- Hong Kong

- /

- Gas Utilities

- /

- SEHK:2886

Should Shareholders Reconsider Binhai Investment Company Limited's (HKG:2886) CEO Compensation Package?

Key Insights

- Binhai Investment's Annual General Meeting to take place on 10th of May

- Total pay for CEO Liang Gao includes HK$404.0k salary

- Total compensation is 65% above industry average

- Binhai Investment's EPS declined by 13% over the past three years while total shareholder loss over the past three years was 7.3%

Shareholders will probably not be too impressed with the underwhelming results at Binhai Investment Company Limited (HKG:2886) recently. At the upcoming AGM on 10th of May, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Binhai Investment

How Does Total Compensation For Liang Gao Compare With Other Companies In The Industry?

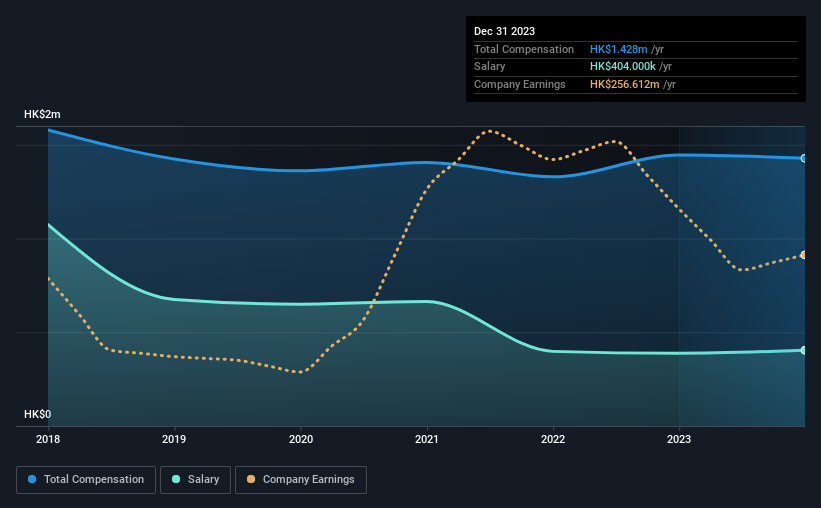

According to our data, Binhai Investment Company Limited has a market capitalization of HK$1.6b, and paid its CEO total annual compensation worth HK$1.4m over the year to December 2023. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$404k.

In comparison with other companies in the Hong Kong Gas Utilities industry with market capitalizations ranging from HK$781m to HK$3.1b, the reported median CEO total compensation was HK$868k. Hence, we can conclude that Liang Gao is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$404k | HK$388k | 28% |

| Other | HK$1.0m | HK$1.1m | 72% |

| Total Compensation | HK$1.4m | HK$1.4m | 100% |

Speaking on an industry level, nearly 67% of total compensation represents salary, while the remainder of 33% is other remuneration. Binhai Investment pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Binhai Investment Company Limited's Growth

Over the last three years, Binhai Investment Company Limited has shrunk its earnings per share by 13% per year. In the last year, its revenue is up 5.0%.

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Binhai Investment Company Limited Been A Good Investment?

Given the total shareholder loss of 7.3% over three years, many shareholders in Binhai Investment Company Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Binhai Investment that investors should look into moving forward.

Important note: Binhai Investment is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Binhai Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2886

Binhai Investment

An investment holding company, operates in gas business in the People’s Republic of China.

Good value average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026