- Israel

- /

- Hospitality

- /

- TASE:FTAL

Fattal Holdings (1998) (TLV:FTAL) shareholder returns have been , earning 19% in 1 year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Over the last year the Fattal Holdings (1998) Ltd (TLV:FTAL) share price is up 19%, but that's less than the broader market return. The longer term returns have not been as good, with the stock price only 5.4% higher than it was three years ago.

Since it's been a strong week for Fattal Holdings (1998) shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Fattal Holdings (1998)

Fattal Holdings (1998) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Fattal Holdings (1998) actually shrunk its revenue over the last year, with a reduction of 22%. The lacklustre gain of 19% over twelve months, is not a bad result given the falling revenue. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

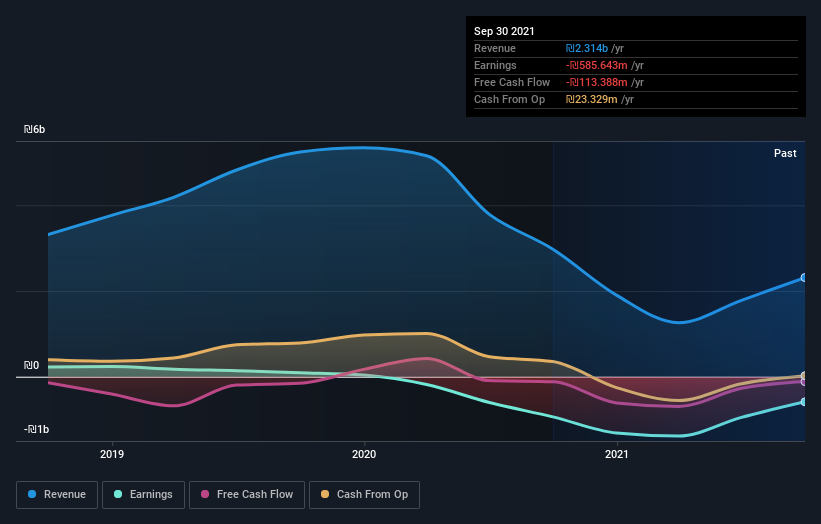

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year Fattal Holdings (1998) shareholders have received a TSR of 19%. Unfortunately this falls short of the market return of around 42%. On the bright side that gain is actually better than the average return of 9% over the last three years, implying that the company is doing better recently. If the business can justify the share price gain with improving fundamental data, then there could be more gains to come. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Fattal Holdings (1998) (1 is significant) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:FTAL

Fattal Holdings (1998)

Owns and operates hotels in Israel and internationally.

Proven track record with very low risk.

Market Insights

Community Narratives