- Hong Kong

- /

- Communications

- /

- SEHK:6869

Yangtze Optical Fibre And Cable (SEHK:6869) Valuation After Follow-On Equity Offering And Sharp Share Price Rerating

Reviewed by Simply Wall St

Yangtze Optical Fibre And Cable Limited (SEHK:6869) has just moved to raise about HK$2.26 billion through a follow on equity offering of 70 million H shares at HK$32.26, a material step for its capital structure.

See our latest analysis for Yangtze Optical Fibre And Cable Limited.

The capital raise lands after a busy spell for Yangtze Optical Fibre And Cable Limited, with recent governance changes and a fresh board line up coinciding with a sharp shift in sentiment. The latest 1 month share price return of 42.21 percent and 7 day gain of 34.83 percent at a HK$47.3 share price suggest strong near term momentum, while a year to date share price return of 288.98 percent and 1 year total shareholder return of 321.78 percent point to a powerful longer term rerating.

If this kind of momentum has you rethinking your watchlist, it could be worth seeing what else is moving among tech names by exploring high growth tech and AI stocks.

But with the stock now trading almost exactly at analyst targets and only a small intrinsic discount implied, investors have to ask: is there still upside to capture, or is future growth already fully priced in?

Price-to-Earnings of 56.3x: Is it justified?

On a trailing basis, Yangtze Optical Fibre And Cable Limited trades on a steep 56.3x price to earnings multiple at its HK$47.3 last close. This places it well above both peers and fair value benchmarks.

The price to earnings ratio measures how much investors are paying today for each dollar of current earnings. It is a key yardstick for established, profit generating tech and communications businesses like Yangtze Optical Fibre And Cable Limited. At 56.3x, the market is effectively baking in a strong profit recovery and sustained growth, despite the fact that earnings fell over the last year and current net profit margins of 4.2 percent are down from 8.2 percent.

Relative to valuation anchors, this premium is pronounced. The stock is flagged as expensive versus the peer average multiple of 15.4x, the broader Asian communications industry at 35.6x, and an estimated fair price to earnings level of 35.6x. Together, these comparisons suggest investors are paying far more than both sector norms and the level our fair ratio work points to as a potential equilibrium the multiple could gravitate toward if optimism fades or growth underdelivers.

Explore the SWS fair ratio for Yangtze Optical Fibre And Cable Limited

Result: Price-to-Earnings of 56.3x (OVERVALUED)

However, still, any slowdown in demand for optical infrastructure or disappointment versus lofty growth expectations could quickly compress Yangtze Optical Fibre And Cable Limited’s elevated multiple.

Find out about the key risks to this Yangtze Optical Fibre And Cable Limited narrative.

Another View: What Does DCF Say?

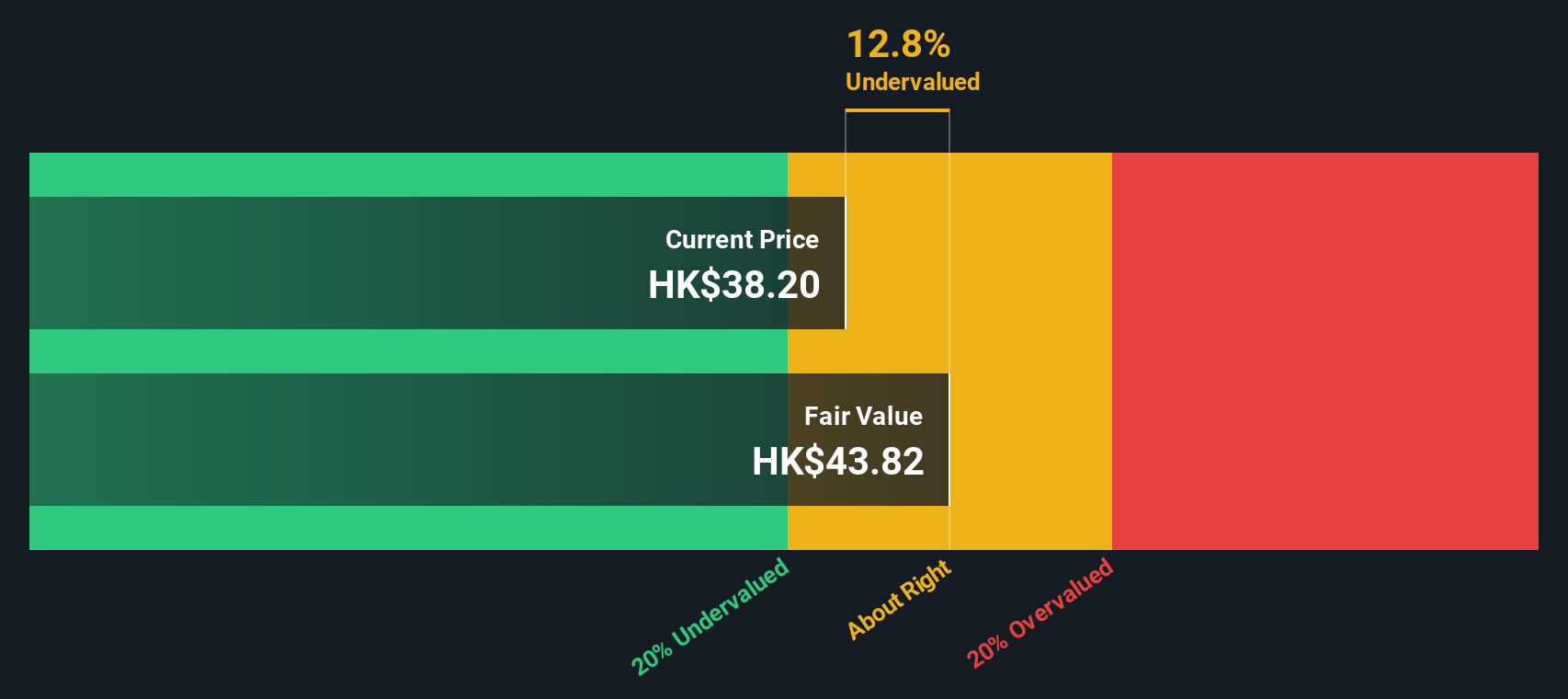

While the earnings multiple looks stretched, our DCF model paints a slightly different picture. It suggests fair value around HK$45.05 versus the HK$47.3 share price, implying only a modest overvaluation. Is the market already pricing in even faster growth than our cash flow assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yangtze Optical Fibre And Cable Limited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yangtze Optical Fibre And Cable Limited Narrative

If you see the story differently or prefer to dive into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Yangtze Optical Fibre And Cable Limited research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Do not stop at one opportunity. Sharpen your edge by scanning fresh ideas on Simply Wall St before the next big move leaves you watching from the sidelines.

- Capture potential multi-baggers early by reviewing these 3611 penny stocks with strong financials that pair tiny market caps with serious financial muscle.

- Ride the next wave of automation and data intelligence by assessing these 26 AI penny stocks shaping the future of software and hardware.

- Lock in quality at sensible prices by targeting these 908 undervalued stocks based on cash flows where cash flows suggest the market may be behind the curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6869

Yangtze Optical Fibre And Cable Limited

Engages in the production and sale of optical fiber preforms rods, optical fiber, and optical fiber cables in China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)