- Hong Kong

- /

- Communications

- /

- SEHK:2342

Comba Telecom (SEHK:2342): Valuation Insights as Board Welcomes Dr. Tan Khee Giap

Reviewed by Kshitija Bhandaru

Comba Telecom Systems Holdings (SEHK:2342) is making headlines after the board announced a key change in its independent director lineup. Ms. Wong Lok Lam is stepping down. Dr. Tan Khee Giap will step in, bringing extensive cross-sector expertise.

See our latest analysis for Comba Telecom Systems Holdings.

After a remarkable surge earlier this year, Comba Telecom’s share price has recently cooled. The stock posted a 1-day gain of 2.46% but experienced a 30-day drop of 9.91%. Still, the momentum over the long haul remains striking, as total shareholder return over the past year sits at an impressive 162.78%. This points to building confidence in the company’s new direction.

If leadership shakeups like this spark your curiosity, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

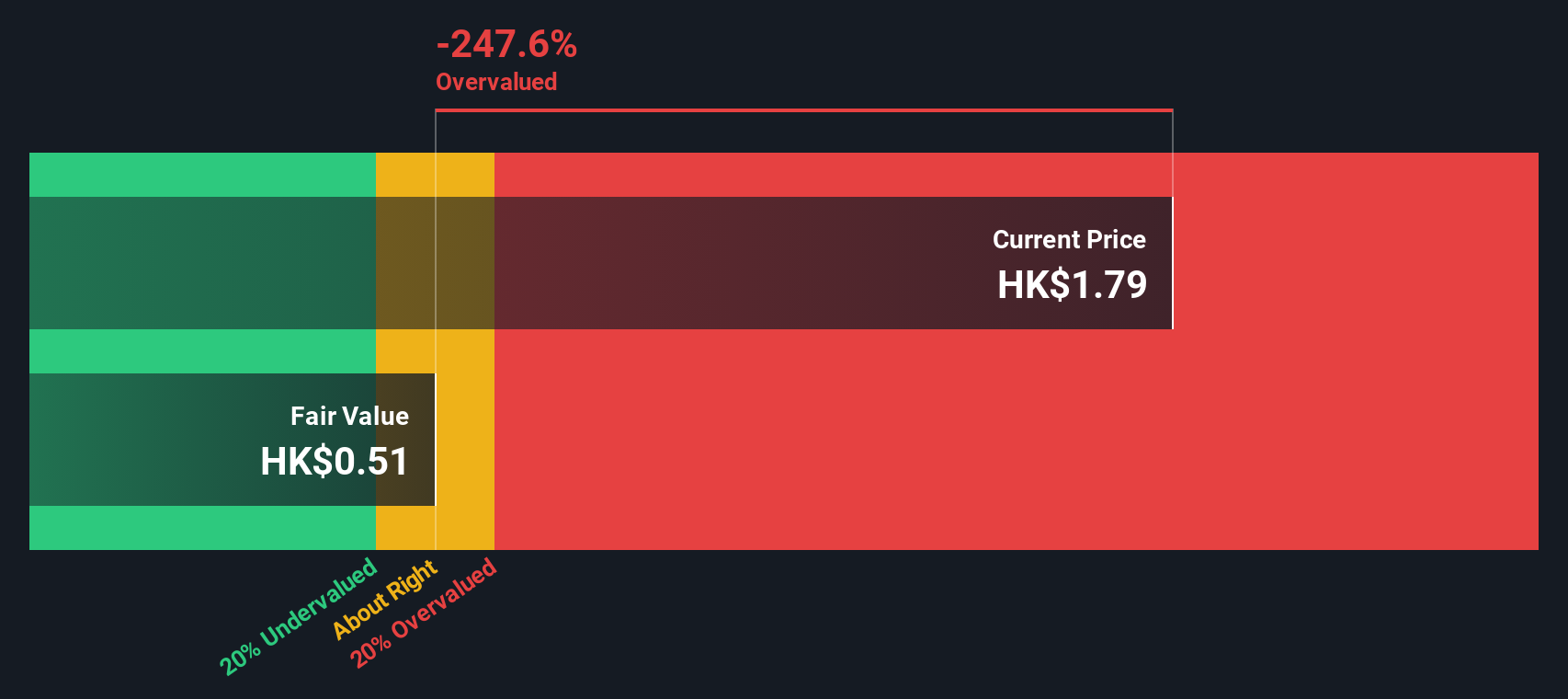

With shares up more than 160% over the past year and major board changes underway, investors are left to wonder: Is Comba Telecom still trading below its true value, or has the market already priced in all the future growth potential?

Price-to-Sales of 2.1x: Is it justified?

Comba Telecom trades at a price-to-sales ratio of 2.1x, putting it noticeably above the Hong Kong Communications industry average of 0.7x. This elevated multiple means investors are paying a significant premium relative to the sector for each dollar of the company’s revenue.

The price-to-sales ratio compares a stock’s market value to its revenues, and it is often favored for unprofitable or growth-stage companies. Since Comba Telecom is not currently profitable, this metric helps gauge how the market values its topline compared to its industry peers. A higher ratio could reflect excitement about future growth, but it also signals higher expectations that must be met over time.

Measured against its competitors, Comba Telecom’s price-to-sales of 2.1x is three times the industry average. This sends a clear signal: the market has high hopes for this company’s turnaround, but current fundamentals lag behind the sector norm. However, when compared to its peer average of 3x, Comba Telecom does appear to offer relatively better value on this multiple, suggesting some price support if industry optimism returns in force.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.1x (OVERVALUED)

However, persistent losses and unclear revenue growth present real uncertainties. These factors could quickly reverse the current optimism around Comba Telecom’s turnaround story.

Find out about the key risks to this Comba Telecom Systems Holdings narrative.

Another View: Our DCF Model Says Overvalued

Looking at a different method, the SWS DCF model estimates Comba Telecom’s fair value at HK$1.38, which is well below its current price of HK$2.91. This suggests the market may be too optimistic right now. Does this gap reflect hidden risks, or is the market picking up on future potential that a model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comba Telecom Systems Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comba Telecom Systems Holdings Narrative

If you see the numbers differently or enjoy drawing your own conclusions, it only takes a few minutes to uncover your unique perspective. Do it your way

A great starting point for your Comba Telecom Systems Holdings research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your strategy to just one stock. Power up your portfolio and get ahead of the crowd by checking out these proven opportunities:

- Spot high-yield opportunities by tapping into these 17 dividend stocks with yields > 3% that consistently deliver strong returns and reliable income for shareholders.

- Seize the next tech breakthrough when you browse these 24 AI penny stocks, where emerging artificial intelligence leaders are redefining entire industries.

- Maximize potential gains by targeting these 873 undervalued stocks based on cash flows that the market may be overlooking, before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, engages in the research and development, manufacture, and sale of wireless telecommunications network system equipment and related engineering services.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)