- Hong Kong

- /

- Communications

- /

- SEHK:285

Exploring High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade negotiations and monetary policy shifts, Asian tech stocks are drawing attention for their potential in the high-growth sector. In this dynamic environment, identifying promising tech companies often involves assessing their innovation capabilities and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 26.11% | 33.37% | ★★★★★★ |

| Auras Technology | 21.28% | 25.47% | ★★★★★★ |

| PharmaEssentia | 31.42% | 57.71% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited focuses on designing, manufacturing, assembling, and selling mobile handset components and modules both in China and globally, with a market capitalization of HK$85.51 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥177.31 billion.

BYD Electronic (International) has demonstrated robust financial performance with a notable increase in sales to CNY 177.31 billion, up from CNY 129.96 billion the previous year, reflecting a growth of over 36%. This surge is supported by an earnings growth of approximately 5.5% year-over-year, outpacing the Communications industry's average of 2.7%. Looking ahead, the company is poised for significant expansion with projected earnings growth of 23.1% annually, surpassing Hong Kong's market average of 10.4%. Moreover, BYD Electronic is enhancing shareholder value through strategic moves like increasing dividends and maintaining a strong focus on innovation and market expansion as evidenced by their recent relocation to a new tech-centric office in Hong Kong’s Science Park. These factors collectively underscore BYD Electronic's potential as a dynamic player in Asia’s high-growth tech sector.

- Unlock comprehensive insights into our analysis of BYD Electronic (International) stock in this health report.

Understand BYD Electronic (International)'s track record by examining our Past report.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★★

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. is a company with a market capitalization of CN¥68.32 billion, primarily engaged in the manufacturing of printed circuit boards (PCBs).

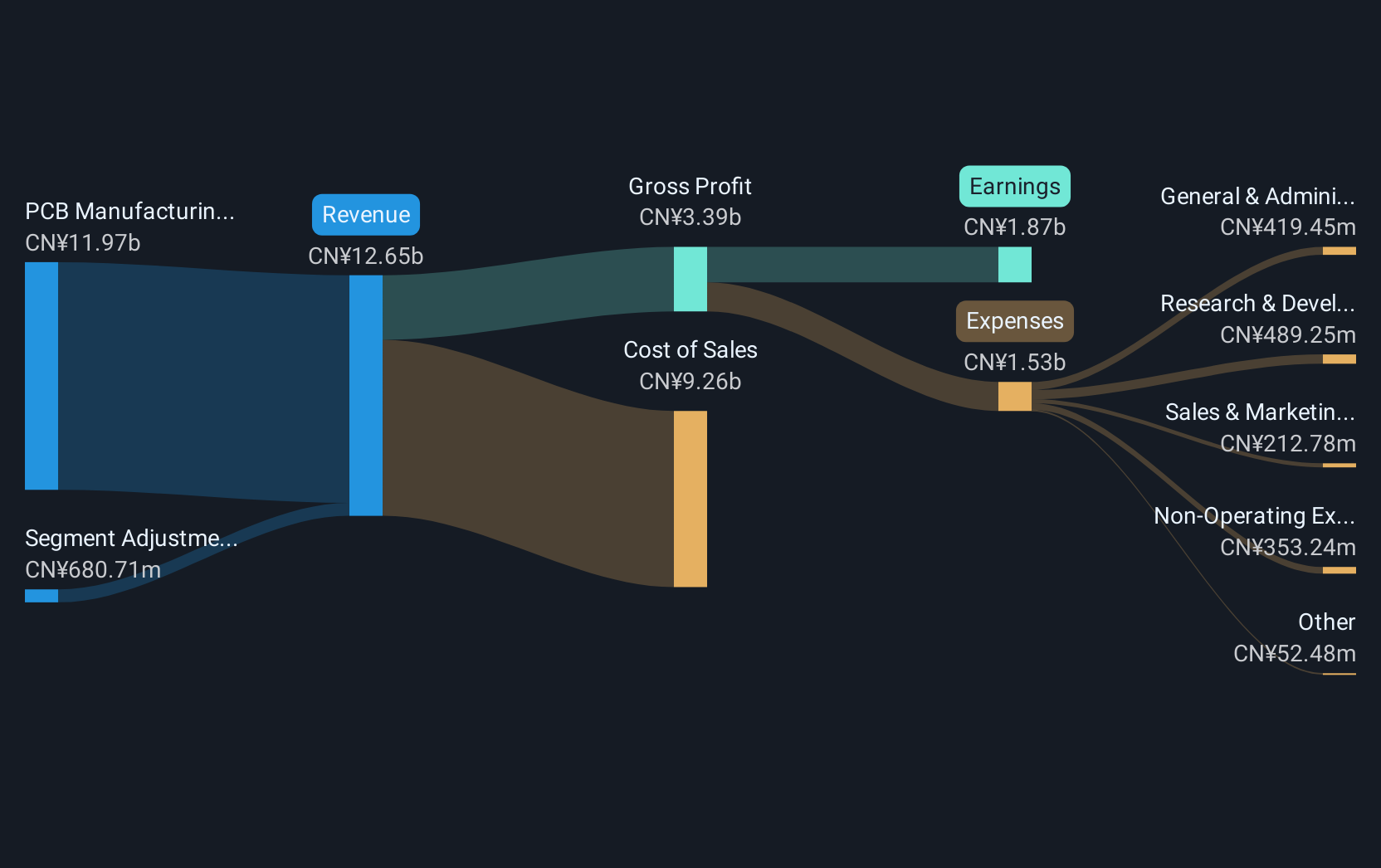

Operations: Victory Giant Technology generates revenue primarily from its PCB manufacturing segment, which accounts for CN¥11.97 billion. The company's operations are focused on producing printed circuit boards, contributing significantly to its overall financial performance.

Victory Giant Technology (HuiZhou)Co.,Ltd. has shown a remarkable financial trajectory, with its revenue soaring by 26.6% annually, outpacing the CN market's average growth of 12.5%. This surge is complemented by an even more impressive annual earnings growth rate of 37.6%, significantly higher than the market forecast of 23.6%. The company's commitment to innovation is evident from its R&D spending, which has been strategically increasing to fuel advancements in high-tech sectors, positioning it well within Asia’s competitive tech landscape. Recent strategic decisions include a dividend increase and significant board changes aimed at bolstering governance and future growth prospects, highlighting its proactive approach in maintaining a strong market position.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with a market capitalization of NT$996.39 billion.

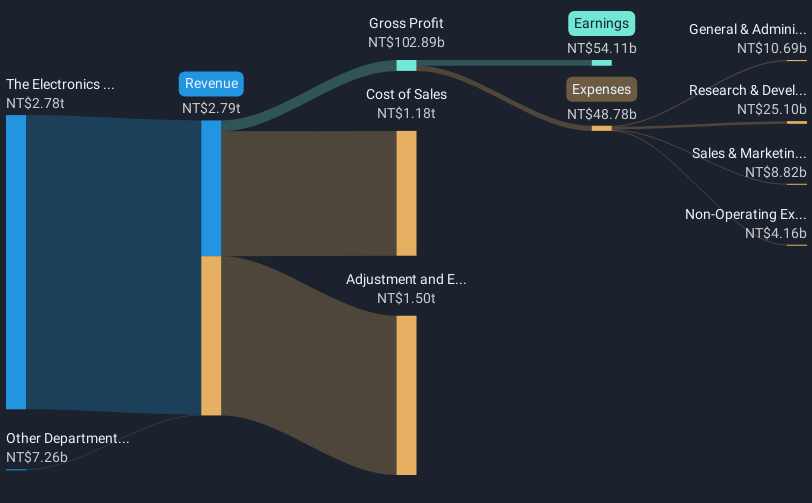

Operations: The company generates revenue primarily from its Electronics Sector, totaling NT$3.05 billion. Despite adjustments and eliminations reducing overall figures, this segment remains a key contributor to the company's financial performance.

Quanta Computer's recent financial performance underscores its robust position in the tech sector, with a notable revenue increase to TWD 1.41 billion, up from TWD 1.09 billion year-over-year. This growth is paired with a surge in net income to TWD 59.7 million from TWD 39.7 million, reflecting a strong earnings growth of approximately 50% over the past year, outperforming the industry average of 16.6%. The company's strategic focus on R&D is evident as it continues to innovate and expand its market reach, ensuring it remains competitive in Asia's dynamic tech landscape. Upcoming changes to its Articles of Incorporation also hint at adaptive corporate governance poised to foster future growth.

- Click to explore a detailed breakdown of our findings in Quanta Computer's health report.

Gain insights into Quanta Computer's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 471 more companies for you to explore.Click here to unveil our expertly curated list of 474 Asian High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BYD Electronic (International) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:285

BYD Electronic (International)

An investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)