Discovering Hidden Opportunities In Three Undiscovered Gems With Solid Foundations

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges as evidenced by the Russell 2000 Index's recent underperformance compared to large-cap counterparts. With economic indicators such as a softening labor market and expectations for interest rate cuts, investors may find value in exploring lesser-known companies with strong fundamentals that can potentially weather these conditions. A good stock in this environment often exhibits solid financial health, a clear growth strategy, and resilience against macroeconomic shifts—qualities that can transform them into hidden opportunities worth considering.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Zheshang Securities Zhejiang Expressway (SHSE:508001)

Simply Wall St Value Rating: ★★★★☆☆

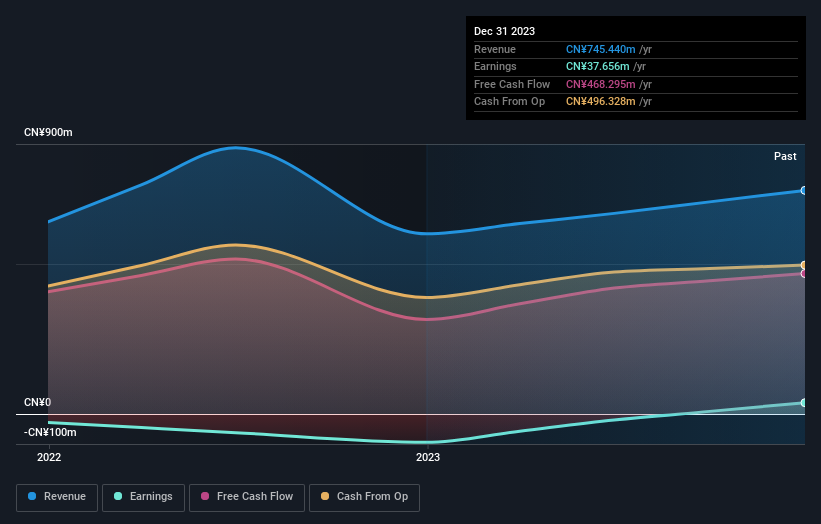

Overview: Zheshang Securities Zhejiang Expressway (ticker: SHSE:508001) operates in the transportation infrastructure sector and has a market capitalization of CN¥3.55 billion.

Operations: The primary revenue stream for Zheshang Securities Zhejiang Expressway comes from its transportation infrastructure segment, generating CN¥746.12 million.

Zheshang Securities Zhejiang Expressway, a smaller player in its field, has shown promising financial health with interest payments on its debt well covered by EBIT at 7.9 times. The company recently turned profitable, making it challenging to compare its earnings growth to the Industrial REITs industry's 5.8%. Additionally, it's trading at a significant discount of 60.8% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and more cash than total debt, Zheshang seems financially robust despite insufficient data on long-term debt reduction trends. A recent dividend announcement reflects shareholder returns focus amidst these strengths.

M.Yochananof and Sons (1988) (TASE:YHNF)

Simply Wall St Value Rating: ★★★★☆☆

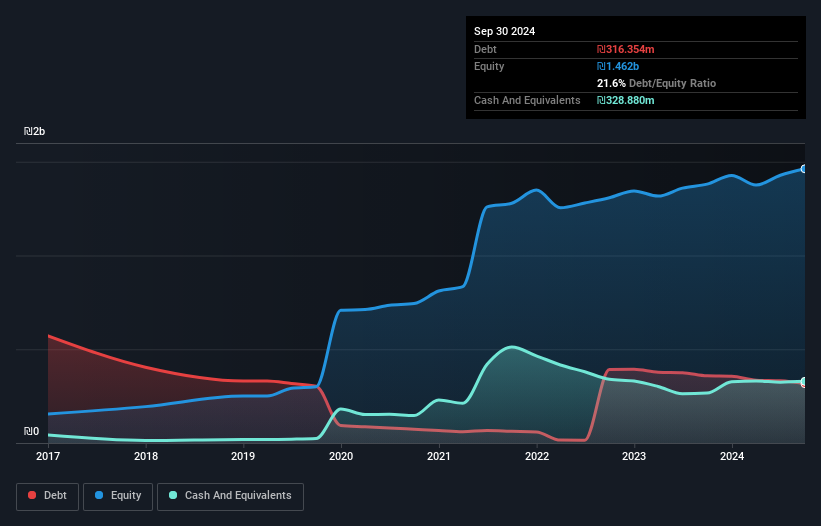

Overview: M.Yochananof and Sons (1988) Ltd operates in the marketing and retail trade of food and related products in Israel with a market capitalization of ₪3.36 billion.

Operations: The primary revenue stream for M.Yochananof and Sons (1988) Ltd comes from the food retail sector, generating ₪4.38 billion. The company's financial performance is influenced by its gross profit margin, which has shown variability over recent periods.

M.Yochananof and Sons (1988) Ltd, a nimble player in the retail sector, showcases impressive growth with earnings surging by 59.6% last year, outpacing its industry peers. The company reported third-quarter sales of ILS 1.25 billion and net income of ILS 51 million, doubling from the previous year’s ILS 25.56 million. Its debt-to-equity ratio has significantly improved over five years from 101% to just under 22%, indicating robust financial health. Additionally, basic earnings per share for nine months stood at ILS 10.74 compared to last year's ILS 6.39, reflecting strong operational performance and potential future value creation for investors.

Fukushima GalileiLtd (TSE:6420)

Simply Wall St Value Rating: ★★★★★★

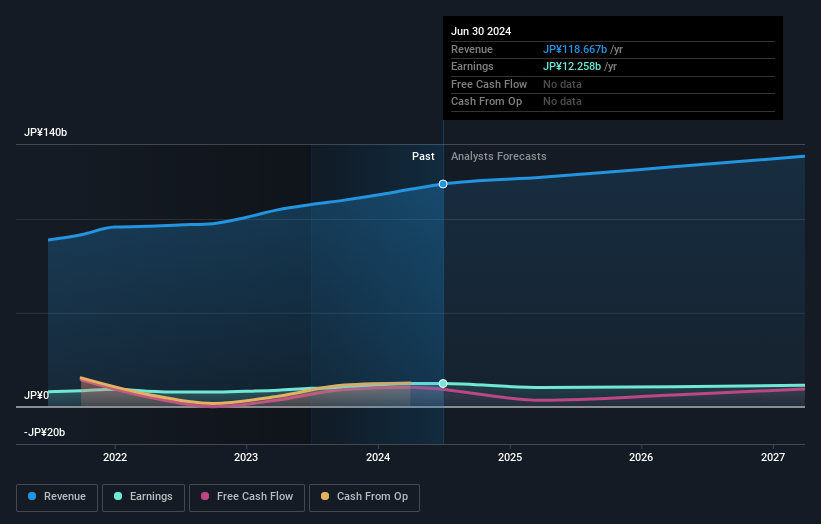

Overview: Fukushima Galilei Co. Ltd. specializes in the manufacturing, sales, and maintenance of commercial freezer refrigerators and refrigerated showcases both domestically in Japan and internationally, with a market cap of ¥109.18 billion.

Operations: Fukushima Galilei generates revenue primarily from the manufacturing and sales of refrigeration devices, with a focus on commercial freezer refrigerators and refrigerated showcases. The company operates both in Japan and internationally.

Fukushima Galilei Ltd. stands out with impressive earnings growth of 20.8% over the past year, notably surpassing the Machinery industry's 0.8%. The company boasts high-quality earnings and trades at a significant discount, about 59.5% below its estimated fair value, offering good relative value compared to peers and industry standards. With no debt on its balance sheet now versus a debt-to-equity ratio of 0.3% five years ago, it seems well-positioned financially despite forecasts predicting a slight average annual decline in earnings by 1.4% over the next three years, suggesting potential challenges ahead in sustaining momentum.

Make It Happen

- Discover the full array of 4495 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6420

Fukushima GalileiLtd

Manufactures, sells, and maintains commercial freezer refrigerators, refrigerated showcases, and other refrigeration devices in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.