Exploring Undiscovered Gems in the Middle East This April 2025

Reviewed by Simply Wall St

In April 2025, Middle Eastern stock markets are experiencing turbulence, with Gulf bourses sinking due to recession fears sparked by U.S. tariffs and countermeasures from China. Despite this challenging environment, investors may find opportunities in lesser-known stocks that demonstrate resilience through strong fundamentals and strategic positioning within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.06% | 49.99% | 57.15% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 13.42% | 32.03% | 47.24% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Meditera Tibbi Malzeme Sanayi ve Ticaret Anonim Sirketi | 2.10% | 33.53% | -19.97% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Link Bilgisayar Sistemleri Yazilimi ve Donanimi Sanayi ve Ticaret (IBSE:LINK)

Simply Wall St Value Rating: ★★★★★★

Overview: Link Bilgisayar Sistemleri Yazilimi ve Donanimi Sanayi ve Ticaret A.S. operates in the software and programming industry with a market capitalization of TRY12.51 billion.

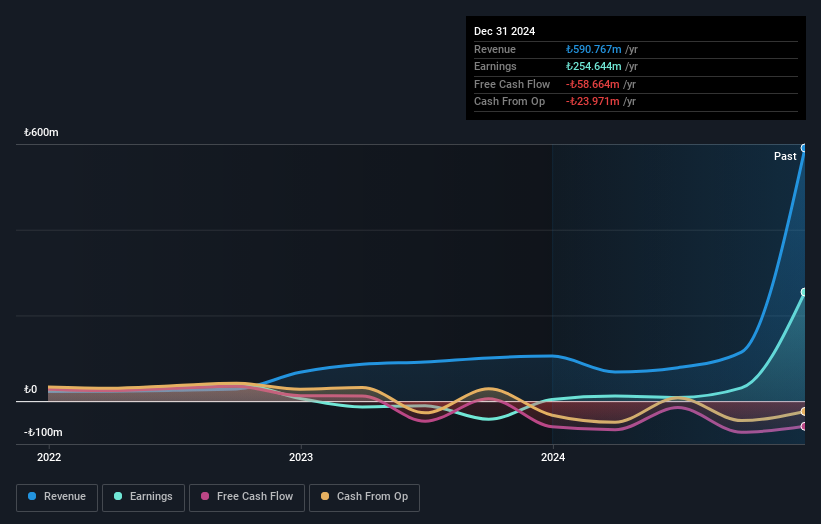

Operations: Link generates revenue primarily from its Software & Programming segment, amounting to TRY590.77 million. The company's gross profit margin is a key financial indicator worth noting at 52.3%.

Link Bilgisayar, a nimble player in the tech space, has showcased an impressive earnings growth of 6217% over the past year, dwarfing the Software industry's 143.8%. With sales skyrocketing to TRY 590.77 million from TRY 105.1 million and net income reaching TRY 254.64 million from TRY 4.03 million, its financial performance is noteworthy despite substantial shareholder dilution recently observed. The company remains debt-free for five years, eliminating concerns over interest coverage and highlighting its robust operational footing in a competitive market landscape, though free cash flow remains negative as of recent data points.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey with a market capitalization of TRY43.95 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from its accident insurance segment, contributing TRY8.34 billion, and fire insurance, adding TRY1.04 billion. The company's cost structure and profitability are reflected in its net profit margin trends over recent periods.

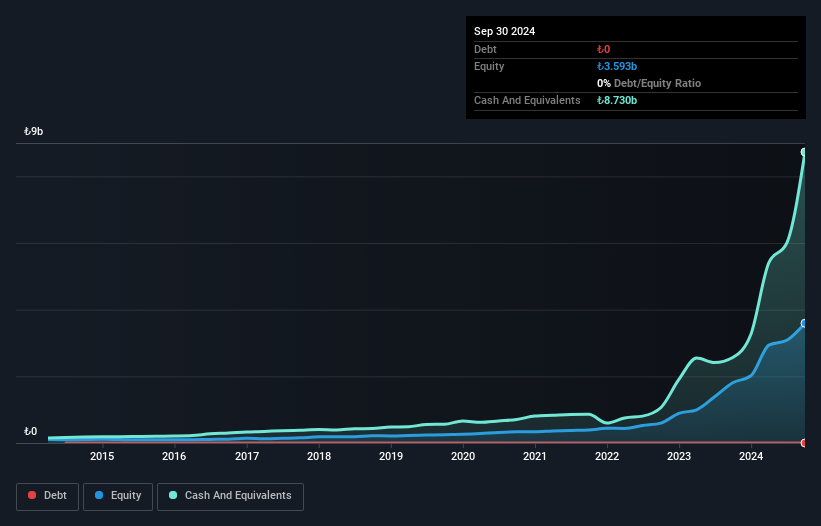

Ray Sigorta Anonim Sirketi, a nimble player in the insurance sector, showcases impressive earnings growth of 145% over the past year, outpacing the industry's 84%. With no debt on its books for five years and high-quality earnings reported, it stands on solid ground. Recent financial results highlight a net income surge to TRY 2.21 billion from TRY 901.94 million last year. The basic earnings per share also doubled to TRY 14 from TRY 6. Despite volatility in share price over recent months, its profitability and robust cash flow position offer an intriguing investment narrative amidst market fluctuations.

- Take a closer look at Ray Sigorta Anonim Sirketi's potential here in our health report.

Gain insights into Ray Sigorta Anonim Sirketi's past trends and performance with our Past report.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aryt Industries Ltd., with a market cap of ₪1.92 billion, develops, produces, and markets electronic thunderbolt products for the defense market in Israel through its subsidiaries.

Operations: Aryt generates revenue primarily from its electronic thunderbolt products for the defense sector. The company's financial performance is highlighted by a net profit margin of 15%, reflecting its ability to effectively manage costs relative to its sales.

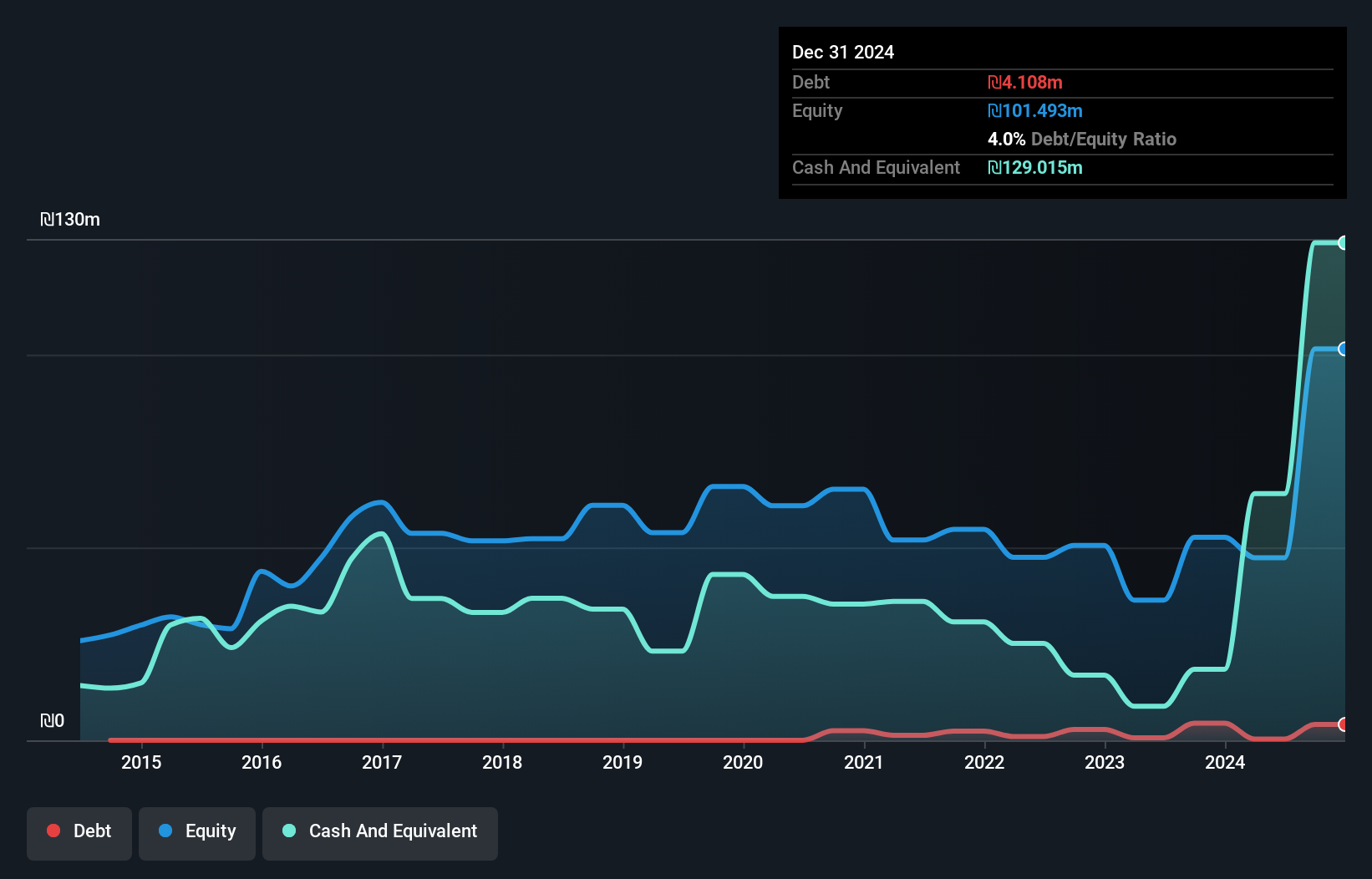

Aryt Industries has been making waves with its impressive earnings growth of 458.5% over the past year, outpacing the Aerospace & Defense sector's 49.3%. Despite a slight uptick in its debt-to-equity ratio from 0% to 0.2% in five years, Aryt remains financially sound, boasting more cash than total debt and interest coverage by EBIT at a robust 24.4 times. The company trades at a significant discount of 91.2% below estimated fair value, suggesting potential upside for investors seeking value plays in the region's dynamic market landscape despite recent dividend cuts to ILS 0.10 per share.

- Unlock comprehensive insights into our analysis of Aryt Industries stock in this health report.

Examine Aryt Industries' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Delve into our full catalog of 241 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LINK

Link Bilgisayar Sistemleri Yazilimi ve Donanimi Sanayi ve Ticaret

Link Bilgisayar Sistemleri Yazilimi ve Donanimi Sanayi ve Ticaret A.S.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)