Discovering Undiscovered Gems in Middle East Stocks September 2025

Reviewed by Simply Wall St

In recent weeks, the Middle East stock markets have experienced a mix of profit-taking and gains, with Saudi Arabia's index facing losses after a significant rally driven by anticipated policy reforms, while Qatar saw modest increases. Amidst these fluctuations, investors are keenly observing economic indicators and market sentiment as they search for promising opportunities in small-cap stocks that can thrive under current conditions. Identifying such stocks often involves looking for companies with strong fundamentals and growth potential that align well with evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

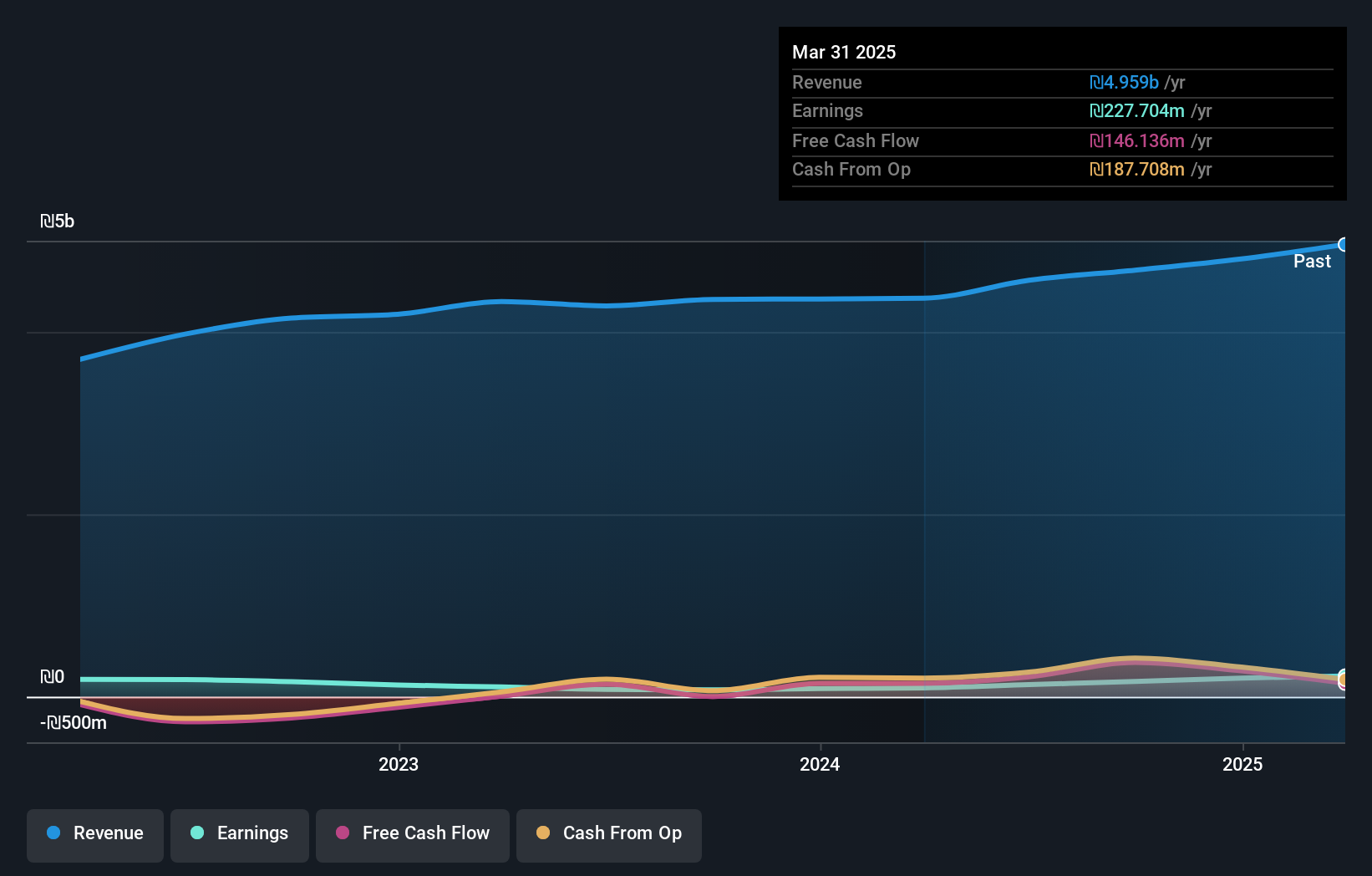

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of ₪2.99 billion.

Operations: The company generates revenue primarily through its insurance products and services offered to individual and corporate customers in Israel. Its financial performance is highlighted by a net profit margin of 6.5%, indicating efficiency in converting revenue into profit.

I.D.I. Insurance has shown a notable performance with net income for Q2 2025 reaching ILS 94.62 million, up from ILS 59.53 million the previous year, and basic earnings per share increasing to ILS 6.42 from ILS 4.05. Despite its earnings growth of 34% not surpassing the industry average of 35%, the company remains debt-free, a significant improvement from a debt-to-equity ratio of 74% five years ago. Its price-to-earnings ratio stands at an attractive level of 9.8x compared to the IL market's average of 14.4x, suggesting potential undervaluation in this volatile market environment.

- Click here to discover the nuances of I.D.I. Insurance with our detailed analytical health report.

Understand I.D.I. Insurance's track record by examining our Past report.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★☆

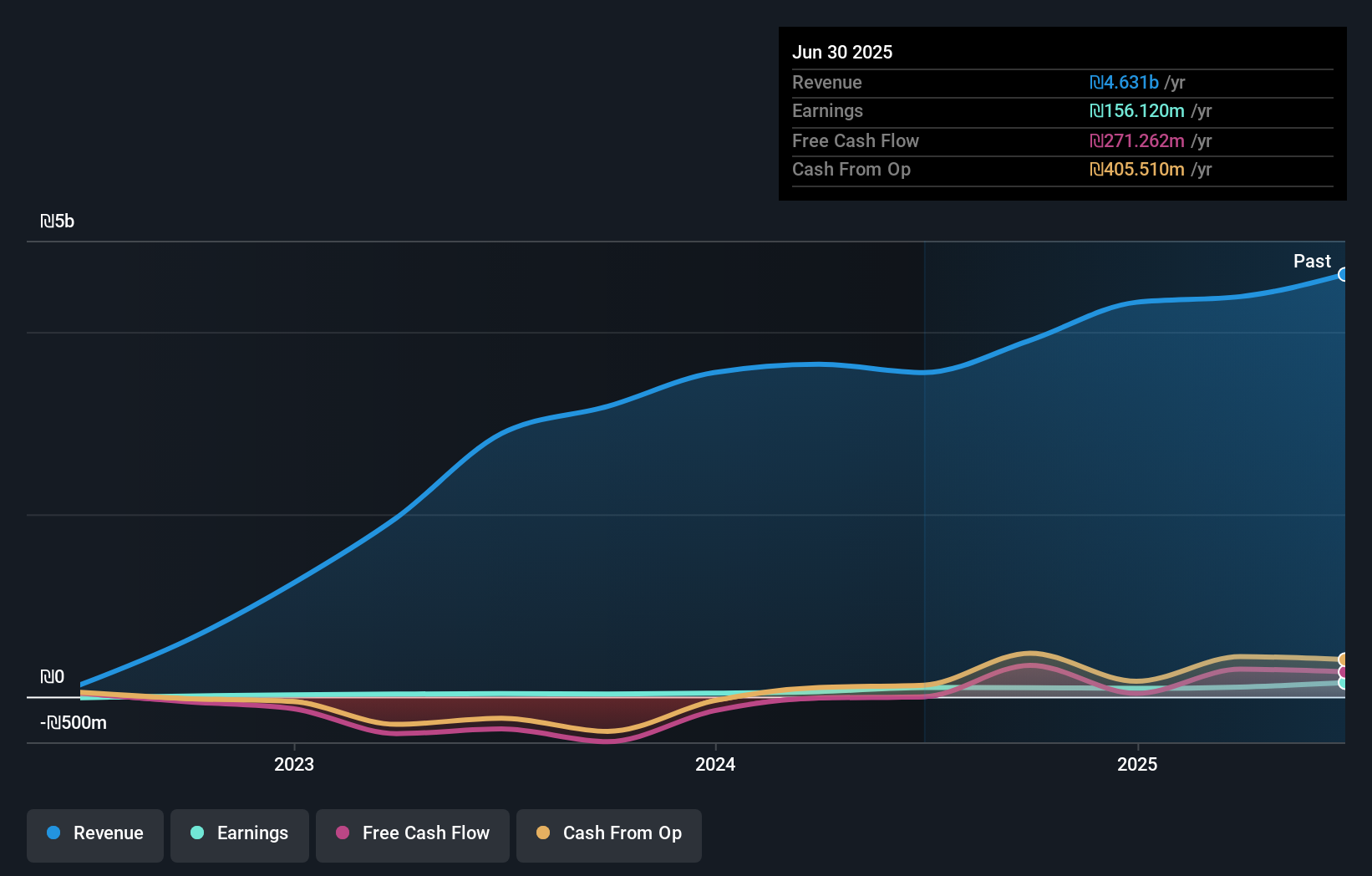

Overview: Neto Malinda Trading Ltd. is engaged in the manufacturing, importing, marketing, and distribution of kosher food products with a market capitalization of approximately ₪2.60 billion.

Operations: Neto Malinda Trading generates revenue primarily from three segments: Import (₪1.86 billion), Local Market (₪2.32 billion), and Neto Group Factories (₪757.57 million).

Neto Malinda Trading, a dynamic player in the food industry, has seen its earnings surge by 71% over the past year, outpacing the industry's 42.1% growth. The company's debt to equity ratio rose from 5.3% to 9.5% over five years but remains satisfactory with a net debt to equity ratio of 9%. Its price-to-earnings ratio stands at an attractive 11.6x compared to the IL market's average of 14.4x, suggesting good value for investors. Recently added to the S&P Global BMI Index and reporting high-quality earnings with EBIT covering interest payments by a robust margin of 41.8x, NTML shows promising potential despite slight dips in quarterly sales and net income compared to last year.

Wesure Global Tech (TASE:WESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wesure Global Tech Ltd, with a market cap of ₪1.19 billion, operates globally through its subsidiaries by developing and marketing technologies for digital platforms in the insurance and finance sectors.

Operations: Wesure Global Tech generates revenue primarily from its General Insurance segment, with Ayalon Insurance contributing ₪2.44 billion and Wesure Insurance adding ₪327.35 million. The Life Insurance and Long-Term Savings segment also plays a significant role, bringing in ₪1.55 billion. The company's cost structure and profitability metrics are not detailed here, but the focus on insurance suggests a diverse revenue model within the financial sector.

Wesure Global Tech, a nimble player in the insurance sector, showcases impressive earnings growth of 55.4% over the past year, outpacing the industry average of 35.3%. Its price-to-earnings ratio stands attractively at 7.6x against the IL market's 14.4x, suggesting potential value for investors. The company reported a net income of ILS 95.88 million for Q2 2025 compared to ILS 45.55 million last year and basic earnings per share rose to ILS 0.73 from ILS 0.41 previously, pointing to robust financial performance despite its volatile share price and increased debt-to-equity ratio from five years ago (63% now).

- Click here and access our complete health analysis report to understand the dynamics of Wesure Global Tech.

Gain insights into Wesure Global Tech's past trends and performance with our Past report.

Summing It All Up

- Get an in-depth perspective on all 205 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:IDIN

I.D.I. Insurance

Provides insurance products and services to individuals and corporate customers in Israel.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives