- Israel

- /

- Oil and Gas

- /

- TASE:CDEV

Middle East's Undiscovered Gems Three Promising Small Cap Stocks

Reviewed by Simply Wall St

As Gulf markets experience gains amid easing US-China trade tensions, investor optimism is on the rise, with indices such as Saudi Arabia's benchmark index and Dubai's main share index seeing positive movements. In this environment of shifting market sentiment, identifying small-cap stocks that demonstrate resilience and growth potential can be key to uncovering promising investment opportunities in the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 0.03% | 13.83% | 35.58% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Saudi Azm for Communication and Information Technology (SASE:7211)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR 1.48 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: Saudi Azm generates revenue primarily from four segments: Advisory (SAR 32.34 million), Enterprise Services (SAR 139.54 million), Proprietary Technologies (SAR 50.19 million), and Platforms for Third Parties (SAR 31.08 million).

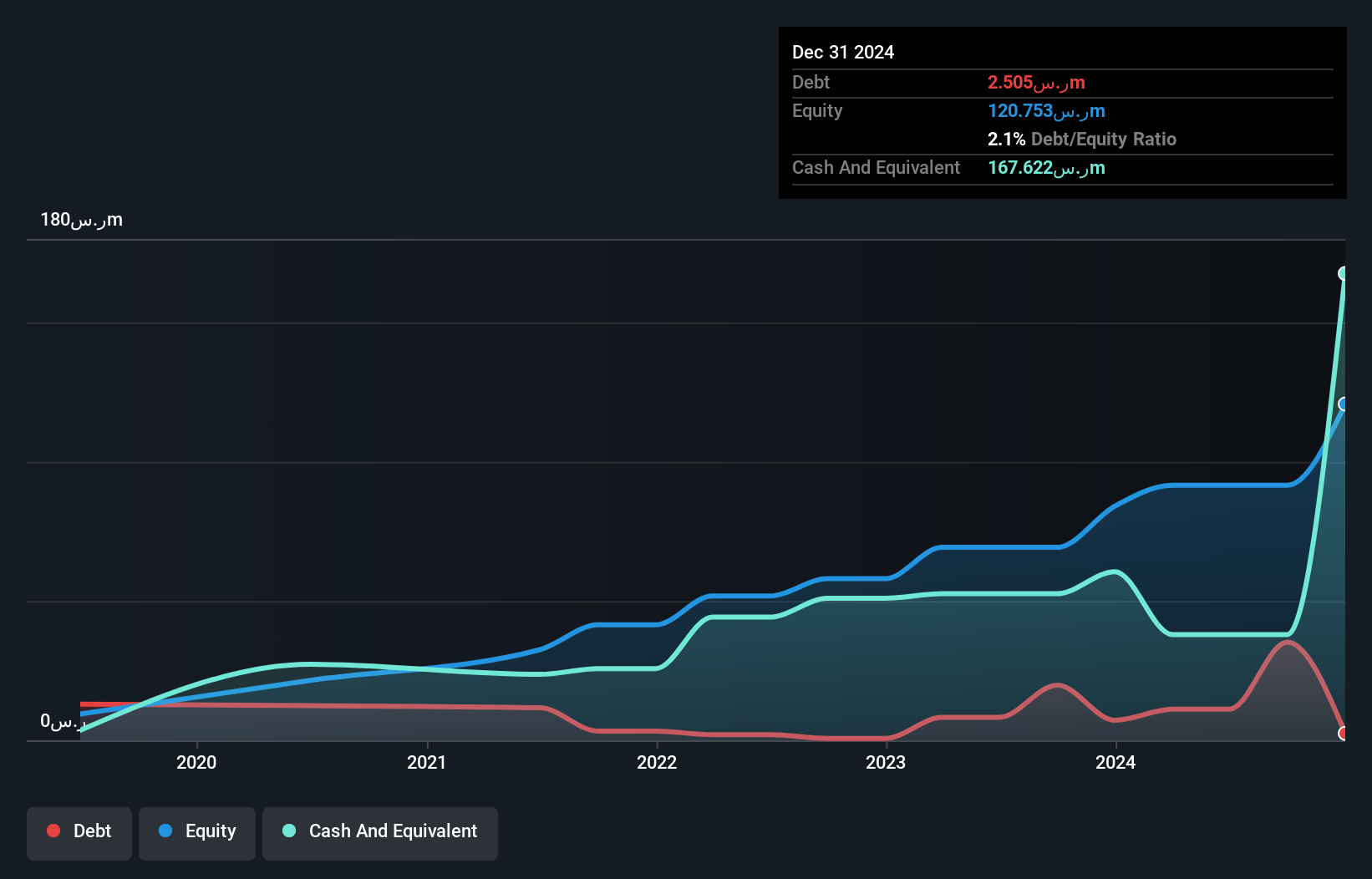

Saudi Azm for Communication and Information Technology, with its nimble market position, showcases impressive financial health. Over the past five years, its debt-to-equity ratio impressively decreased from 57.9% to 3.5%, signaling disciplined financial management. The company reported SAR 69.96 million in sales and SAR 13.45 million in net income for the first quarter ending September 2025, highlighting strong operational performance alongside a basic earnings per share of SAR 0.24 from continuing operations. Notably trading at a significant discount to estimated fair value by about 72%, Saudi Azm's earnings growth of 34% outpaces the IT industry's average of 8%.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market cap of ₪1.30 billion.

Operations: Cohen Development Gas & Oil generates revenue primarily from the production and management of oil and gas exploration, amounting to $27.91 million.

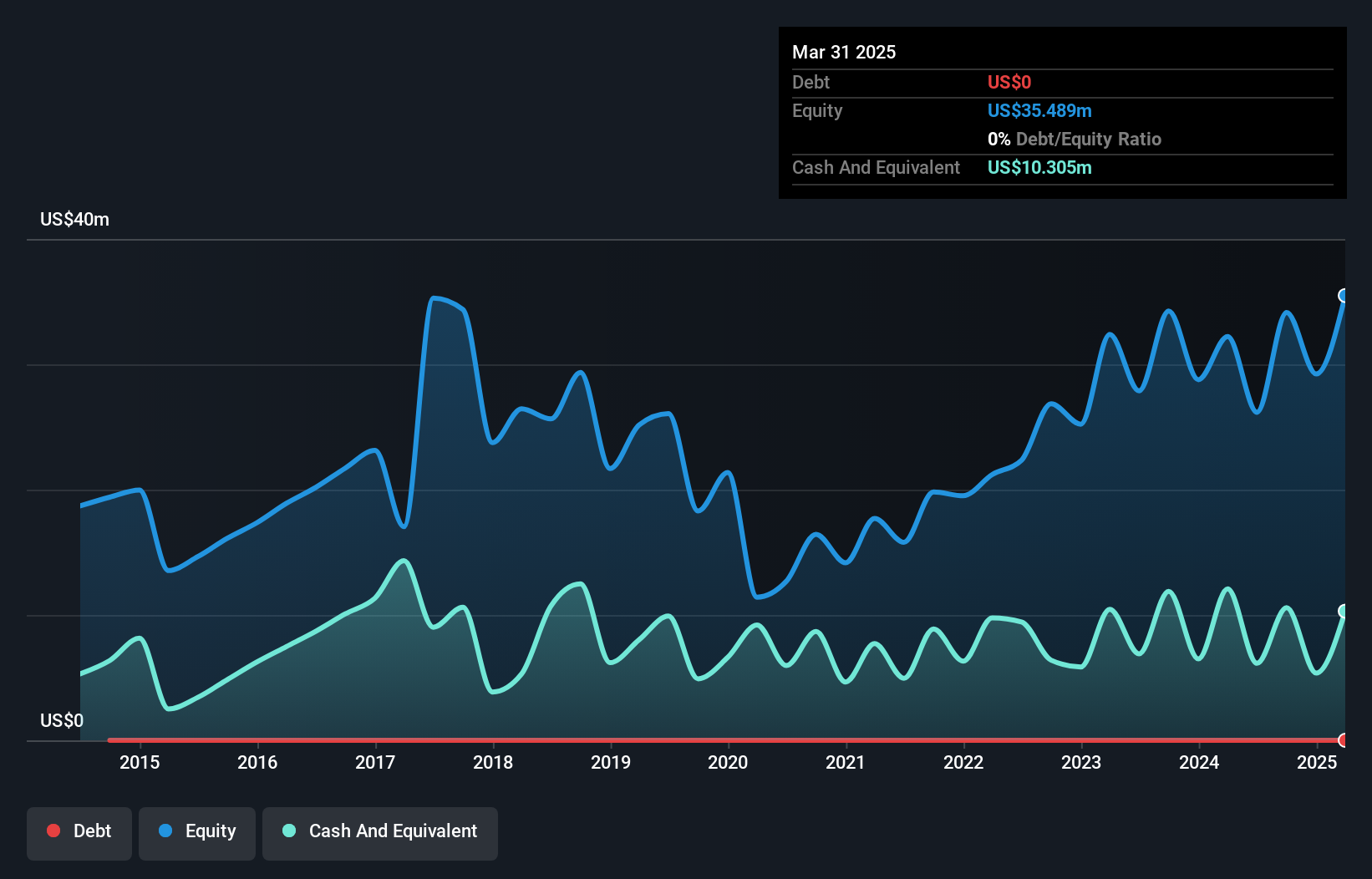

Cohen Development Gas & Oil, a smaller player in the energy sector, has demonstrated impressive financial health with no debt over the past five years. Its earnings growth of 66.1% last year outpaced the oil and gas industry average of 0.3%, highlighting its robust performance. The company reported a notable increase in net income for Q2 2025 at US$11.15 million, compared to US$4.7 million a year prior, with basic earnings per share rising to US$1.73 from US$0.73 previously. With a price-to-earnings ratio of 12.8x below the IL market average of 16x, it seems attractively valued relative to peers.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

Overview: Telsys Ltd. is a company that markets and distributes electronic components in Israel, with a market cap of ₪1.73 billion.

Operations: Telsys generates revenue primarily from the SOM Sector and Distribution, with revenues of ₪277.49 million and ₪143.68 million, respectively. The net profit margin is a key metric to consider when evaluating its financial performance.

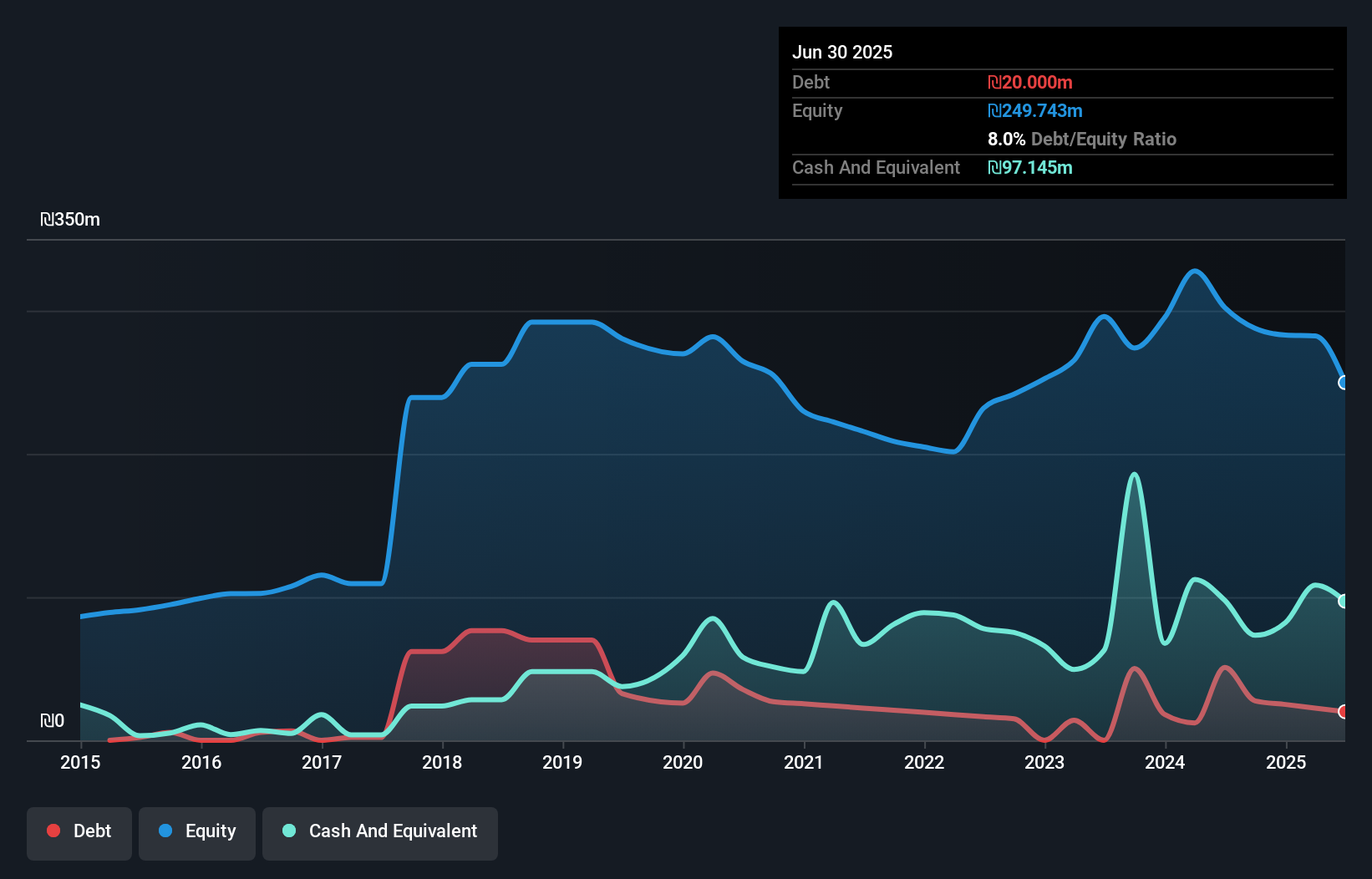

Telsys has been making waves with its consistent performance over the past five years, achieving an impressive 25.5% annual earnings growth despite trailing behind the electronic industry's recent pace. The company's debt-to-equity ratio improved from 13.4% to 8%, showcasing prudent financial management, while its price-to-earnings ratio of 15.5x remains attractive compared to the IL market's average of 16x. Recent earnings reports highlight a robust increase in sales to ILS 111.95 million and net income reaching ILS 32.63 million for Q2, reflecting a solid foundation for future growth amid competitive industry dynamics.

- Get an in-depth perspective on Telsys' performance by reading our health report here.

Assess Telsys' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Get an in-depth perspective on all 210 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CDEV

Cohen Development Gas & Oil

Engages in the exploration for, development, production, and marketing of natural gas, condensate, and oil in Israel, Cyprus, and Morocco.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)