- New Zealand

- /

- Software

- /

- NZSE:SKO

3 Asian Penny Stocks With Market Caps Under US$400M

Reviewed by Simply Wall St

Asian markets have been navigating a complex landscape, influenced by global trade dynamics and economic policy shifts. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture the interest of investors seeking growth opportunities at lower price points. While the term "penny stocks" might seem outdated, these investments can still offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.18 | SGD478.24M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.66 | THB2.8B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$3.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Serko (NZSE:SKO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Serko Limited offers online travel booking and expense management services across New Zealand, Australia, the United States, Europe, and other international markets, with a market cap of NZ$361.38 million.

Operations: The company's revenue is derived from the provision of software solutions, totaling NZ$88.48 million.

Market Cap: NZ$361.38M

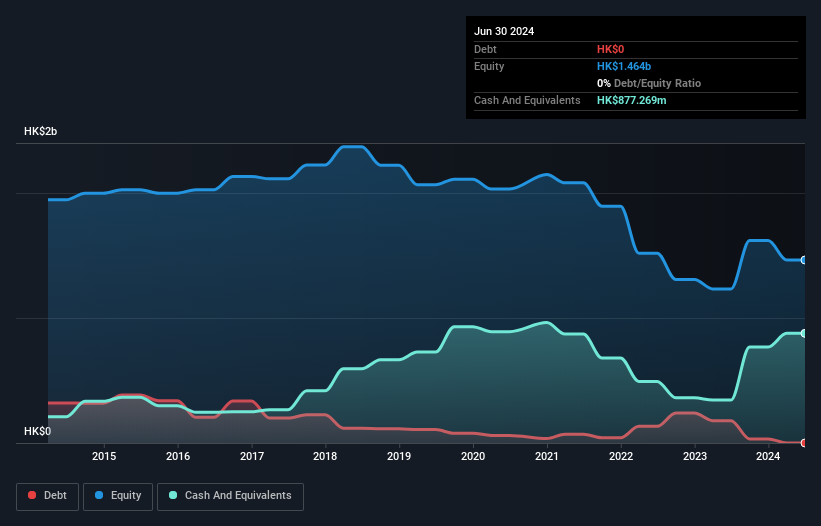

Serko Limited, with a market cap of NZ$361.38 million, operates in the online travel booking and expense management sector across various international markets. Despite being unprofitable, Serko has reduced its losses over the past five years at 4.4% annually and is forecast to grow earnings by 94.2% per year. The company trades significantly below estimated fair value and maintains a strong cash position with sufficient runway for over three years based on current free cash flow. Serko's management team and board are experienced, contributing to stability despite the absence of debt and ongoing profitability challenges.

- Navigate through the intricacies of Serko with our comprehensive balance sheet health report here.

- Assess Serko's future earnings estimates with our detailed growth reports.

SIM Technology Group (SEHK:2000)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SIM Technology Group Limited is an investment holding company that designs, develops, manufactures, and sells handsets and Internet of Things (IoT) terminals across China, Hong Kong, other Asian countries, Europe, and the United States with a market cap of HK$696.59 million.

Operations: The company's revenue is primarily derived from its Handsets and IoT Terminals Business, including Electronics Manufacturing Services, which generated HK$356 million, followed by the Automotive Intelligent Products Business at HK$54.10 million and Property Management at HK$43.80 million.

Market Cap: HK$696.59M

SIM Technology Group, with a market cap of HK$696.59 million, focuses on handsets and IoT terminals. Despite being unprofitable, the company has improved its financial health by reducing its debt to equity ratio over five years and maintaining more cash than total debt. Revenue for the first nine months of 2025 was HK$270.4 million, slightly down from the previous year. The management team is experienced with an average tenure of 3.4 years, contributing to stability alongside a sufficient cash runway exceeding three years if current free cash flow levels are maintained despite shrinking by 34.6% annually.

- Jump into the full analysis health report here for a deeper understanding of SIM Technology Group.

- Evaluate SIM Technology Group's historical performance by accessing our past performance report.

Qinghai Spring Medicinal Resources Technology (SHSE:600381)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Spring Medicinal Resources Technology Co., Ltd. operates in the medicinal resources sector, focusing on the development and sale of traditional Chinese medicine products, with a market cap of CN¥2.84 billion.

Operations: Qinghai Spring Medicinal Resources Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.84B

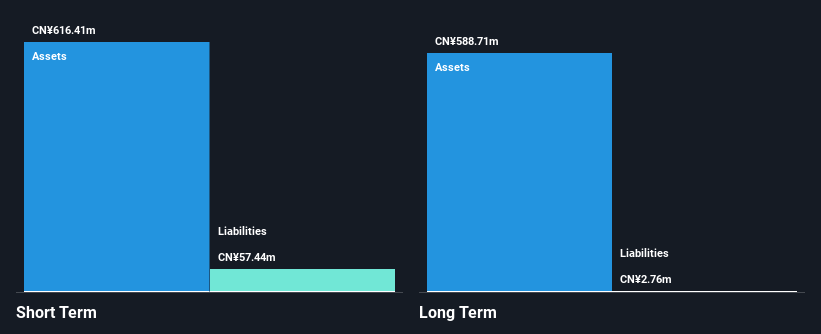

Qinghai Spring Medicinal Resources Technology, with a market cap of CN¥2.84 billion, reported half-year revenues of CN¥124.87 million, down from the previous year. Despite being unprofitable and showing a negative return on equity of -13.15%, the company achieved a net income of CN¥1.32 million compared to a significant loss previously. It remains debt-free with short-term assets comfortably covering both short-term and long-term liabilities, indicating solid financial health. The company has an experienced management team averaging 10.4 years in tenure and maintains a stable weekly volatility at 6%, suggesting operational steadiness amidst challenges in profitability growth.

- Get an in-depth perspective on Qinghai Spring Medicinal Resources Technology's performance by reading our balance sheet health report here.

- Gain insights into Qinghai Spring Medicinal Resources Technology's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Get an in-depth perspective on all 963 Asian Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKO

Serko

Provides online travel booking and expense management services in New Zealand, Australia, the United States, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)