- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1732

Xiangxing International Holding (HKG:1732) investors are up 24% in the past week, but earnings have declined over the last year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Xiangxing International Holding Limited (HKG:1732) share price had more than doubled in just one year - up 246%. Also pleasing for shareholders was the 69% gain in the last three months. Looking back further, the stock price is 184% higher than it was three years ago.

Since the stock has added HK$126m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Xiangxing International Holding

SWOT Analysis for Xiangxing International Holding

- Debt is not viewed as a risk.

- Earnings declined over the past year.

- Shareholders have been diluted in the past year.

- Trading below our estimate of fair value by more than 20%.

- Lack of analyst coverage makes it difficult to determine 1732's earnings prospects.

- No apparent threats visible for 1732.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Xiangxing International Holding actually saw its earnings per share drop 4.1%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Unfortunately Xiangxing International Holding's fell 18% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

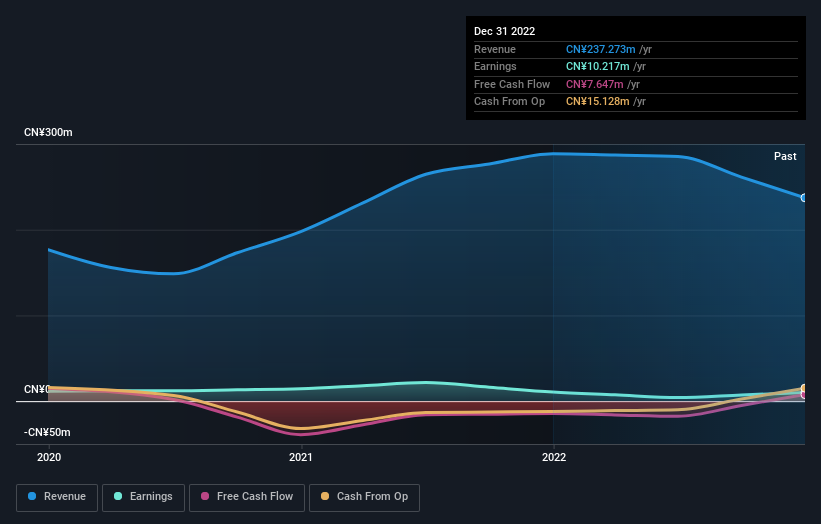

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Xiangxing International Holding has rewarded shareholders with a total shareholder return of 246% in the last twelve months. Notably the five-year annualised TSR loss of 2% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 6 warning signs for Xiangxing International Holding (1 is concerning) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1732

Xiangxing International Holding

An investment holding company, provides intra-port services, logistics services, and supply chain operations in the People’s Republic of China.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives