- Israel

- /

- Construction

- /

- TASE:ORON

Do Oron Group Investments & Holdings's (TLV:ORON) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Oron Group Investments & Holdings (TLV:ORON). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Oron Group Investments & Holdings

Oron Group Investments & Holdings's Improving Profits

Over the last three years, Oron Group Investments & Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Oron Group Investments & Holdings's EPS soared from ₪0.28 to ₪0.43, in just one year. That's a impressive gain of 55%.

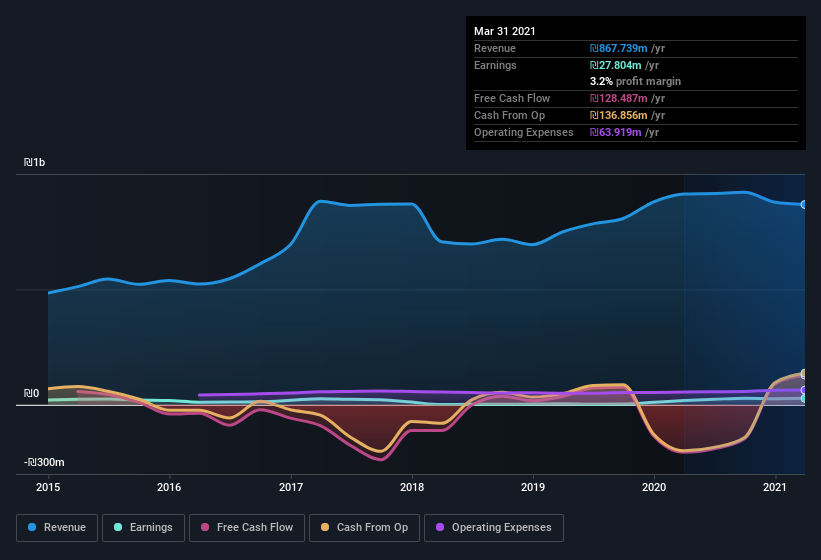

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Oron Group Investments & Holdings may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Oron Group Investments & Holdings is no giant, with a market capitalization of ₪839m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Oron Group Investments & Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Oron Group Investments & Holdings insiders own a meaningful share of the business. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₪630m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Oron Group Investments & Holdings To Your Watchlist?

For growth investors like me, Oron Group Investments & Holdings's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. We don't want to rain on the parade too much, but we did also find 2 warning signs for Oron Group Investments & Holdings that you need to be mindful of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ORON

Oron Group Investments & Holdings

Engages in the civil engineering, infrastructure, and construction businesses in Israel.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives