- United Arab Emirates

- /

- Capital Markets

- /

- DFM:ALRAMZ

Middle Eastern Penny Stock Highlights For December 2025

Reviewed by Simply Wall St

As most Gulf markets gain momentum ahead of a crucial Federal Reserve decision, investors are closely watching the implications for regional economies, particularly those with currencies pegged to the U.S. dollar. In this context, penny stocks—though often considered a niche investment area—remain relevant for their potential to offer growth opportunities in smaller or newer companies. By focusing on financial strength, these stocks can present compelling options for investors seeking hidden value and long-term potential in the Middle Eastern market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.538 | ₪181.96M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.80 | AED323.4M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.70 | AED15.73B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.814 | AED2.39B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED510.93M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.557 | ₪200.72M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Al Ramz Corporation Investment and Development P.J.S.C (DFM:ALRAMZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Ramz Corporation Investment and Development P.J.S.C. is a financial institution in the UAE offering services such as asset management, corporate finance, brokerage, and more, with a market cap of AED692.89 million.

Operations: The company's revenue is primarily generated from its Brokerage and Money Markets segment, totaling AED140.96 million.

Market Cap: AED692.89M

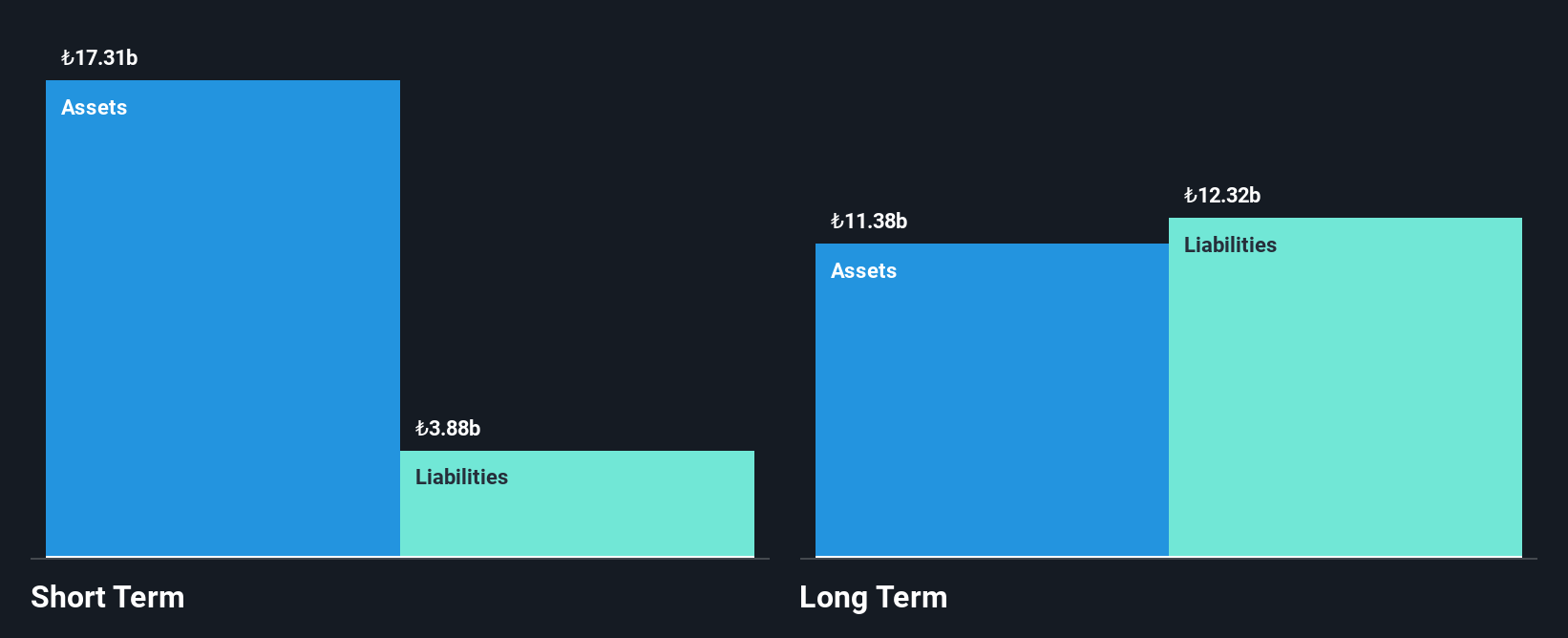

Al Ramz Corporation Investment and Development P.J.S.C. demonstrates a solid financial position with short-term assets exceeding both its long- and short-term liabilities, and has shown significant earnings growth of 43.6% over the past year. Despite having a low return on equity at 6.9%, the company maintains high-quality earnings and stable cash flow coverage for its debt, which is now higher than its total cash holdings. Recent developments include Al Ramz Capital's appointment as Liquidity Provider for Lulu Retail Holdings PLC on ADX, enhancing trading activity and investor confidence in their shares, while recent board changes reflect ongoing governance adjustments.

- Dive into the specifics of Al Ramz Corporation Investment and Development P.J.S.C here with our thorough balance sheet health report.

- Evaluate Al Ramz Corporation Investment and Development P.J.S.C's historical performance by accessing our past performance report.

Ihlas Holding (IBSE:IHLAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ihlas Holding A.S. operates in construction and real estate, media, manufacturing and trading, as well as healthcare and education sectors in Turkey and internationally, with a market cap of TRY3.90 billion.

Operations: The company generates revenue from several segments, including Media (TRY2.36 billion), Marketing (TRY5.09 billion), and Construction (TRY628 million).

Market Cap: TRY3.9B

Ihlas Holding A.S. faces challenges with recent financial performance, reporting a net loss of TRY 702.2 million in Q3 2025 compared to a profit the previous year, and increasing losses over nine months. Despite these setbacks, the company maintains a satisfactory debt level with a net debt to equity ratio of 9.1% and has not diluted shareholders recently. Its short-term assets significantly exceed both short- and long-term liabilities, suggesting financial resilience amidst volatility in share price and earnings decline at an annual rate of 9.1% over five years. The management team is experienced with an average tenure of nearly 14 years, which may aid strategic navigation through current challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Ihlas Holding.

- Understand Ihlas Holding's track record by examining our performance history report.

Alarum Technologies (TASE:ALAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alarum Technologies Ltd. offers web data collection solutions across various regions including the Americas, Europe, Southeast Asia, the Middle East, and Africa, with a market cap of ₪181.96 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: ₪181.96M

Alarum Technologies has shown significant revenue growth, reporting US$13.01 million in Q3 2025, up from US$7.19 million the previous year, with a forecasted high revenue level for Q4. Despite this growth, net income and profit margins have decreased compared to last year, indicating potential profitability challenges. The company's financial position is strong with more cash than debt and short-term assets exceeding liabilities. However, the stock remains highly volatile and earnings growth has been negative over the past year. The management team is relatively new with an average tenure of 1.9 years.

- Get an in-depth perspective on Alarum Technologies' performance by reading our balance sheet health report here.

- Gain insights into Alarum Technologies' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Reveal the 78 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:ALRAMZ

Al Ramz Corporation Investment and Development P.J.S.C

A financial institution, engages in the provision of asset management, corporate finance, brokerage, lending, security margins, market making, liquidity providing, public offering management, and financial research services in the United Arab Emirates.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026