Does China Silver Technology Holdings (HKG:515) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that China Silver Technology Holdings Limited (HKG:515) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for China Silver Technology Holdings

What Is China Silver Technology Holdings's Debt?

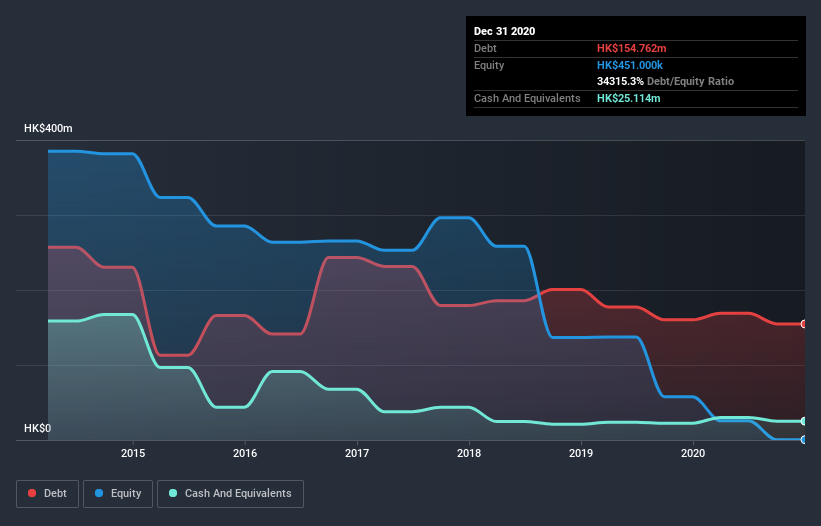

The chart below, which you can click on for greater detail, shows that China Silver Technology Holdings had HK$154.8m in debt in December 2020; about the same as the year before. However, it also had HK$25.1m in cash, and so its net debt is HK$129.6m.

How Healthy Is China Silver Technology Holdings' Balance Sheet?

According to the last reported balance sheet, China Silver Technology Holdings had liabilities of HK$506.7m due within 12 months, and liabilities of HK$18.4m due beyond 12 months. On the other hand, it had cash of HK$25.1m and HK$238.1m worth of receivables due within a year. So it has liabilities totalling HK$261.9m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's HK$231.1m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since China Silver Technology Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year China Silver Technology Holdings had a loss before interest and tax, and actually shrunk its revenue by 13%, to HK$238m. We would much prefer see growth.

Caveat Emptor

While China Silver Technology Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping HK$57m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. For example, we would not want to see a repeat of last year's loss of HK$74m. In the meantime, we consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for China Silver Technology Holdings (1 is significant) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading China Silver Technology Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:515

China Silver Technology Holdings

Manufactures and trades in light emitting diode (LED) lighting products and printed circuit boards (PCBs) in the People’s Republic of China, Hong Kong, other Asian countries, Hungary, Turkey, Germany, and rest of Europe.

Moderate risk and overvalued.

Market Insights

Community Narratives