- Hong Kong

- /

- Renewable Energy

- /

- SEHK:916

Longyuan Power (SEHK:916) Margin Expansion Reinforces Operational Quality Narrative

Reviewed by Simply Wall St

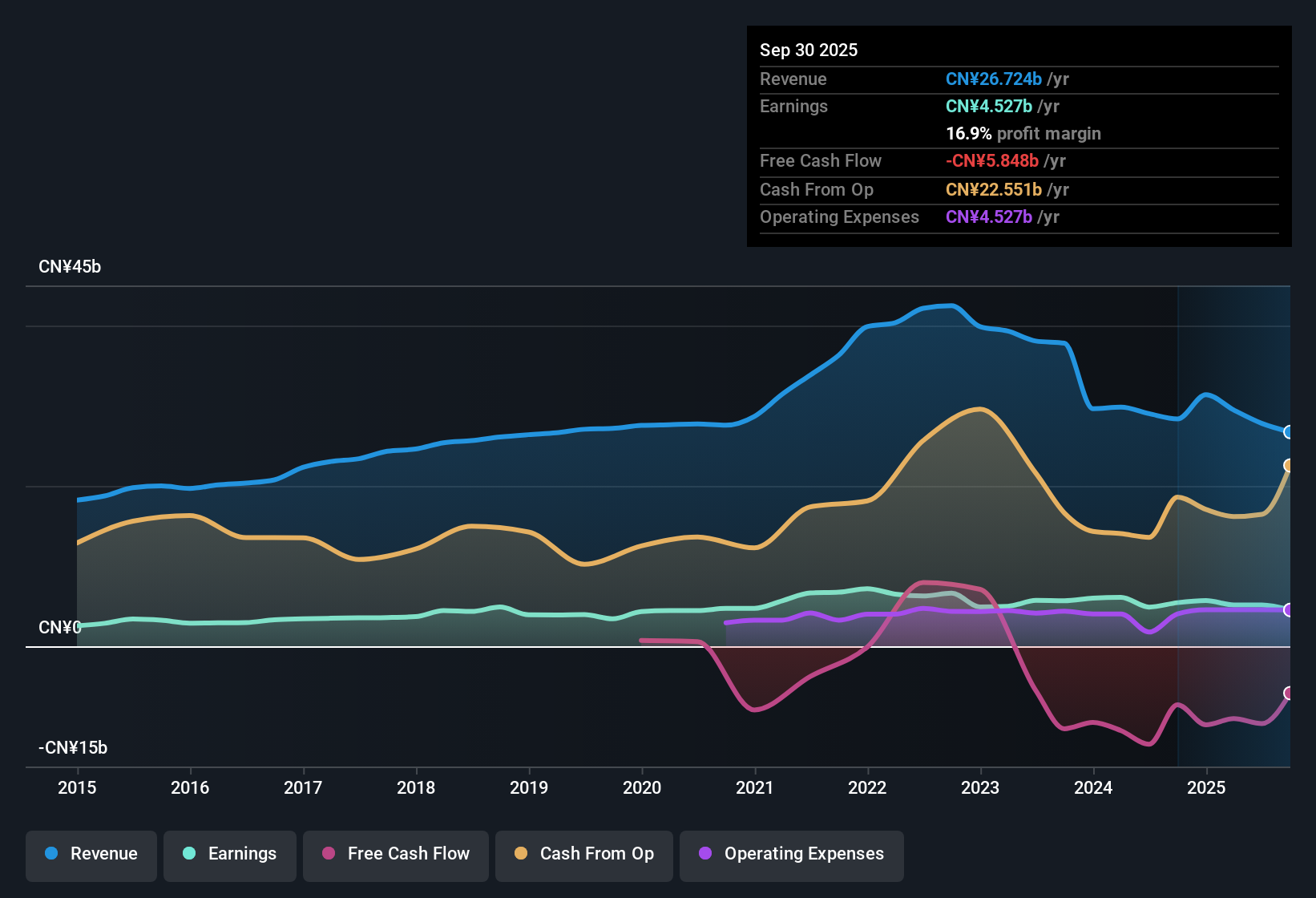

China Longyuan Power Group (SEHK:916) reported net profit margins of 18.6%, a noticeable improvement from last year’s 16.8%. EPS growth over the past year clocked in at 5.5%, reversing a prior five-year average decline of 2.1% annually. With shares trading at a P/E of 11x, below both sector and peer averages, investors see attractive value and quality trends. However, questions about dividend sustainability and financial strength continue to loom over sentiment.

See our full analysis for China Longyuan Power Group.Next, let’s see how these reported earnings compare to the prevailing narratives in the market. Some community views are likely to be confirmed, but others might face a new challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Forecast Lags Broad Market

- Longyuan's annual earnings are projected to grow by 10.29%, which trails the Hong Kong market's forecasted 12.3% earnings growth and 8.6% revenue growth.

- Prevailing market view notes that while some momentum is visible, the company's slower-than-market earnings growth keeps expectations muted for a major re-rating.

- The 10.29% projected growth underscores a positive trajectory, but investors might hesitate given that peers and the wider market are expected to outperform on a relative basis.

- Some prospective buyers may favor companies with growth forecasts that exceed market benchmarks, not just approach them, potentially capping how much sentiment can improve in the near-term.

Profit Margins Outpace Peers

- Recent profit margins are 18.6%, higher than last year's 16.8%, and continue to support the view that Longyuan delivers quality, efficient operations within the Asian Renewable Energy landscape.

- According to prevailing market analysis, these above-average margins reinforce the company’s reputation for efficient management among its competitors.

- Bulls argue that stronger margins are a sign of operational discipline, offering reassurance for those prioritizing earnings quality over headline growth rates.

- The consistency of margin expansion, especially when peer and sector averages are lower, could provide Longyuan some insulation from cost pressures affecting the broader industry.

Shares Trade at a 21% Discount to Sector

- The company’s current P/E ratio stands at 11x, notably lower than the Asian Renewable Energy industry average of 17x and the peer group average of 14.4x, making Longyuan one of the more attractively valued large-cap names in its space.

- Prevailing market commentary highlights that this valuation gap makes Longyuan appealing for value-focused investors, even though future growth rates trail the sector.

- A discount of this size often signals that the market is pricing in ongoing risks around dividend sustainability or balance sheet strength, despite margin expansion.

- Investors keen on relative value might see opportunity, but market caution suggests the lower P/E is likely to persist until questions about financial position and dividend are addressed within filings or official updates.

See our latest analysis for China Longyuan Power Group.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Longyuan Power Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Longyuan’s slower-than-market profit growth and lingering doubts about dividend stability and balance sheet strength limit sentiment. This is the case even though the valuation appears attractive.

For investors seeking reliability and resilience, discover solid balance sheet and fundamentals stocks screener (1985 results) to identify companies built on stronger financial foundations and less uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:916

China Longyuan Power Group

Generates and sells wind, coal, and photovoltaic (PV) power in the Chinese Mainland, Canada, South Africa, and Ukraine.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)