- Japan

- /

- Construction

- /

- TSE:1941

Three Undiscovered Gems With Promising Potential On None

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by a mix of corporate earnings reports and geopolitical developments, with the S&P 500 and Nasdaq Composite experiencing notable fluctuations. As investors navigate these uncertain times, the search for promising opportunities in less-explored areas becomes crucial, especially given the mixed performance across major indices. Identifying stocks with strong fundamentals and growth potential can be particularly rewarding in such an environment, as these undiscovered gems may offer resilience amid broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

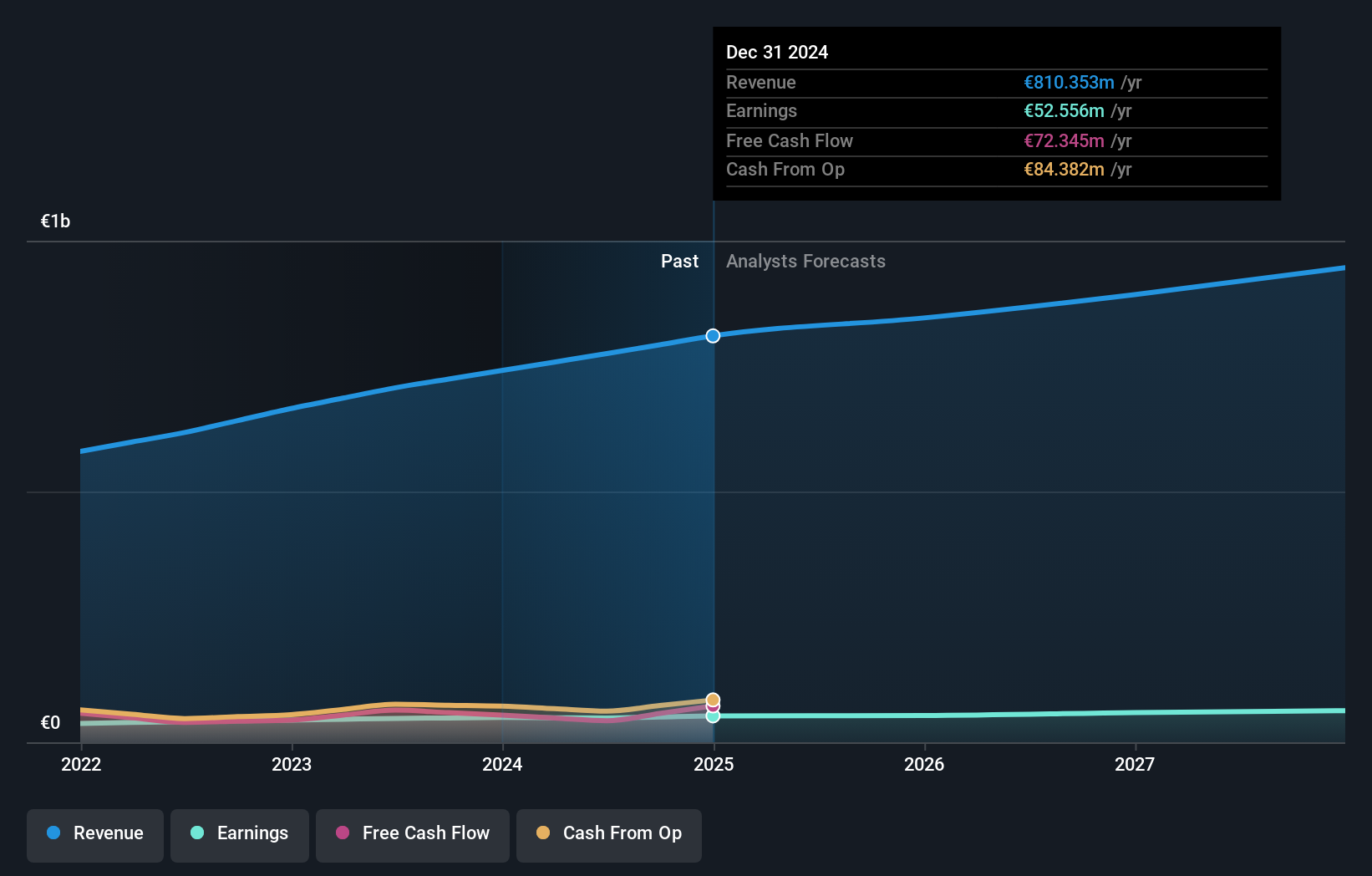

Overview: Neurones S.A. is an information technology services company that offers infrastructure, application, and consulting services both in France and internationally, with a market capitalization of €1.10 billion.

Operations: Neurones derives its revenue primarily from infrastructure services (€483.86 million), followed by application services (€236.52 million) and consulting (€54.53 million).

Neurones, a nimble player in the IT sector, has demonstrated resilience with earnings growth of 1.8% over the past year, outpacing the industry average of -4%. The company's financial health is underscored by its cash position exceeding total debt and a manageable debt to equity ratio increase from 0% to 2.8% over five years. Interest payments are well-covered by profits, reflecting robust operational efficiency. With positive free cash flow and high-quality earnings, Neurones seems well-positioned for stability amidst industry fluctuations. Recent participation in forums like CIC Market Solutions suggests active engagement with market opportunities.

- Navigate through the intricacies of Neurones with our comprehensive health report here.

Understand Neurones' track record by examining our Past report.

Ratio Energies - Limited Partnership (TASE:RATI)

Simply Wall St Value Rating: ★★★★☆☆

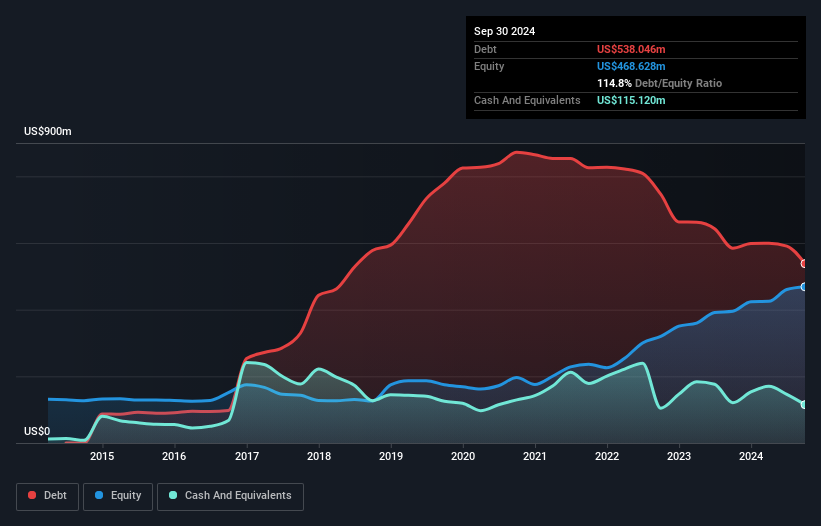

Overview: Ratio Energies - Limited Partnership, along with its subsidiaries, is involved in the exploration, development, and production of oil and natural gas both in Israel and internationally, with a market cap of ₪4.30 billion.

Operations: The partnership generates revenue primarily from its oil and gas exploration and production segment, amounting to $315.58 million.

Ratio Energies, a relatively small player in the energy sector, has shown some promising financial metrics despite its challenges. Over the past five years, its debt to equity ratio impressively dropped from 445.8% to 114.8%, though it remains high at 90.2%. The company reported a net income of US$38.23 million for Q3 2024, up from US$33.8 million the previous year, indicating robust earnings growth of 45.6% annually over five years. Despite lagging behind industry earnings growth rates recently, Ratio Energies trades at a value below fair estimates and maintains positive free cash flow with well-covered interest payments by EBIT at 4.4x coverage.

Chudenko (TSE:1941)

Simply Wall St Value Rating: ★★★★★★

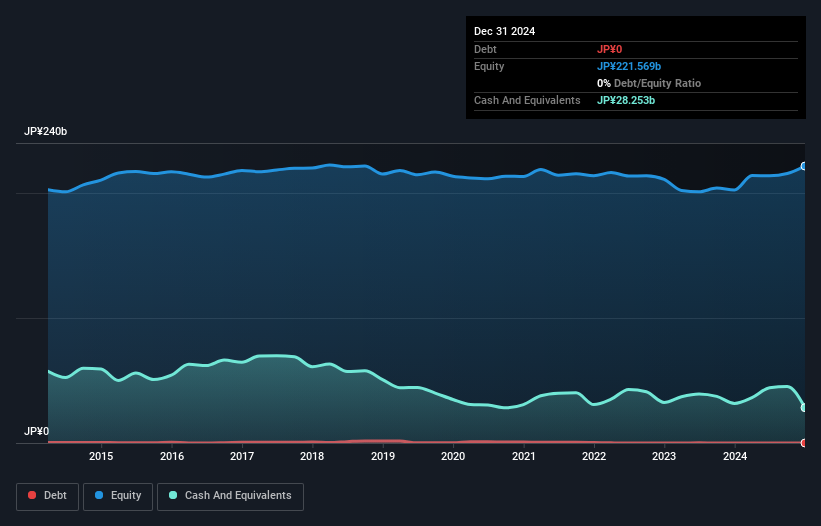

Overview: Chudenko Corporation is an equipment engineering company in Japan with a market capitalization of ¥175.43 billion.

Operations: Chudenko generates revenue primarily through its equipment engineering services. The company's gross profit margin has been observed at 14.5% in recent periods, reflecting its cost management and pricing strategies.

Chudenko, a compact player in its field, offers an intriguing value proposition with a price-to-earnings ratio of 8.7x, notably under the JP market average of 13.5x. The company has made significant strides by becoming debt-free over the past five years and achieving profitability this year. With high-quality earnings reported and positive free cash flow, Chudenko seems well-positioned financially. Recently completing a share buyback of 500,000 shares for ¥1,650 million to boost shareholder returns further underscores its commitment to capital efficiency. This financial health could make it an attractive option for those exploring potential growth opportunities in the sector.

Summing It All Up

- Navigate through the entire inventory of 4688 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1941

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives