- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1265

We Think Tianjin Jinran Public Utilities (HKG:1265) Needs To Drive Business Growth Carefully

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Tianjin Jinran Public Utilities (HKG:1265) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Tianjin Jinran Public Utilities

When Might Tianjin Jinran Public Utilities Run Out Of Money?

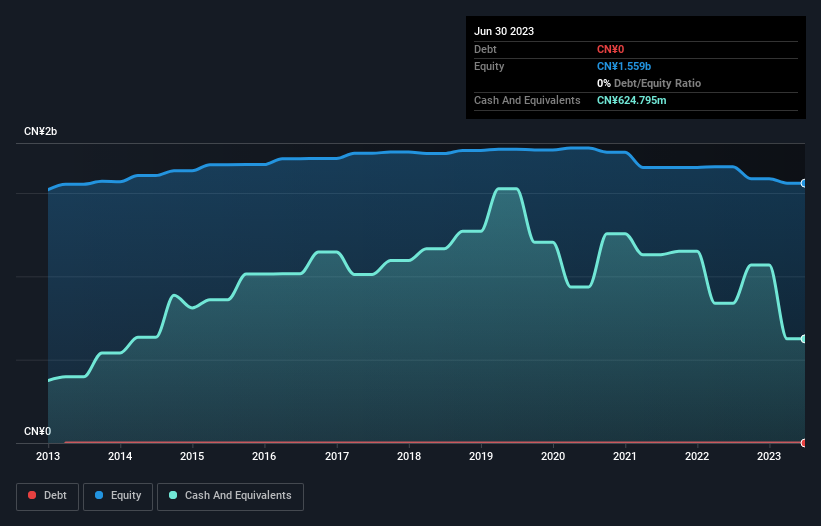

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2023, Tianjin Jinran Public Utilities had CN¥625m in cash, and was debt-free. Looking at the last year, the company burnt through CN¥203m. So it had a cash runway of about 3.1 years from June 2023. A runway of this length affords the company the time and space it needs to develop the business. The image below shows how its cash balance has been changing over the last few years.

How Well Is Tianjin Jinran Public Utilities Growing?

Tianjin Jinran Public Utilities reduced its cash burn by 2.7% during the last year, which points to some degree of discipline. Revenue also improved during the period, increasing by 4.5%. Considering both these factors, we're not particularly excited by its growth profile. In reality, this article only makes a short study of the company's growth data. You can take a look at how Tianjin Jinran Public Utilities has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Tianjin Jinran Public Utilities Raise Cash?

We are certainly impressed with the progress Tianjin Jinran Public Utilities has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of CN¥474m, Tianjin Jinran Public Utilities' CN¥203m in cash burn equates to about 43% of its market value. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

Is Tianjin Jinran Public Utilities' Cash Burn A Worry?

On this analysis of Tianjin Jinran Public Utilities' cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Taking a deeper dive, we've spotted 2 warning signs for Tianjin Jinran Public Utilities you should be aware of, and 1 of them is a bit unpleasant.

Of course Tianjin Jinran Public Utilities may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianjin Jinran Public Utilities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1265

Tianjin Jinran Public Utilities

Engages in the sale of piped natural gas in Mainland China.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)