- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

Shareholders Will Probably Hold Off On Increasing Lenovo Group Limited's (HKG:992) CEO Compensation For The Time Being

Key Insights

- Lenovo Group's Annual General Meeting to take place on 17th of July

- Total pay for CEO Yuanqing Yang includes US$1.33m salary

- The overall pay is 1,949% above the industry average

- Lenovo Group's total shareholder return over the past three years was 56% while its EPS was down 14% over the past three years

Performance at Lenovo Group Limited (HKG:992) has been reasonably good and CEO Yuanqing Yang has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 17th of July, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Lenovo Group

How Does Total Compensation For Yuanqing Yang Compare With Other Companies In The Industry?

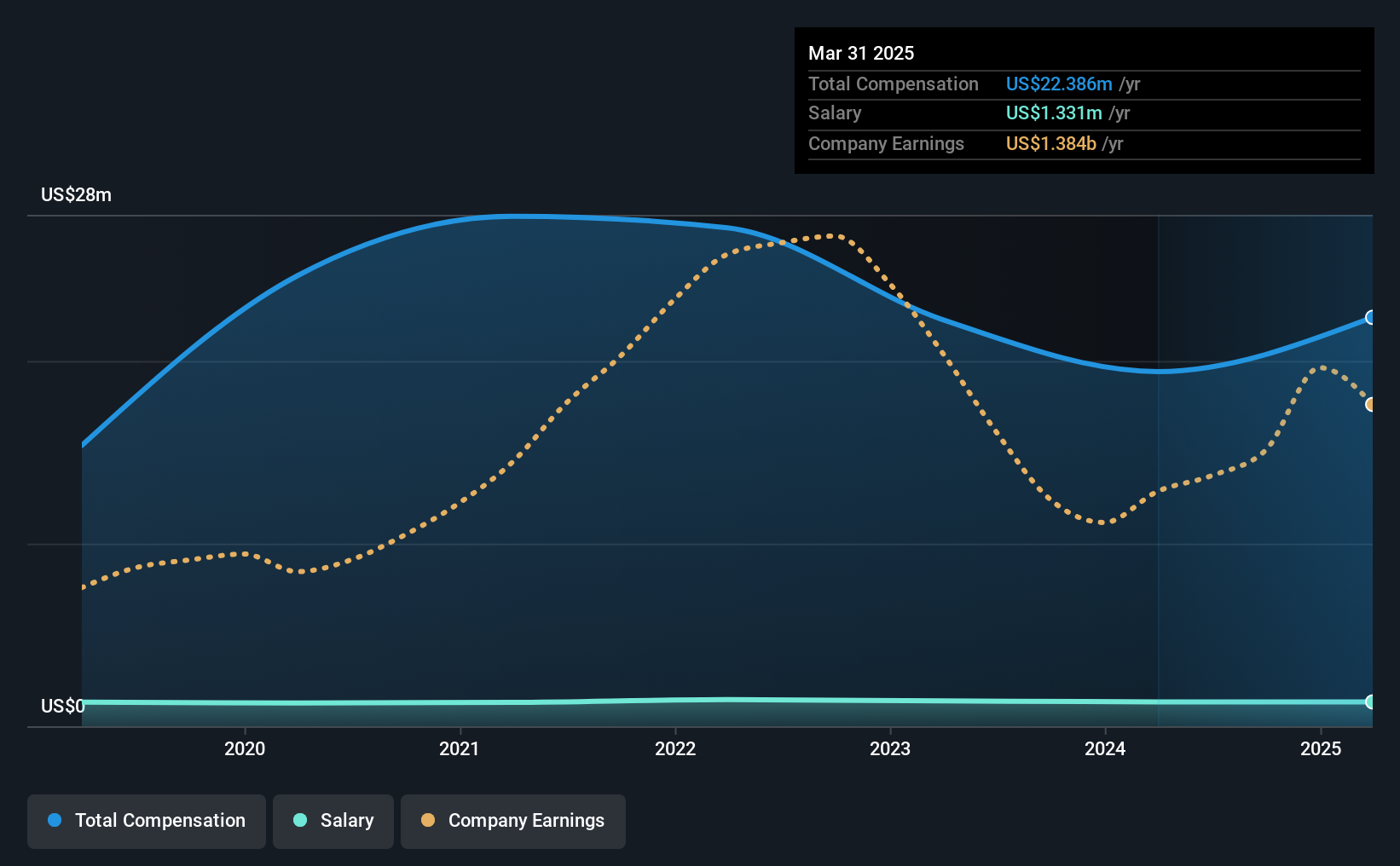

At the time of writing, our data shows that Lenovo Group Limited has a market capitalization of HK$119b, and reported total annual CEO compensation of US$22m for the year to March 2025. Notably, that's an increase of 15% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.3m.

For comparison, other companies in the Hong Kong Tech industry with market capitalizations above HK$63b, reported a median total CEO compensation of US$1.1m. Hence, we can conclude that Yuanqing Yang is remunerated higher than the industry median. Furthermore, Yuanqing Yang directly owns HK$7.2b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$1.3m | US$1.3m | 6% |

| Other | US$21m | US$18m | 94% |

| Total Compensation | US$22m | US$19m | 100% |

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. It's interesting to note that Lenovo Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Lenovo Group Limited's Growth

Over the last three years, Lenovo Group Limited has shrunk its earnings per share by 14% per year. It achieved revenue growth of 21% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Lenovo Group Limited Been A Good Investment?

Boasting a total shareholder return of 56% over three years, Lenovo Group Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. Until EPS growth picks back up, we think shareholders may find it hard to justify increasing CEO pay given that they are already paid above industry average.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Lenovo Group (1 is a bit unpleasant!) that you should be aware of before investing here.

Important note: Lenovo Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.