- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810) Is Down 9.7% After US Tariff Threats Roil China Tech Shares

Reviewed by Sasha Jovanovic

- The Hang Seng China Enterprises Index recently saw a significant decline, led in part by Xiaomi Corp. and Alibaba Group, following news that former US President Donald Trump threatened additional 100% tariffs on Chinese goods in response to Beijing's new export controls on critical minerals.

- This escalation in US-China trade tensions has increased market anxiety, particularly among investors in major Chinese tech firms that have global exposure.

- We'll explore how heightened US tariff threats and trade uncertainty might affect Xiaomi's long-term global expansion and margin outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Xiaomi Investment Narrative Recap

Xiaomi shareholders tend to believe in the company’s ability to evolve from a price-focused smartphone brand into a global ecosystem provider, capturing growth through premium products, global expansion, and smart hardware innovation. While short-term concerns around US tariff threats have weighed on sentiment, these policies do not appear to materially change the company’s fundamental global expansion catalyst or the key risk of margin pressures caused by intense price competition.

Recently, Xiaomi announced continued share buybacks, signaling management’s confidence and a pro-shareholder approach as volatility rises. While unrelated to trade issues, this move may provide near-term support for the share price and aligns with Xiaomi’s ambitions to underpin long-term growth, despite ongoing industry headwinds.

But in contrast, investors should be mindful of how prolonged price wars and margin pressure in the smartphone industry may...

Read the full narrative on Xiaomi (it's free!)

Xiaomi's outlook forecasts CN¥765.2 billion in revenue and CN¥69.6 billion in earnings by 2028. This is based on a projected 21.3% annual revenue growth and an earnings increase of CN¥32.4 billion from the current CN¥37.2 billion.

Uncover how Xiaomi's forecasts yield a HK$66.01 fair value, a 36% upside to its current price.

Exploring Other Perspectives

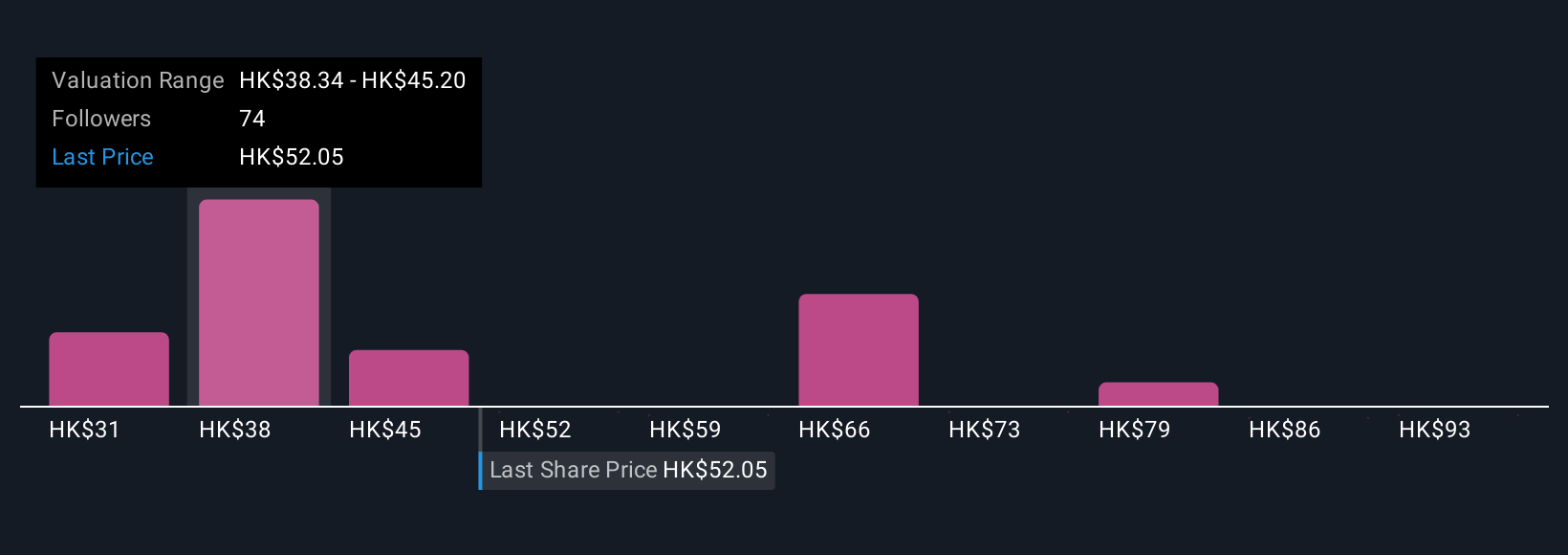

Sixteen fair value estimates from the Simply Wall St Community range widely from HK$31.49 to HK$100 per share. With such variance, it is clear that opinions differ greatly especially when considering Xiaomi’s margin risks in a fiercely contested smartphone market.

Explore 16 other fair value estimates on Xiaomi - why the stock might be worth over 2x more than the current price!

Build Your Own Xiaomi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xiaomi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xiaomi's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives