As global markets experience fluctuations, with U.S. consumer confidence declining and major stock indexes showing mixed performance, investors are seeking opportunities that offer potential growth despite uncertain conditions. Penny stocks, though often considered speculative, can present valuable opportunities when backed by strong financials and sound fundamentals. In this article, we explore three promising penny stocks that stand out for their financial strength and potential to deliver impressive returns in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp industries globally, with a market cap of €1.55 billion.

Operations: The company generates €1.92 billion in revenue from its operations in the folding boxboard, fresh fibre linerboard, and market pulp sectors.

Market Cap: €1.55B

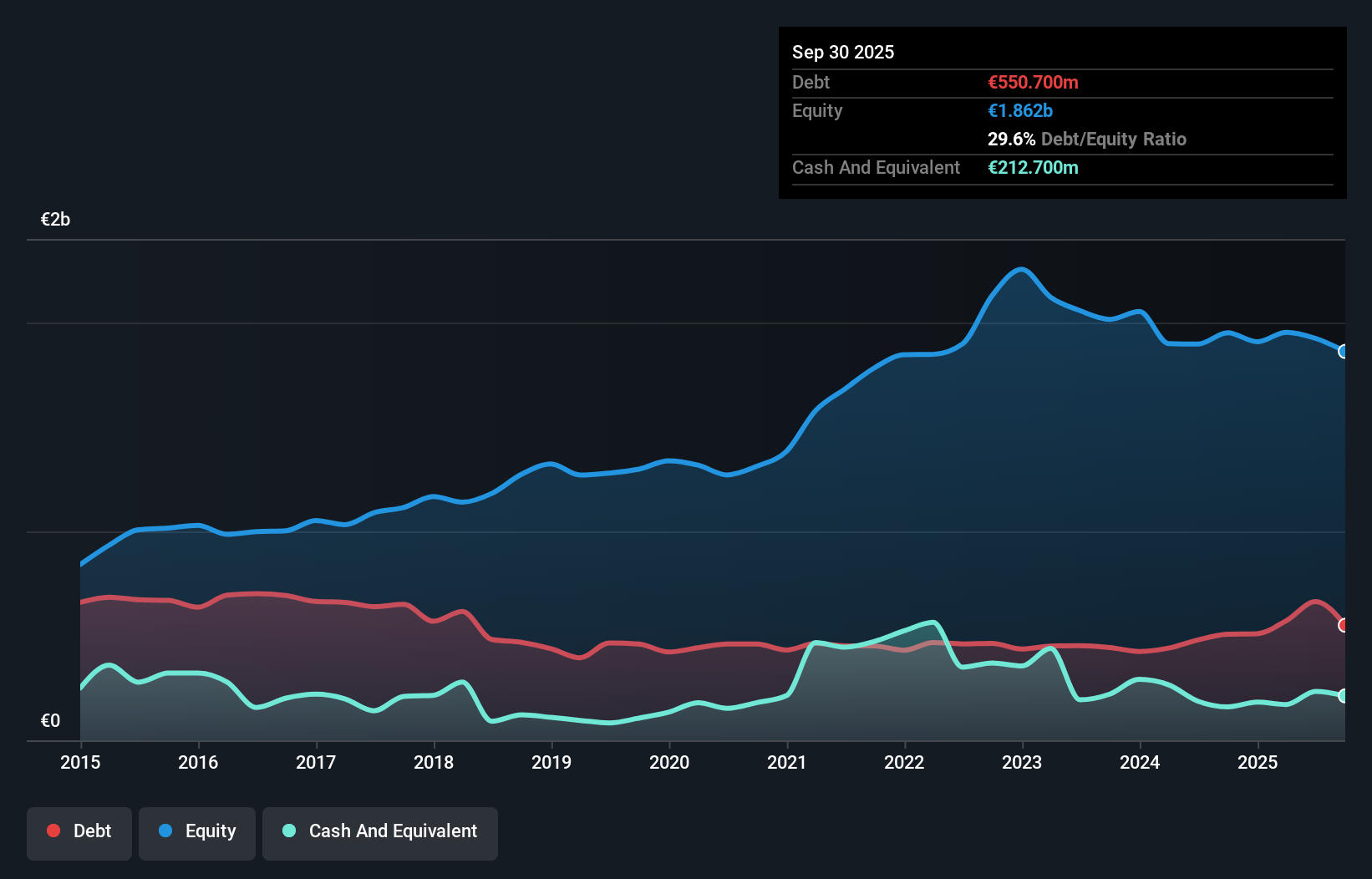

Metsä Board Oyj, with a market cap of €1.55 billion and revenue of €1.92 billion, operates in the packaging industry but faces challenges such as negative earnings growth over the past year and declining profit margins. Despite its satisfactory debt management, including a net debt to equity ratio of 17.8%, the company's current net profit margin is lower than last year at 1.8%. Recent initiatives include enhancing recycling processes through QR codes on product labels, reflecting its commitment to sustainability and innovation. However, upcoming earnings guidance suggests weaker performance compared to previous quarters.

- Navigate through the intricacies of Metsä Board Oyj with our comprehensive balance sheet health report here.

- Examine Metsä Board Oyj's earnings growth report to understand how analysts expect it to perform.

Guangshen Railway (SEHK:525)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangshen Railway Company Limited operates in the railway passenger and freight transportation sectors in the People's Republic of China, with a market cap of HK$23.72 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥27.05 billion.

Market Cap: HK$23.72B

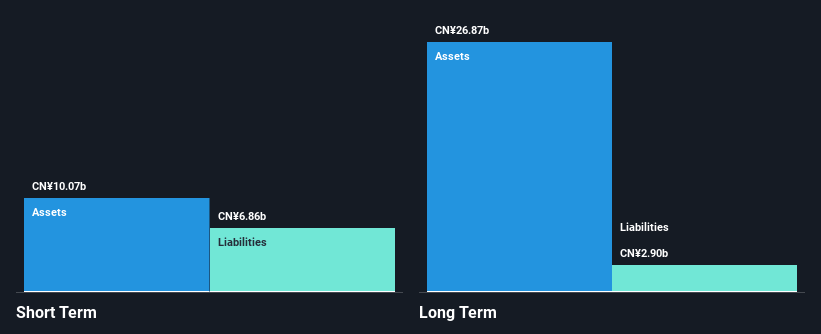

Guangshen Railway Company Limited, with a market cap of HK$23.72 billion and revenue of CN¥27.05 billion, has experienced significant earnings growth over the past year, surpassing industry averages. Its short-term assets comfortably cover both short- and long-term liabilities, indicating solid financial health. Despite a low return on equity at 4.6%, the company maintains high-quality earnings and stable weekly volatility at 7%. Recent board changes include the resignation of Chairman Wei Hao and an upcoming vote on appointing Mr. Jiang Hui as a director, reflecting ongoing corporate governance adjustments amidst steady operational performance improvements.

- Get an in-depth perspective on Guangshen Railway's performance by reading our balance sheet health report here.

- Understand Guangshen Railway's earnings outlook by examining our growth report.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$63 billion.

Operations: The company generates revenue primarily from Property Investment and Development (CN¥50.70 billion) and Property Leasing (CN¥279.66 million).

Market Cap: HK$6.3B

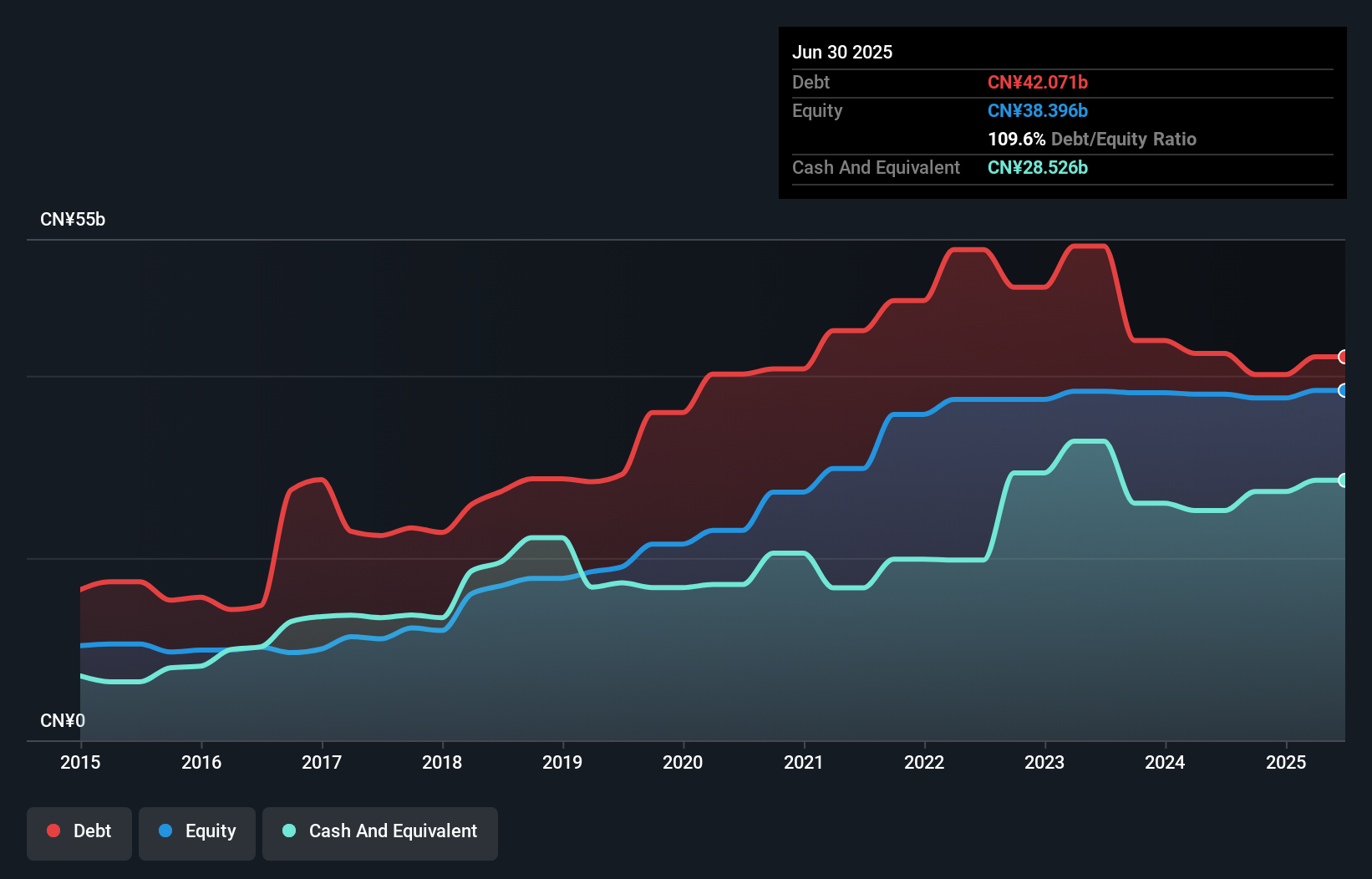

China Overseas Grand Oceans Group Limited, with a market cap of HK$63 billion, has faced challenges including a significant one-off loss of CN¥1.5 billion impacting recent financial results. Despite this, the company maintains strong short-term asset coverage over both short- and long-term liabilities. Although its net profit margins have declined to 2.9% from last year’s 4.4%, and return on equity remains low at 2.4%, the company is trading slightly below its estimated fair value and offers good relative value compared to peers. Recent sales figures show mixed performance with notable monthly increases but overall yearly declines in contracted sales volumes and values.

- Unlock comprehensive insights into our analysis of China Overseas Grand Oceans Group stock in this financial health report.

- Assess China Overseas Grand Oceans Group's future earnings estimates with our detailed growth reports.

Make It Happen

- Take a closer look at our Penny Stocks list of 5,815 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Metsä Board Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:METSB

Metsä Board Oyj

Engages in the folding boxboard, fresh fibre linerboard, and market pulp businesses in Finland and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives