- Israel

- /

- Aerospace & Defense

- /

- TASE:RSEL

RSL Electronics Ltd.'s (TLV:RSEL) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Most readers would already be aware that RSL Electronics' (TLV:RSEL) stock increased significantly by 58% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study RSL Electronics' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for RSL Electronics

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for RSL Electronics is:

13% = ₪3.5m ÷ ₪27m (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ₪1 of shareholders' capital it has, the company made ₪0.13 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of RSL Electronics' Earnings Growth And 13% ROE

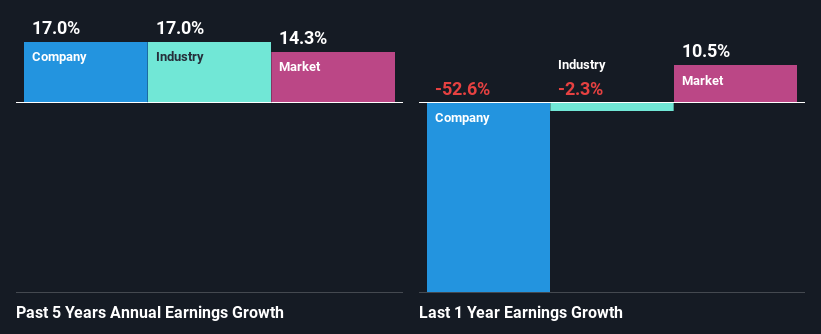

To start with, RSL Electronics' ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 13%. This probably goes some way in explaining RSL Electronics' moderate 17% growth over the past five years amongst other factors.

We then performed a comparison between RSL Electronics' net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 17% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for RSEL? You can find out in our latest intrinsic value infographic research report

Is RSL Electronics Using Its Retained Earnings Effectively?

While RSL Electronics has a three-year median payout ratio of 52% (which means it retains 48% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Along with seeing a growth in earnings, RSL Electronics only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders.

Summary

In total, we are pretty happy with RSL Electronics' performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. Up till now, we've only made a short study of the company's growth data. To gain further insights into RSL Electronics' past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you're looking to trade RSL Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:RSEL

RSL Electronics

Develops, manufactures, and sells control systems, utilities, health monitoring, and diagnostics and prognostics systems for aerospace, railroad, energy, and defense sectors in Israel and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives