Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Ericsson Nikola Tesla d.d. (ZGSE:ERNT) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Ericsson Nikola Tesla d.d

How Much Debt Does Ericsson Nikola Tesla d.d Carry?

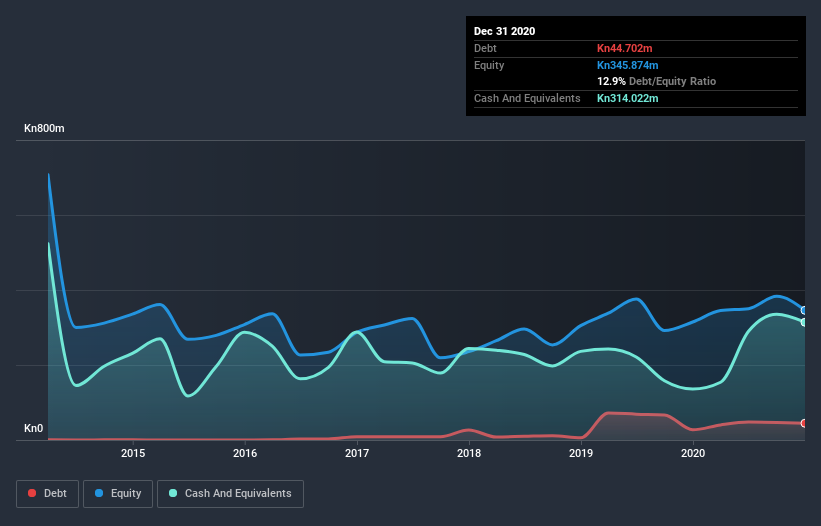

The image below, which you can click on for greater detail, shows that at December 2020 Ericsson Nikola Tesla d.d had debt of Kn44.7m, up from Kn27.4m in one year. However, its balance sheet shows it holds Kn314.0m in cash, so it actually has Kn269.3m net cash.

How Strong Is Ericsson Nikola Tesla d.d's Balance Sheet?

According to the last reported balance sheet, Ericsson Nikola Tesla d.d had liabilities of Kn569.1m due within 12 months, and liabilities of Kn79.3m due beyond 12 months. On the other hand, it had cash of Kn314.0m and Kn300.5m worth of receivables due within a year. So its liabilities total Kn33.8m more than the combination of its cash and short-term receivables.

Having regard to Ericsson Nikola Tesla d.d's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the Kn2.12b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Ericsson Nikola Tesla d.d also has more cash than debt, so we're pretty confident it can manage its debt safely.

Also good is that Ericsson Nikola Tesla d.d grew its EBIT at 11% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Ericsson Nikola Tesla d.d can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Ericsson Nikola Tesla d.d may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Ericsson Nikola Tesla d.d recorded free cash flow worth a fulsome 80% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Ericsson Nikola Tesla d.d has Kn269.3m in net cash. The cherry on top was that in converted 80% of that EBIT to free cash flow, bringing in Kn248m. So is Ericsson Nikola Tesla d.d's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Ericsson Nikola Tesla d.d , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Ericsson Nikola Tesla d.d, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ericsson Nikola Tesla d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ZGSE:ERNT

Ericsson Nikola Tesla d.d

Provides communication products, and ICT solutions and related services in the Republic of Croatia, Bosnia and Herzegovina, and Central and Eastern Europe.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026