Key Takeaways

- Diversification into high-growth sectors and international markets, along with deep OEM integration, is driving predictable, scalable, and higher-margin recurring revenues.

- Operational efficiencies and ecosystem lock-in are boosting profitability, supporting sustainable margin expansion and long-term earnings growth.

- Intensifying regulation, commoditization of digital payments, and high investment needs may constrain Nayax's revenue growth, profitability, and ability to expand its self-service device market.

Catalysts

About Nayax- A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

- Nayax's expansion into high-growth verticals like EV charging-with partnerships locking in OEM integrations and first-mover advantages-positions the company to capture outsized recurring SaaS and processing revenues in emerging markets where payment digitalization is rapidly accelerating, supporting both topline revenue and long-term gross margin expansion.

- The accelerating shift from cash to contactless payments globally is driving increased transaction volumes and recurring revenue growth-now representing 74% of revenue and expanding at >30% YoY-indicating continued predictable, higher-margin earnings as the broader adoption of digital payment infrastructure continues to play out.

- Strategic M&A and international expansion, particularly the integration of recent acquisitions and entry into underpenetrated regions like Brazil and Benelux, are providing operational leverage, scale, and synergies that boost both revenue growth rates and profitability, evidenced by annualized gross margin improvements and operating margin gains.

- Growth in ecosystem lock-in, driven by the embedding of Nayax's payment platforms inside OEM devices and diversification of value-added services (including SaaS, embedded banking, and business management), is likely to lift ARPU, reduce customer churn, and drive scalable operating leverage, supporting sustainable margin expansion and earnings growth.

- Ongoing operational optimization-such as renegotiated bank acquirer contracts, improved smart-routing, and supply chain efficiencies-is already driving higher processing and hardware margins, and continued efforts in this area should further boost net margins, free cash flow, and bottom-line earnings in future periods.

Nayax Future Earnings and Revenue Growth

Assumptions

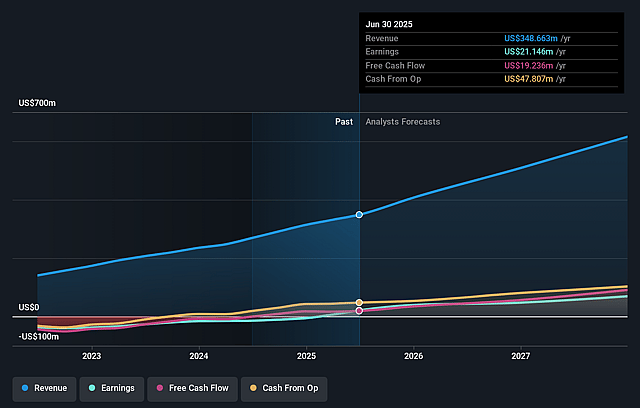

How have these above catalysts been quantified?- Analysts are assuming Nayax's revenue will grow by 24.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 12.0% in 3 years time.

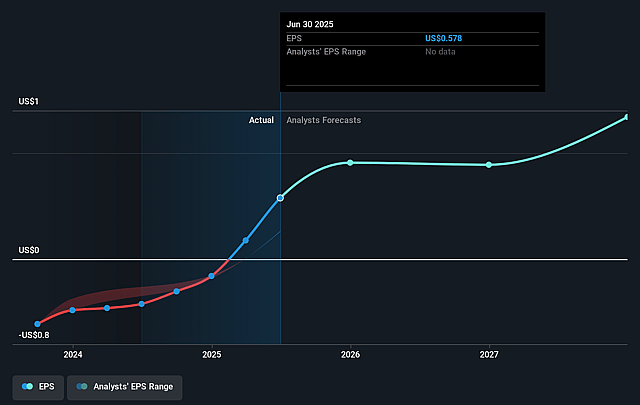

- Analysts expect earnings to reach $81.0 million (and earnings per share of $1.34) by about September 2028, up from $21.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $50.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 88.5x today. This future PE is greater than the current PE for the IL Electronic industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 1.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.57%, as per the Simply Wall St company report.

Nayax Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying privacy regulation and rising global data security scrutiny may reduce Nayax's ability to leverage customer transaction data across jurisdictions (such as in embedded banking or analytics-driven SaaS upsells), negatively impacting recurring revenue growth and cross-selling opportunities.

- The increasing commoditization of digital payments and broadening competition from large, well-capitalized payment and fintech providers-especially as Nayax moves into verticals like EV charging and retail-could pressure transaction margins, hardware and SaaS pricing, ultimately limiting future net margin expansion.

- Heavy reliance on continued R&D, acquisitions, and the buildout of new divisions (such as embedded banking) requires sustained, significant capital investment; missteps in integration or execution, or the need for further equity offerings, could erode earnings per share and impact both net income and free cash flow.

- The trend towards direct-to-consumer, mobile-first retail and declining growth in retrofitting of legacy vending may limit the expansion of Nayax's core unattended/self-service device market, risking slower device deployment growth and restraining total addressable market revenue expansion.

- Escalating regulatory and compliance costs-particularly for embedded financial products across multiple international markets-could disproportionately impact medium-sized players like Nayax, straining operational agility and putting further pressure on profitability and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₪153.68 for Nayax based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₪178.97, and the most bearish reporting a price target of just ₪128.39.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $673.0 million, earnings will come to $81.0 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 10.6%.

- Given the current share price of ₪169.2, the analyst price target of ₪153.68 is 10.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.