- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

The three-year decline in earnings might be taking its toll on FIT Hon Teng (HKG:6088) shareholders as stock falls 15% over the past week

It's been a soft week for FIT Hon Teng Limited (HKG:6088) shares, which are down 15%. In contrast, the return over three years has been impressive. In three years the stock price has launched 276% higher: a great result. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

Although FIT Hon Teng has shed HK$5.0b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, FIT Hon Teng failed to grow earnings per share, which fell 11% (annualized).

This means it's unlikely the market is judging the company based on earnings growth. Therefore, we think it's worth considering other metrics as well.

We severely doubt anyone is particularly impressed with the modest 0.5% three-year revenue growth rate. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

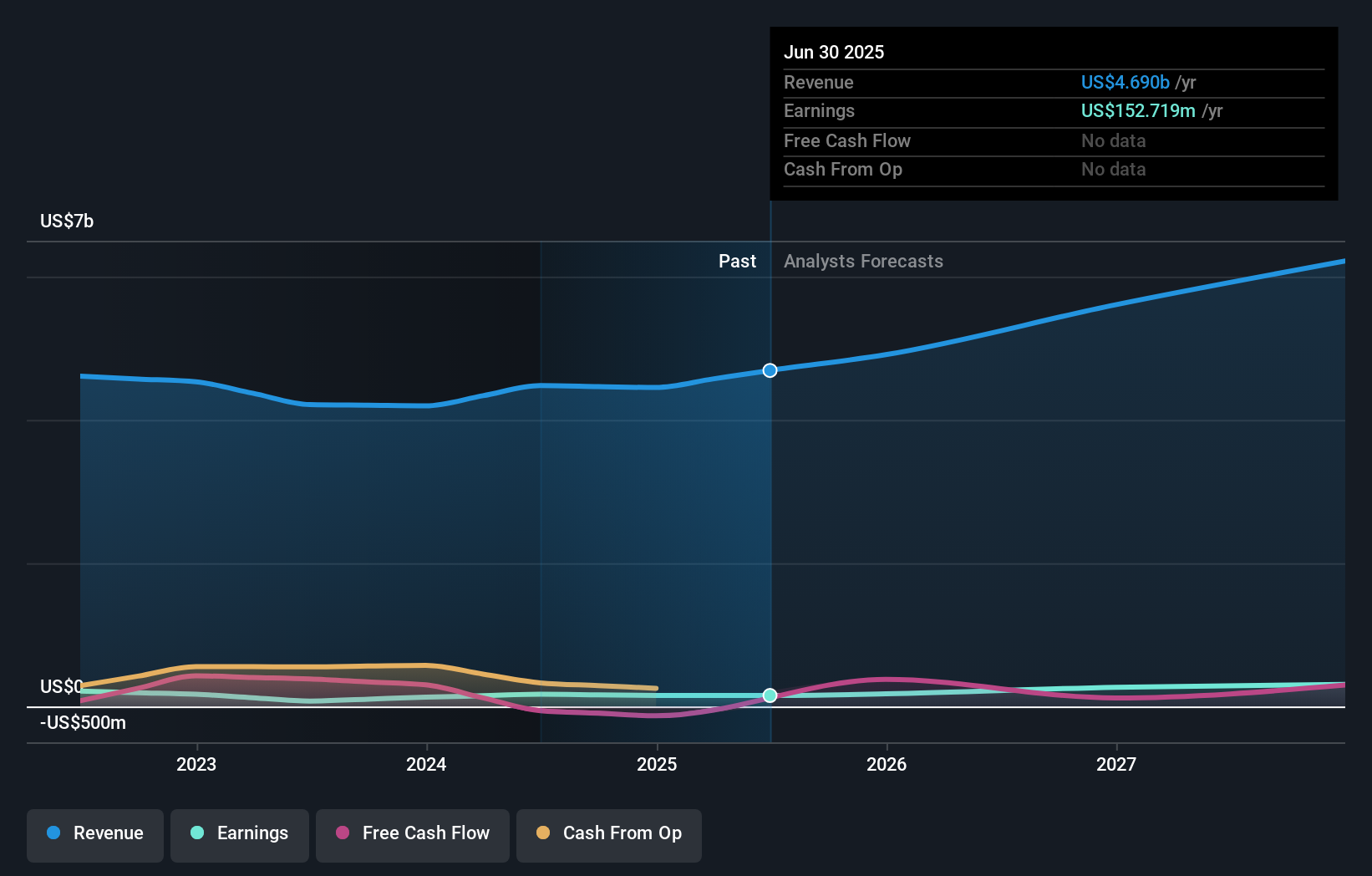

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that FIT Hon Teng has rewarded shareholders with a total shareholder return of 105% in the last twelve months. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand FIT Hon Teng better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with FIT Hon Teng .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives