Is Now The Time To Put Clal Insurance Enterprises Holdings (TLV:CLIS) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Clal Insurance Enterprises Holdings (TLV:CLIS). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Clal Insurance Enterprises Holdings

How Fast Is Clal Insurance Enterprises Holdings Growing Its Earnings Per Share?

Over the last three years, Clal Insurance Enterprises Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Clal Insurance Enterprises Holdings's EPS shot from ₪6.48 to ₪14.61, over the last year. Year on year growth of 125% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

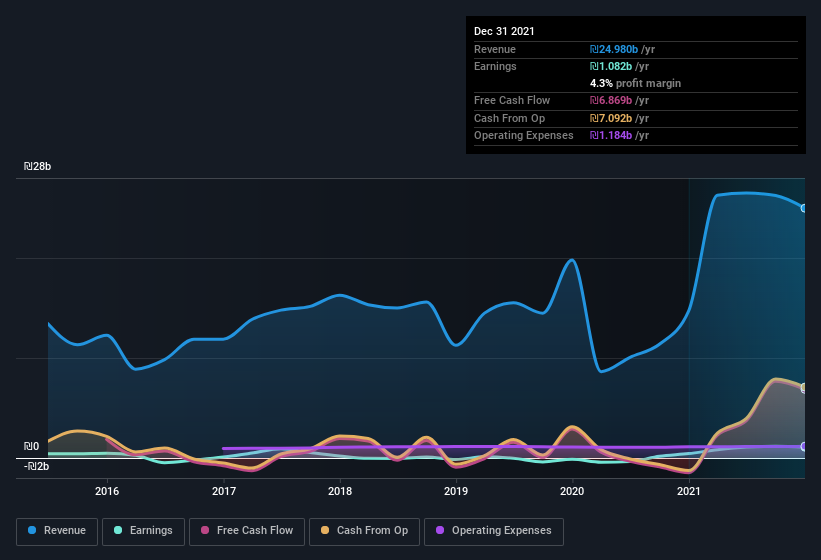

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Clal Insurance Enterprises Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Clal Insurance Enterprises Holdings's EBIT margins were flat over the last year, revenue grew by a solid 70% to ₪25b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Clal Insurance Enterprises Holdings's balance sheet strength, before getting too excited.

Are Clal Insurance Enterprises Holdings Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Clal Insurance Enterprises Holdings shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at ₪448m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Clal Insurance Enterprises Holdings with market caps between ₪3.3b and ₪11b is about ₪3.8m.

The Clal Insurance Enterprises Holdings CEO received ₪2.9m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Clal Insurance Enterprises Holdings To Your Watchlist?

Clal Insurance Enterprises Holdings's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think Clal Insurance Enterprises Holdings is worth considering carefully. You should always think about risks though. Case in point, we've spotted 1 warning sign for Clal Insurance Enterprises Holdings you should be aware of.

Although Clal Insurance Enterprises Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CLIS

Clal Insurance Enterprises Holdings

Operates in the fields of insurance, pensions, provident funds and finance, and credit insurance in Israel.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.