- China

- /

- Electronic Equipment and Components

- /

- SHSE:603678

High Growth Tech Stocks in Asia to Watch March 2025

Reviewed by Simply Wall St

As global markets grapple with uncertainties surrounding trade policies and economic growth, the Asian tech sector remains a focal point for investors seeking opportunities amidst volatility. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to changing market dynamics, while capitalizing on innovation and regional economic trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 40.38% | 52.94% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices as well as connectors, operating both in Taiwan and internationally, with a market cap of HK$22.11 billion.

Operations: FIT Hon Teng Limited generates its revenue primarily from two segments: Consumer Products, contributing $690.95 million, and Intermediate Products, contributing $3.94 billion.

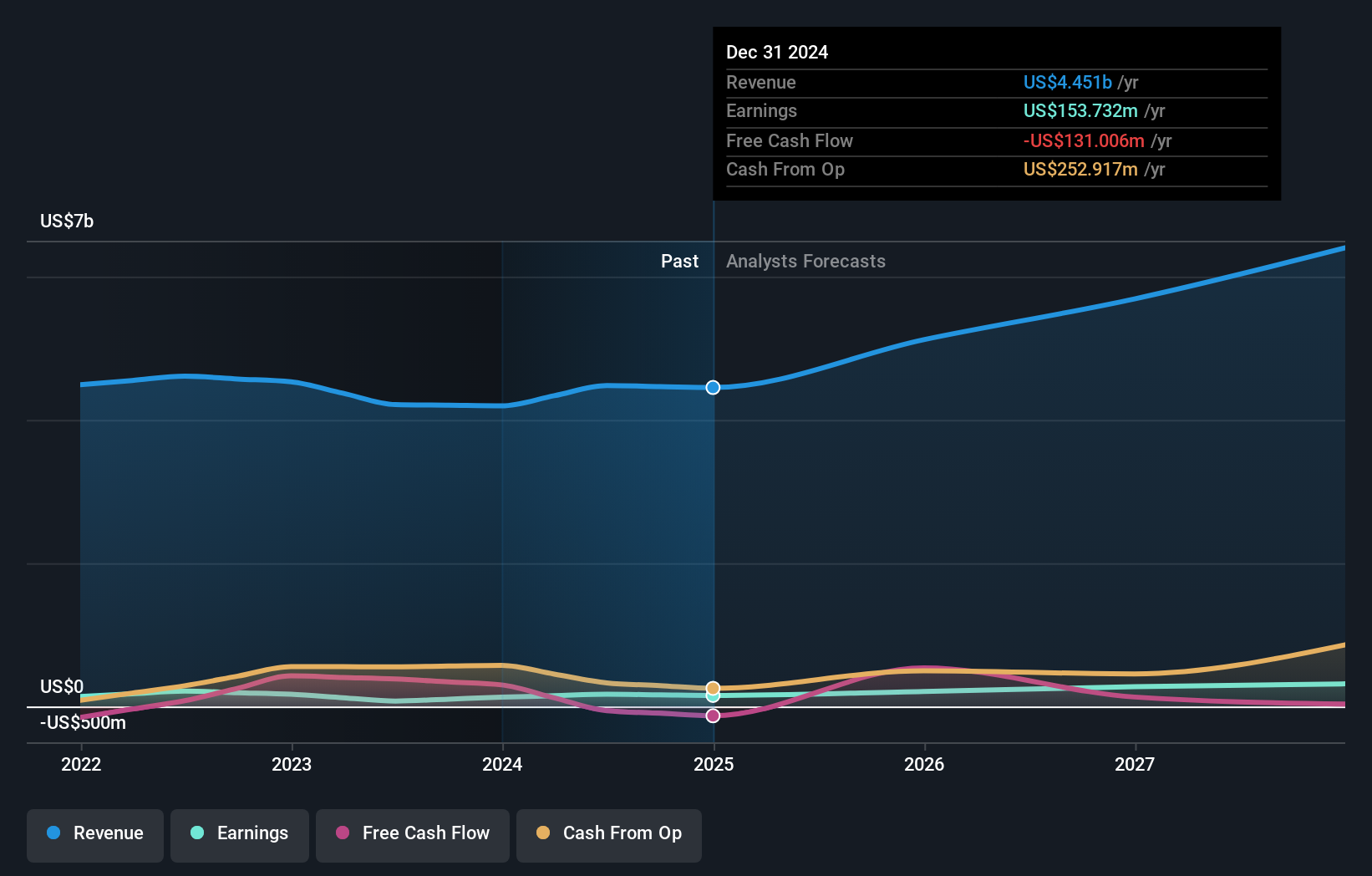

FIT Hon Teng has demonstrated robust growth, with earnings soaring by 125.6% over the past year, significantly outpacing the electronic industry's average of 11.7%. This performance is underpinned by a revenue increase projected at 16.2% annually, surpassing Hong Kong's market growth rate of 7.7%. Looking ahead, the company's earnings are expected to continue their upward trajectory at an impressive rate of 31% per year, well above the local market forecast of 11.6%. These financial indicators suggest FIT Hon Teng is effectively capitalizing on market opportunities and enhancing shareholder value despite a highly volatile share price in recent months.

- Delve into the full analysis health report here for a deeper understanding of FIT Hon Teng.

Assess FIT Hon Teng's past performance with our detailed historical performance reports.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

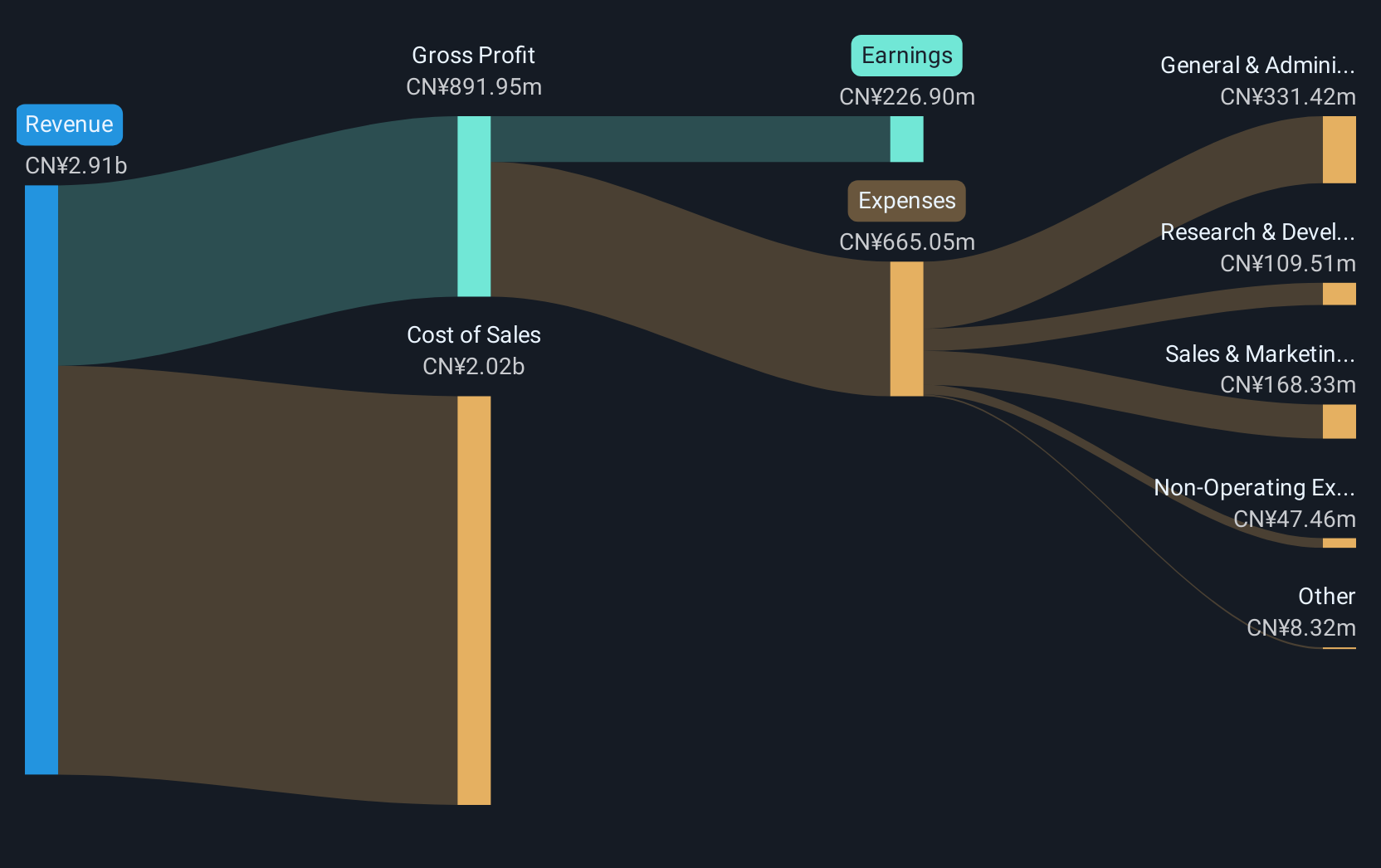

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry and has a market cap of CN¥17.82 billion.

Operations: Torch Electron is involved in the electronic components sector, focusing on producing and selling various electronic products. The company generates revenue primarily from its specialized product lines within this industry.

Fujian Torch Electron Technology is capturing attention with its robust annual revenue growth of 21.9%, outpacing the broader Chinese market's expansion of 13.3%. This growth is complemented by an impressive forecast for earnings, expected to surge at 36.5% annually, significantly above the market average of 25.5%. The company's commitment to innovation is underscored by substantial R&D investments, which have recently amounted to CN¥120 million, representing a strategic focus on developing cutting-edge technologies in the electronic sector. Despite some challenges marked by a one-off financial gain impacting recent results and a downturn in earnings last year, Fujian Torch remains poised for future growth driven by its strategic initiatives and market positioning.

- Navigate through the intricacies of Fujian Torch Electron Technology with our comprehensive health report here.

Understand Fujian Torch Electron Technology's track record by examining our Past report.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a diverse range of internet services globally and has a market capitalization of ¥327.80 billion.

Operations: The company generates significant revenue from its Internet Infrastructure segment, amounting to ¥184.91 billion, followed by the Internet Finance Business at ¥43.73 billion and the Internet Advertising and Media Business at ¥34.07 billion. The Crypto Asset Business also contributes notably with revenue of ¥9.13 billion.

GMO Internet Group, a player in the Asian tech scene, is demonstrating solid financial health with an annual revenue growth of 7.6%, outpacing Japan's market average of 4.2%. The company's commitment to innovation is evident from its R&D spending which recently reached ¥3 billion, reflecting a strategic emphasis on developing advanced technologies. Furthermore, GMO has actively enhanced shareholder value through recent share repurchases totaling ¥3.68 billion for 1.45% of its issued capital, underscoring confidence in its operational strategy and future prospects in the competitive tech landscape.

- Take a closer look at GMO internet group's potential here in our health report.

Examine GMO internet group's past performance report to understand how it has performed in the past.

Key Takeaways

- Click here to access our complete index of 516 Asian High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603678

Fujian Torch Electron Technology

Fujian Torch Electron Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives