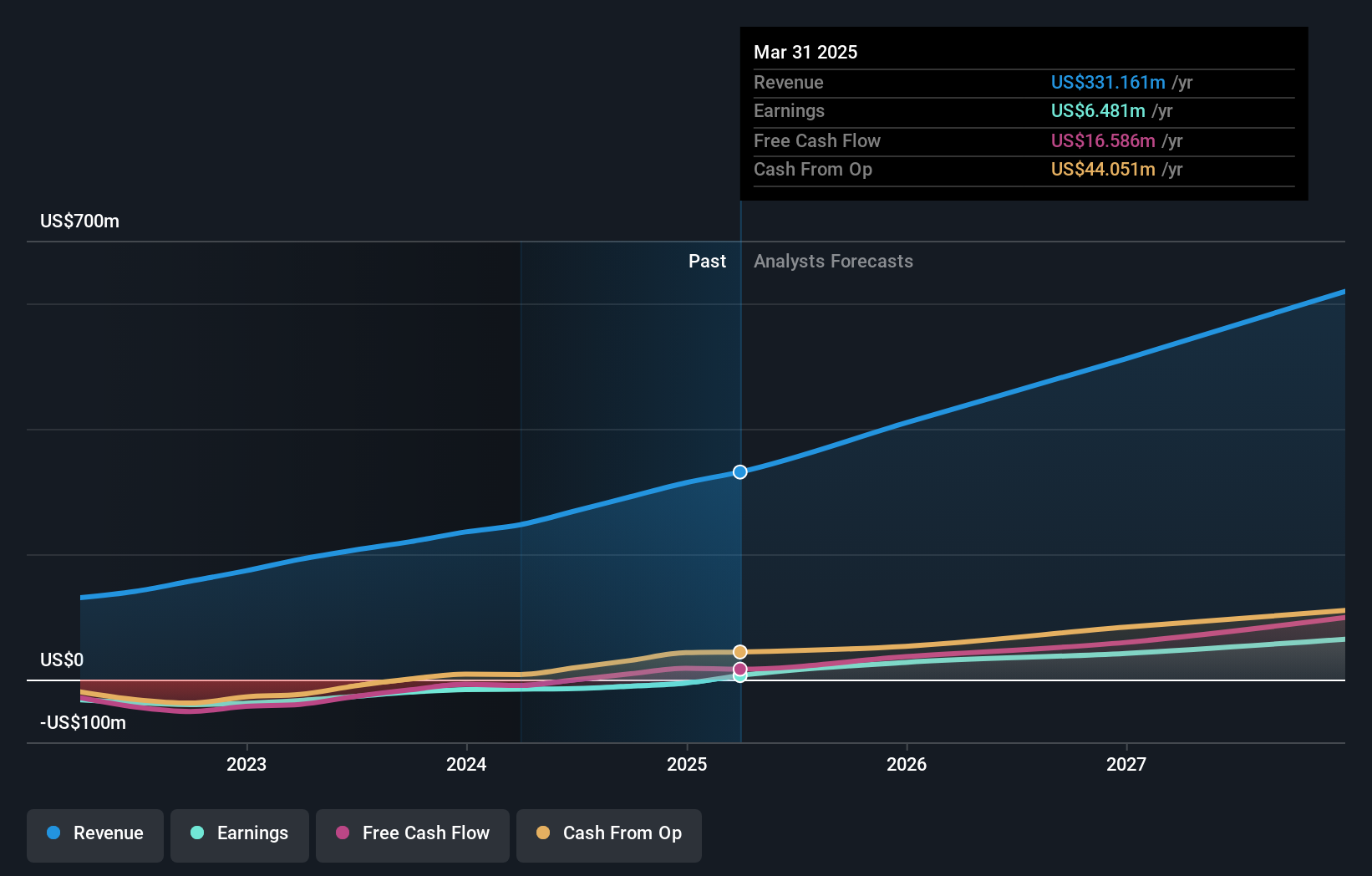

Nayax's narrative projects $673.0 million in revenue and $81.0 million in earnings by 2028. This requires 24.5% yearly revenue growth and a $59.9 million increase in earnings from the current $21.1 million.

Uncover how Nayax's forecasts yield a ₪153.68 fair value, in line with its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have shared fair value targets for Nayax, ranging widely from ₪67.69 to ₪191.91 per share. While this signals differing opinions about potential upside or overpricing, these views come as Nayax leans into new EV sector partnerships to drive recurring revenues and confront evolving margin pressures; consider these varied community perspectives as you weigh alternative outlooks on the company’s future performance.

Explore 3 other fair value estimates on Nayax - why the stock might be worth less than half the current price!

Build Your Own Nayax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nayax research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nayax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nayax's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives