- United Arab Emirates

- /

- Insurance

- /

- ADX:EIC

Three Undiscovered Gems in the Middle East to Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. Federal Reserve's recent interest rate cut influences Gulf markets, most regional indices have shown gains, reflecting a cautiously optimistic sentiment despite ongoing global economic uncertainties. In this dynamic landscape, identifying promising stocks involves looking for companies with solid fundamentals and growth potential that can capitalize on favorable market conditions and strategic opportunities in the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market capitalization of AED1.10 billion.

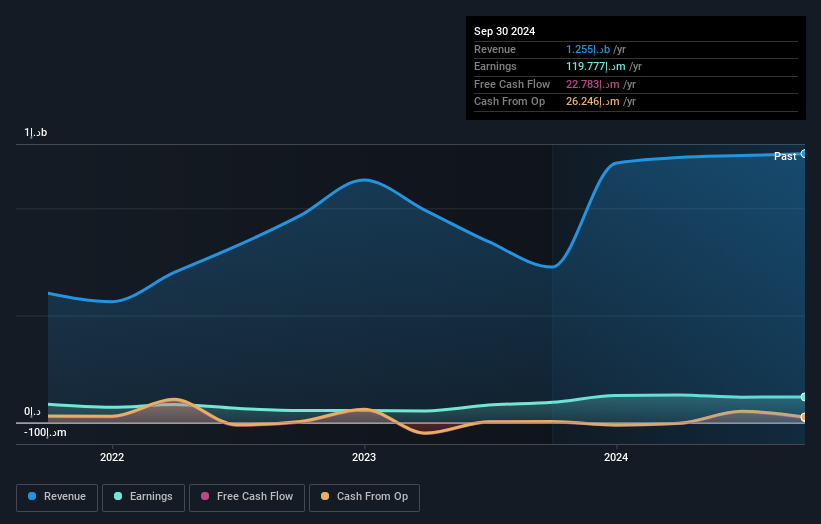

Operations: Emirates Insurance Company P.J.S.C. generates revenue primarily from underwriting activities, contributing AED2.41 billion, and investments, which add AED86.04 million. The company's financial performance is influenced by its net profit margin trends over time.

Emirates Insurance Company, a small player in the Middle East insurance sector, has shown robust financial health with high-quality earnings and a debt-free status over the past five years. Its earnings have grown at 4.9% annually, although recent growth of 14.8% lagged behind the industry's 28.1%. The company's Price-to-Earnings ratio stands attractively at 8x compared to the AE market's 11.6x. Recent results highlight a net income rise to AED 39 million for Q3 from AED 29 million last year, with basic EPS increasing to AED 0.26 from AED 0.19, reflecting solid performance amidst industry challenges.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

Overview: Atreyu Capital Markets Ltd operates in Israel, offering investment management services through its subsidiaries, with a market cap of ₪1.33 billion.

Operations: Atreyu Capital Markets generates revenue primarily from its investment management services, amounting to ₪110.61 million.

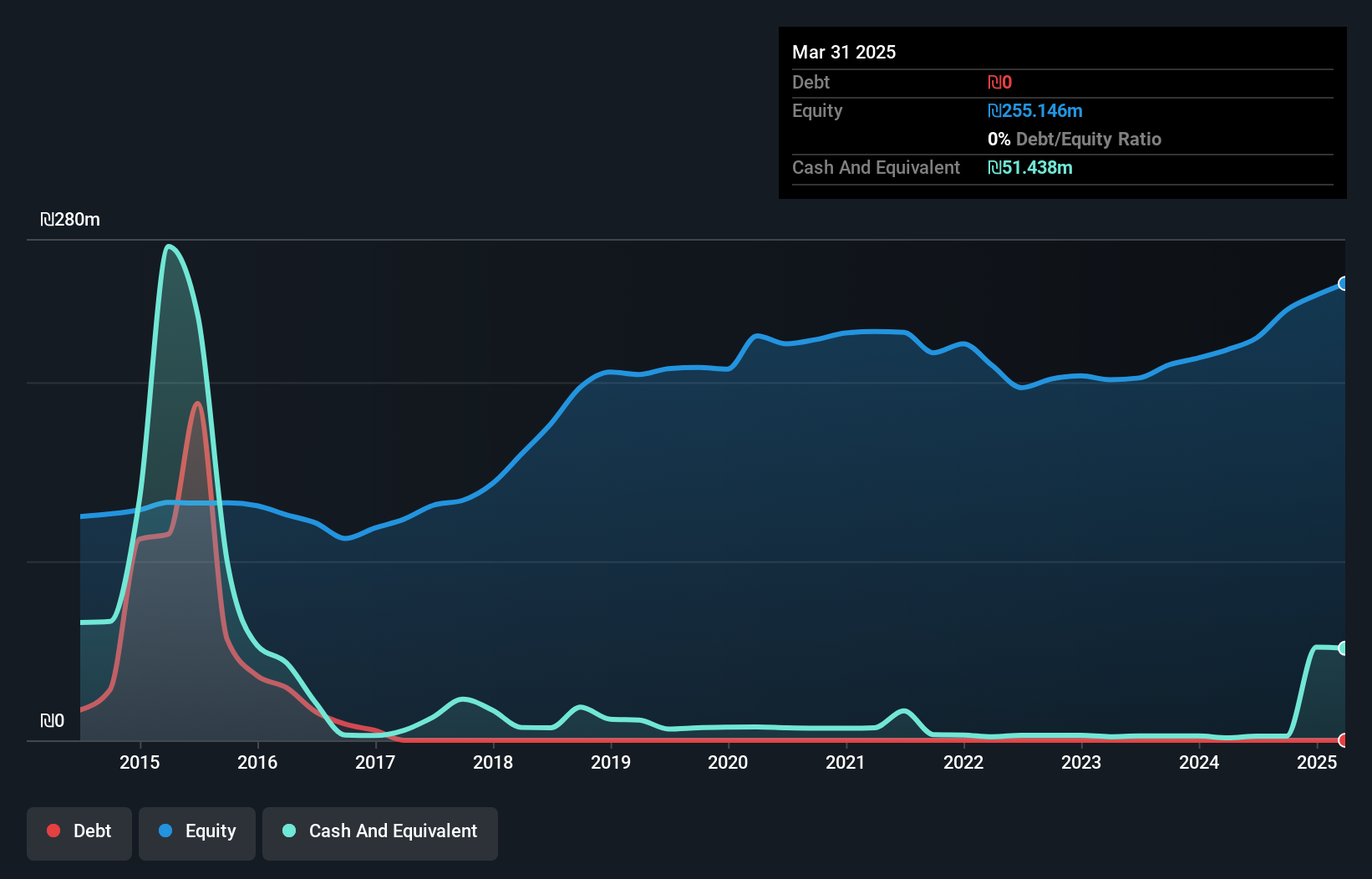

Atreyu Capital Markets, a nimble player in the capital markets sector, showcases robust financial health with no debt on its books and consistent earnings growth of 4.4% annually over the past five years. The company reported third-quarter revenue of ILS 30.49 million and net income of ILS 29.48 million, reflecting a solid performance compared to last year’s figures. Its price-to-earnings ratio stands at an attractive 12.5x, below the IL market average of 15.3x, suggesting potential value for investors seeking opportunities in this region's financial landscape. Recent inclusion in the S&P Global BMI Index further underscores its growing prominence.

- Unlock comprehensive insights into our analysis of Atreyu Capital Markets stock in this health report.

Gain insights into Atreyu Capital Markets' past trends and performance with our Past report.

Meitav Trade Investments (TASE:MTRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Meitav Trade Investments Ltd, with a market cap of ₪969.81 million, offers financial investment services.

Operations: With revenue from asset management totaling ₪218.44 million, Meitav Trade Investments Ltd focuses on financial investment services.

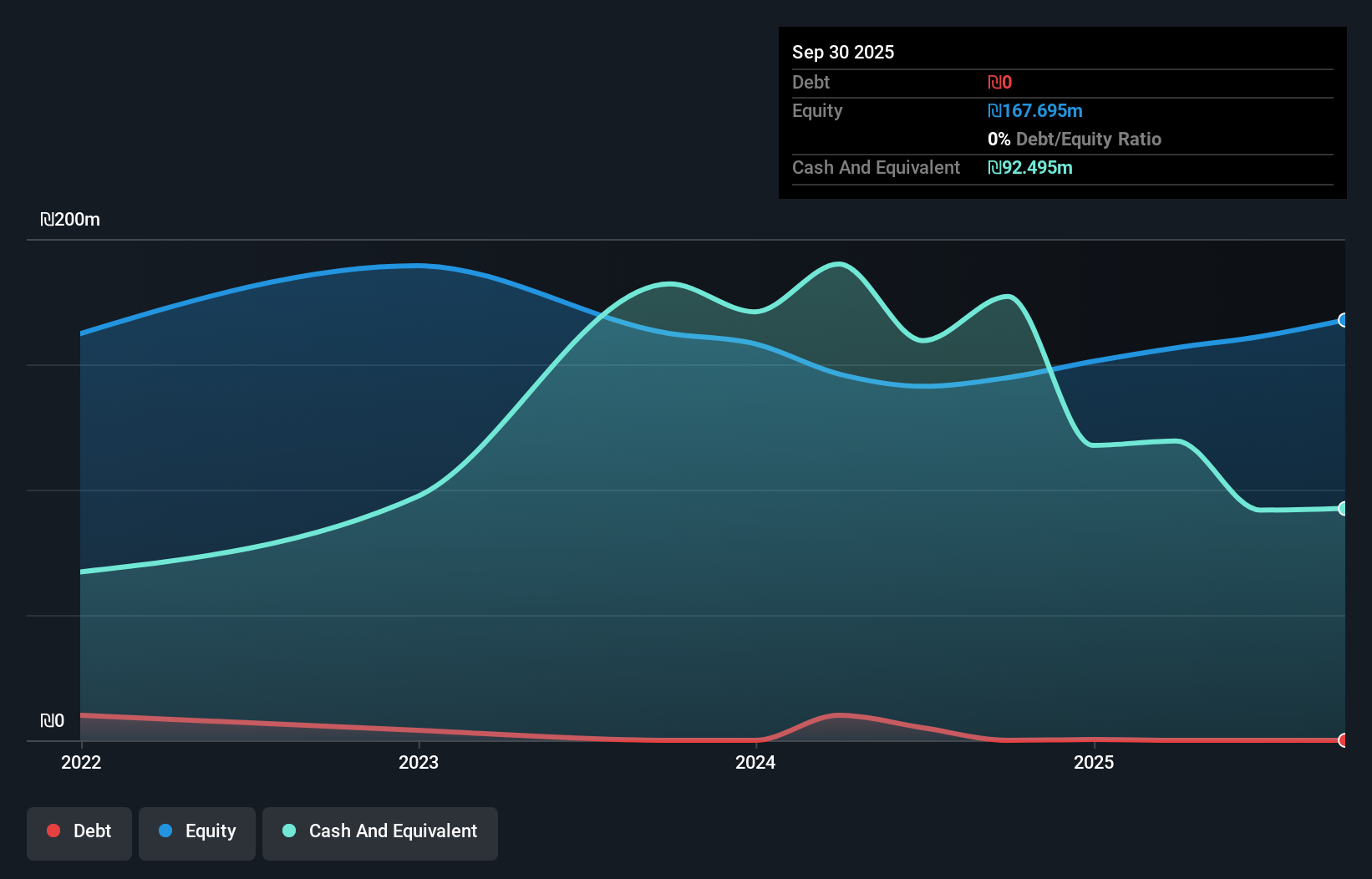

In the dynamic landscape of Middle Eastern investments, Meitav Trade Investments stands out with its robust performance. The company's recent earnings report shows a significant increase in revenue to ILS 58.18 million for Q3 2025, up from ILS 46.12 million in the previous year. Net income also rose to ILS 16 million from ILS 11.74 million, reflecting high-quality earnings and profitability without any debt burden over the past five years. Despite not being free cash flow positive, Meitav's earnings growth of 35.6% outpaces the Capital Markets industry average of 28.7%, showcasing its competitive edge and potential for future value creation within this sector.

Taking Advantage

- Unlock our comprehensive list of 181 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emirates Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:EIC

Emirates Insurance Company P.J.S.C

Engages in writing general insurance and reinsurance in the United Arab Emirates, the United States, and Europe.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026