- Israel

- /

- Communications

- /

- TASE:MCRNT

Middle Eastern Penny Stocks With Market Caps Below US$2B

Reviewed by Simply Wall St

Most Gulf markets have recently shown positive movements, buoyed by hopes for relief from U.S. tariffs and other global economic factors. In this context, penny stocks—though often associated with speculative investing—can still present valuable opportunities when backed by solid financials. This article will focus on three Middle Eastern penny stocks that demonstrate strong balance sheets and potential for growth, offering intriguing prospects for investors seeking to explore beyond the usual market leaders.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.307 | ₪159.97M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.055 | ₪3.28B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.63B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.35 | ₪174.7M | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.44 | TRY1.23B | ★★★★★☆ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.681 | ₪17.84M | ★★★★★★ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.83 | TRY512.4M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.25 | AED9.61B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.434 | ₪541.34M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.80 | ₪74.64M | ★★★★★★ |

Click here to see the full list of 93 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market capitalization of AED4.58 billion.

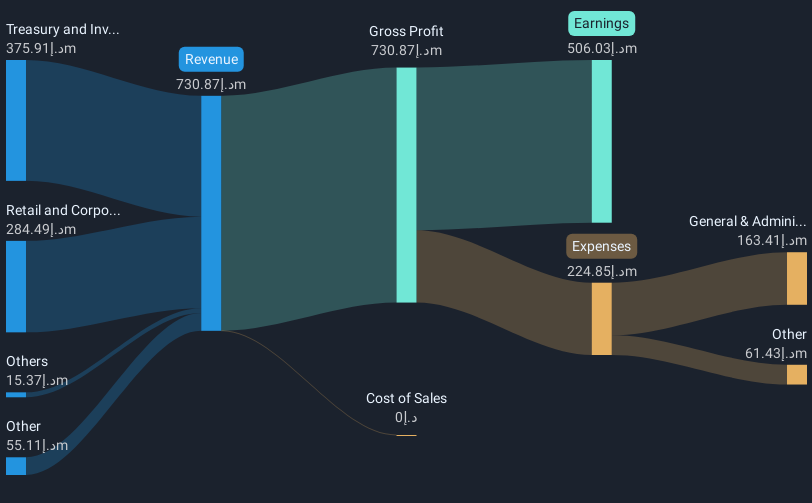

Operations: The bank's revenue is primarily derived from its Treasury and Investments segment, accounting for AED375.91 million, followed by Retail and Corporate Banking services generating AED284.49 million.

Market Cap: AED4.58B

National Bank of Umm Al-Qaiwain (PSC) provides a compelling case for those interested in penny stocks within the Middle East, with a market capitalization of AED4.58 billion. The bank's Price-To-Earnings ratio of 9.1x suggests good value compared to the AE market average. However, it faces challenges such as a high level of bad loans at 4% and low Return on Equity at 8.5%. Despite these hurdles, its earnings have grown by 15.3% annually over five years, supported by primarily low-risk funding sources like customer deposits, which constitute 96% of liabilities. Recent earnings reports indicate stable net income growth to AED506 million for 2024.

- Take a closer look at National Bank of Umm Al-Qaiwain (PSC)'s potential here in our financial health report.

- Examine National Bank of Umm Al-Qaiwain (PSC)'s past performance report to understand how it has performed in prior years.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development Co. (ADX:SCIDC) operates in the cement and industrial development sector, with a market capitalization of AED382.59 million.

Operations: Sharjah Cement and Industrial Development Co. (ADX:SCIDC) does not report specific revenue segments.

Market Cap: AED382.59M

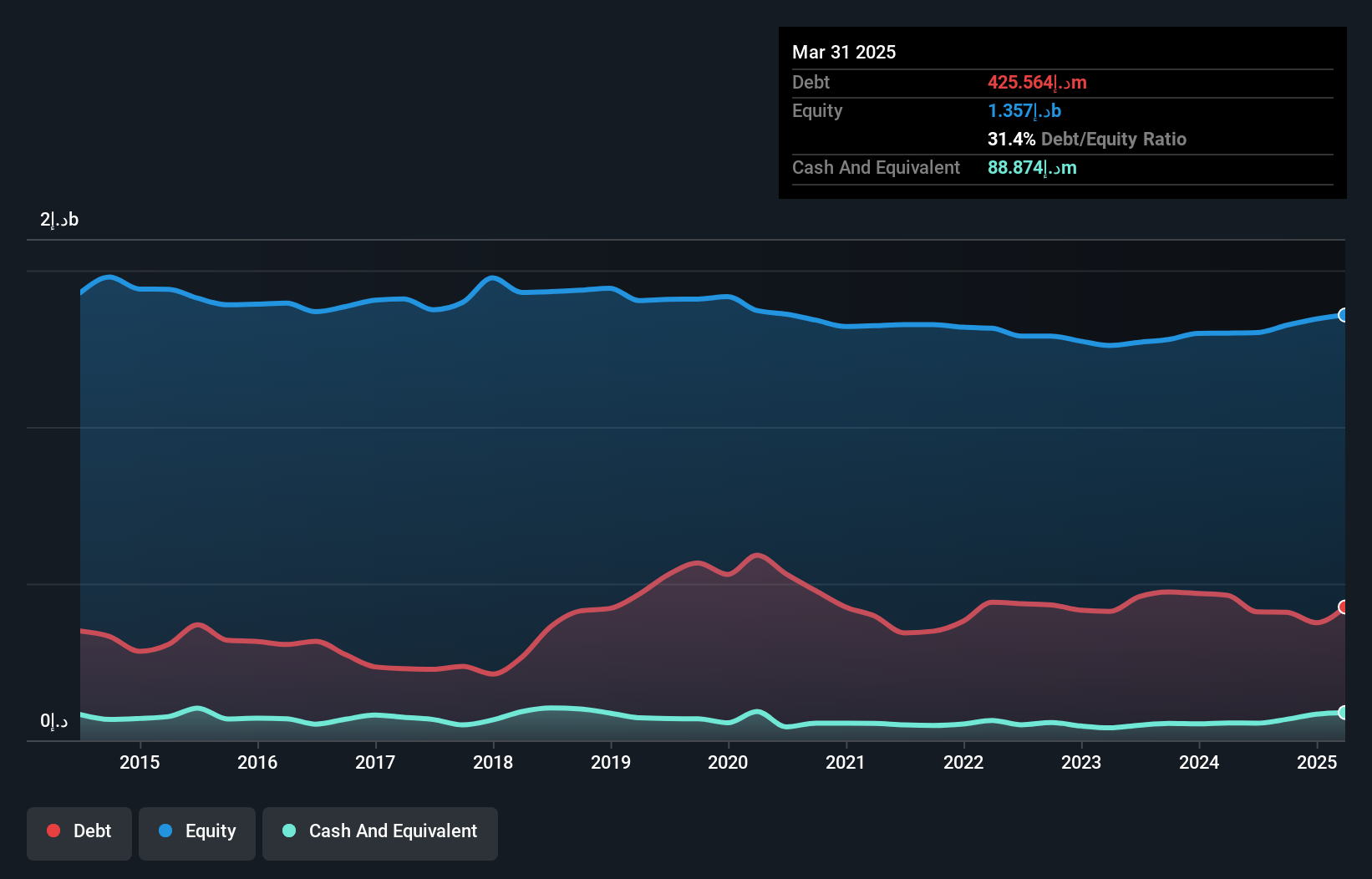

Sharjah Cement and Industrial Development Co. offers potential for investors interested in penny stocks, with a market cap of AED382.59 million. The company reported significant earnings growth of 758.2% over the past year, outperforming the Basic Materials industry average. Its net profit margin improved to 4.6%, supported by a satisfactory net debt to equity ratio of 25.8%. Short-term assets exceed both short and long-term liabilities, indicating strong liquidity management. While the board lacks experience with an average tenure of 1.2 years, stable weekly volatility and undiluted shareholder value reflect resilience amidst market fluctuations.

- Click here and access our complete financial health analysis report to understand the dynamics of Sharjah Cement and Industrial Development (PJSC).

- Review our historical performance report to gain insights into Sharjah Cement and Industrial Development (PJSC)'s track record.

Micronet (TASE:MCRNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Micronet Ltd develops, manufactures, and markets mobile computing platforms for fleet and mobile workforce management solutions, with a market cap of ₪25.70 million.

Operations: The company generates revenue primarily from its hardware products segment, totaling ₪3.33 million.

Market Cap: ₪25.7M

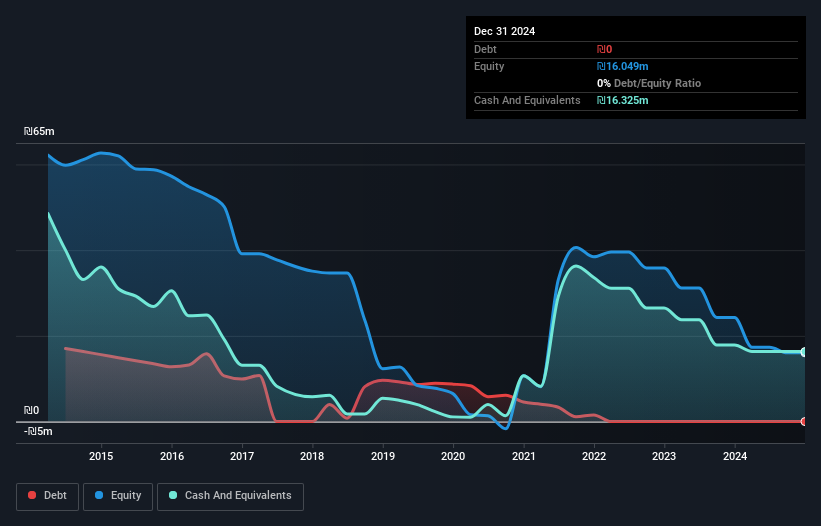

Micronet Ltd, with a market cap of ₪25.70 million, presents a mixed picture for penny stock investors. Despite stable weekly volatility over the past year, it remains higher than most IL stocks. The company is pre-revenue with sales under US$1 million and has been unprofitable, though its net loss decreased to ₪8.46 million from the previous year. Management shows experience with an average tenure of 4.5 years, and the firm benefits from being debt-free and having sufficient cash runway for over three years. However, its board lacks experience and share price volatility remains high recently.

- Navigate through the intricacies of Micronet with our comprehensive balance sheet health report here.

- Explore historical data to track Micronet's performance over time in our past results report.

Next Steps

- Jump into our full catalog of 93 Middle Eastern Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MCRNT

Micronet

Develops, manufactures, and markets mobile computing platforms for integration into fleet and mobile workforce management solutions.

Flawless balance sheet slight.

Market Insights

Community Narratives