- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

AAC Technologies Holdings Inc.'s (HKG:2018) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Most readers would already be aware that AAC Technologies Holdings' (HKG:2018) stock increased significantly by 30% over the past three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Specifically, we decided to study AAC Technologies Holdings' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for AAC Technologies Holdings

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AAC Technologies Holdings is:

4.6% = CN¥1.0b ÷ CN¥23b (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.05.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

AAC Technologies Holdings' Earnings Growth And 4.6% ROE

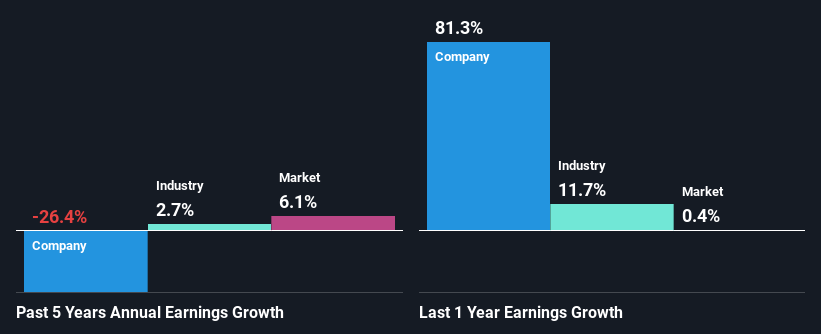

At first glance, AAC Technologies Holdings' ROE doesn't look very promising. Next, when compared to the average industry ROE of 7.7%, the company's ROE leaves us feeling even less enthusiastic. Given the circumstances, the significant decline in net income by 26% seen by AAC Technologies Holdings over the last five years is not surprising. We reckon that there could also be other factors at play here. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared AAC Technologies Holdings' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 2.7% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is AAC Technologies Holdings fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is AAC Technologies Holdings Using Its Retained Earnings Effectively?

AAC Technologies Holdings' low three-year median payout ratio of 17% (or a retention ratio of 83%) over the last three years should mean that the company is retaining most of its earnings to fuel its growth but the company's earnings have actually shrunk. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

In addition, AAC Technologies Holdings has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 18%. However, AAC Technologies Holdings' ROE is predicted to rise to 9.8% despite there being no anticipated change in its payout ratio.

Conclusion

On the whole, we feel that the performance shown by AAC Technologies Holdings can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026